The next piece of digital currency puzzle; NFT protocols in the world of defy

The success of future digital currency products depends on their ability to interact simultaneously with the decentralized financial industry, or defaults and tokens, or NFTs.

Decentralized finance and proverbial tokens are becoming more and more popular and growing at an astonishing rate. Despite this trend, it is now possible to believe that digital currency-related programs, despite all the shortcomings, are on track to succeed.

But the question is, does this trend reflect the real growth in the number of users of these programs, or is it the result of the activity of influencers who move from one market to another, and now it is DIFA’s turn?

We take this article from an article From the Quinn Telegraph website, we are looking for an answer to this riddle, and we are trying to explore the true meaning of this growing trend for the digital currency industry and its impact on the future of innovation. So, let’s take a closer look at the growth of defenses and NFTs.

Defy and NFT; Two noisy products these days

Arguably the most common use of smart contracts right now is decentralized finance. Market makers, algorithmic stablecoins and Yield Farming strategies have become a hot topic these days.

This fever started in the first quarter of 2020 and continued until the end; The period is referred to by the media as the “Summer of Defy”. During this time, SushiSwap launched its liquidity extraction attack on the Uni Swap platform, Yearn.finance launched the first interest farm, and Uni Swap launched an airdrop.

Attacking liquidity extraction means creating financial incentives to attract users and liquidity suppliers from other decentralized platforms. In 2020, the newly established Sushi Swap platform was able to capture a significant portion of the exchange ion’s liquidity by launching a liquidity extraction attack on the decentralized ion swap exchange.

Overall, during this time we have seen the strongest communities formed around the ownership of tokens of various protocols, creating a positive feedback loop that increases the value of Difai assets.

Also read: The most comprehensive defense training; From garlic to onions, decentralized platforms

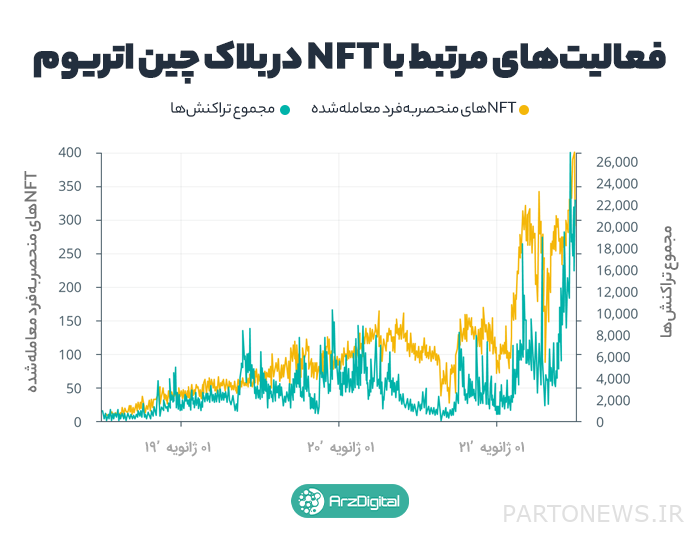

NFTs, now known as CryptoPunks, account for an increasing share of Atrium network activity. With the rapid development of this technology, NFTs now form a wide range of active market segments, including avatar-based projects, digital artwork, sports collections, virtual fields, and revenue-generating games.

In addition, celebrities such as Andy Murray and Ashton Kutcher, along with contemporary artists such as Damien Hirst, are eager to enter the NFT market and gain a foothold in the field. Find yourself.

The growth of NFT-based applications and the increasing intra-chain activities of these tokens have made it impossible for us to ignore them as an emerging digital asset.

Also read: Familiarity with the 10 most expensive NFTs to date

users NFT And Defy

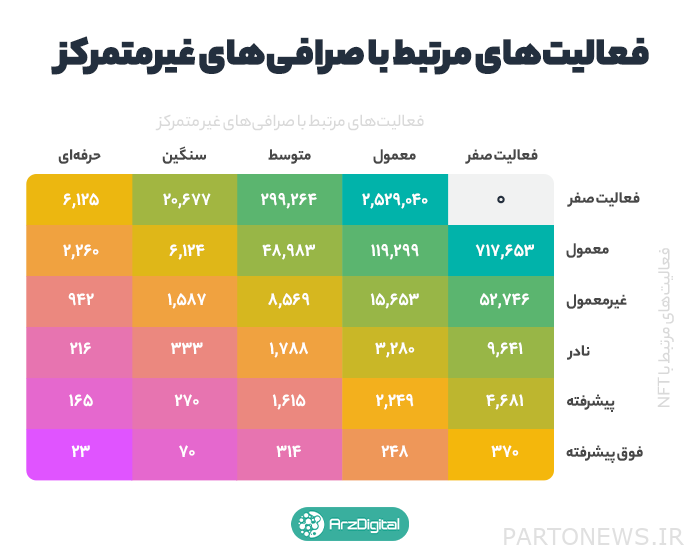

What we are talking about here are wallets active in the field of defense and NFT. Our analysis shows that a collector of NFT tokens accounts for a total of 0.1% of NFT transactions; While a professional trader in decentralized exchanges (Dex), owns 1% of the transactions of these exchanges.

