10% growth of net profit of listed companies in one year – Tejaratnews

According to Tejarat News, a review of the total index chart in the last 6 months shows that the capital market has been affected by many incidents during this period; From the war between Hamas and Israel to the war over food prices, they have all made the capital market bearish. But the work does not end there; Because fundamentally, the market situation has worsened in the summer.

First of all, it should be said that the total value of the market at the end of this summer has decreased by seven percent compared to the spring. Also, the seasonal income of capital market companies has decreased by 6.49% in summer compared to spring and has reached 1.288 million tomans to 1.204 million tomans.

The drop in income generation of capital market companies, along with the increase in costs, has severely lowered the profitability of listed companies; So that the total net profit of capital market companies has reached 191 thousand and 884 billion tomans with a fall of more than 46% from 361 thousand eight billion tomans.

12-month market record

First of all, it should be known that ttm is derived from the phrase trailing twelve months, which means the last 12 months. Contrary to the decline in the performance of market companies in the summer, the situation of the last 12 months of the market at the end of the summer of 1402 has improved compared to the end of the summer of 1401. So that the ttm income of the whole market at the end of this summer has reached four million and 576 thousand billion tomans from three million and 718 thousand thousand billion tomans at the end of the summer of 1401 (ttm) with a growth of more than 23%.

Also, the production costs or the cost of the sold products of the capital market companies have also grown by the same amount in this period and from two million and 779 thousand thousand billion tomans at the end of the summer of 1401 (ttm) with a growth of 23.32 percent to three million and 427 thousand thousand. billion tomans reached at the end of summer 1402 (ttm).

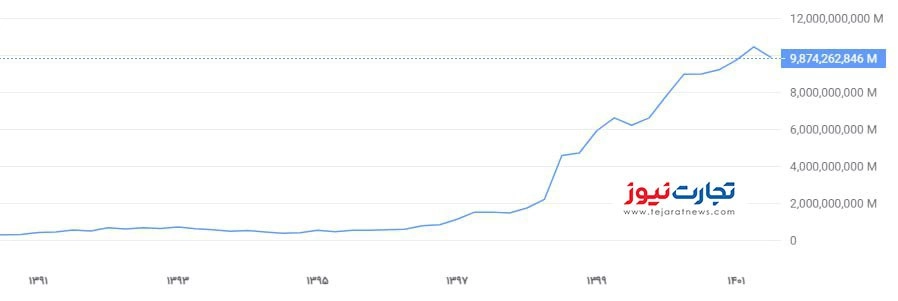

In this way, it should be said that the total net profit of capital market companies at the end of summer 2012 has reached 987 thousand 426 billion tomans from 898 thousand 693 billion tomans with a growth of about 10%.

Comparison of capital market returns

All that has been said, the fundamental situation of the capital market was in the two 12-month periods leading to the end of the summer of 1401 and 1402. But it should be seen how the total index has performed in these two intervals. As seen in the chart below, the overall index followed a sideways trend in the 12 months ending in the summer of 1401, registering a negative return of 2.45%.

But the same imager grew more than 60% in the 12 months ending in the summer of 1402 and showed better performance. Finally, it should be said that although the performance of the market this summer compared to spring was fundamentally and technically weaker, but if the 12 months leading to this summer are evaluated with the 12 months leading to the summer of last year, it is clear that the capital market is currently It is in a better condition.

Read more reports on the capital market page.