Looking at the statistics of NFT and Dex users, we see that NFT collectors and Dex traders are separate users.

This review also introduces us to a new type of user: NFT-DEX Active Users. There are currently 23 influential users who have a significant stake in both NFT and Dex trading.

Also, if we pay attention to the distribution of these users, another trend becomes apparent: the more a user is active in transaction defense protocols, the more likely he is to be an NFT collector.

Also read: NFT build tutorial; How to sell our unique tokens?

Defy to NFT And NFT Needs a defense

Not surprisingly, Defy has reached such a level of maturity that it is no longer sufficient to be reproducible. Asset ownership can be so personalized or optimized that in practice it makes more sense to use NFTs instead.

The third version of UniSwap acts as a pioneer in this, and in its new automated market maker design, allows users to customize the price range in liquidity situations.

In addition to the NFT world requiring NFT protocols, the NFT world is rapidly adapting to DIFA. NFTs, which are driven by protocols such as NFT20 and NFTX, are offered in the form of tokens that are connected to dex-based liquidity pools, through which they can be used financially.

Users can now access a collection of each piece of digital art without having to purchase it separately. The integration of NFTs and defenses, as we see them today, is destroying the original and “unparalleled” definition. What will be the next step?

Products that combine Difai and NFT will be the ultimate winners

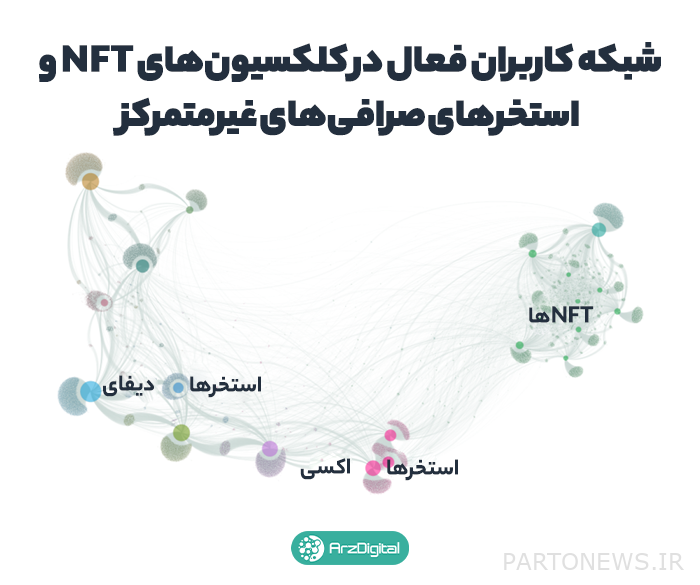

It seems that the ultimate destiny of NFTs and defy will be a combination. Axie Infinity is a clear example of this combination. Axi, which is (currently) probably the largest monetization product in the Chinese bloc, is a kind of monetization game. The game is based on NFT, which combines tokens with in-game cash pools. This is a real combination of NFT and Difai.

Looking at the Atrium network transactions, we see that Oxy has been able to build a bridge between Difai and NFT. The future success of digital currency-related products also depends on their ability to interact simultaneously with NFT and Difai users. According to Atrium Transaction Statistics over a seven-day period, Oxy Pools have successfully built bridges between the Defy and NFT subgroups.

in the future what will it be?

The growth in the number of Difai and NFT users reflects the growing tendency to innovate in the digital currency ecosystem in the long run. Tokens, programs and products that can attract experienced and new users of the industry through the simultaneous use of Difai and NFT, will be the first beneficiaries of this innovation.

If you accept the hypothesis that having multiple users in a domain flexes the value of a digital asset, then you can probably guess that markets are ready for strong growth.

The abundance of Difai and NFT applications has led to the formation of large projects and various applications in this market. The growth in the number of active users in this field indicates the creation of new value in this market, and we can hope that in the future, digital currencies will surpass traditional assets.