104% growth in retail value and stock market boom

According to the economic correspondent of Fars News Agency, the stock market took a completely different trend in the third week of March compared to the previous weeks. This week, all capital market performance indicators showed the stock market entering a balanced and upward trend. If this continues, we can hope that the stock market will emerge from recession next year.

The total stock index was able to enter the 1.3 million unit channel last week, but in the last two months, returning to this index and reaching half of this channel had become a dream for shareholders. The increase in the price of currency, the increase in the price of oil, the clarification of the details of the budget for 1401, and the increase in the price of basic metals were among the issues that had a great impact on the growth of the overall stock index.

Of course, in the meantime, the dualities in the stock market should not be ignored. The dual shares of small and large and the dual shares of rials and dollars are among the items that created an interesting confrontation in the stock market this week.

At the beginning of the week, small shares of the growing capital market were balanced by the overall index and the aggregate index. In the middle of the week, rial shares caused the growth of the total index, and at the end of the week, the confrontation between dollar and rial shares caused the total index to fluctuate on a daily basis.

* 5% growth of the total stock index

The stock market index climbed in the third week of March to have a positive return after a week break. The index rose 17,592 points on Saturday after falling 0.56 percent last week. On Sunday, the index continued to grow and climbed 23,816 units.

On Monday, the index climbed for the third day in a row, leaving an increase of 20,308 units. On Tuesday, the index fell against expectations and fell by 6,337 units; But on the last working day of the week, the total index of Tehran Stock Exchange increased by 11,734 units.

At present, the total stock index increased by 67,113 units to 1,348,303 units and recorded a return of 5.2 percent.

* Less growth of the total homogeneous index than the total index

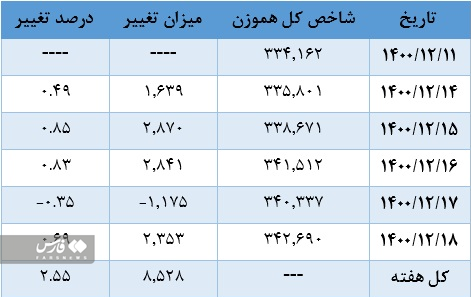

Last week, the overall homogen index was also bullish; However, the growth rate of this index has been almost half of the total index, which shows that the large and significant shares of the capital market have experienced more growth in the third week of March. The total homogen index increased by 1,639 units on Saturday and increased by 2,870 units on Sunday.

The index rose by 2,841 points on Monday and fell by 1,175 points on Tuesday, like all other stock indexes. On Wednesday, the growth of this index was 2,353 units. The overall homogeneous index at the end of the week was 8,528 points higher than the previous week and recorded a positive return of 2.55%.

* The growth of the value of small transactions is a sign of stock market rise?

The stock market last week faced an increase in the volume of small trades and total trades. Some capital market experts believe in this regard, if the value of retail transactions is stabilized above 4 thousand billion tomans, we can hope that the stock market has largely emerged from the recession that has occurred in recent months.

The total value of transactions in the capital market in the third week of March compared to the previous week increased by 6% and the average total value of transactions reached 41 thousand and 753 billion tomans.

The total value of retail transactions this week increased by 104% to 4108 billion tomans, which shows that the real shareholders with the entry of money and trading on the stock exchange to some extent to its upward trend in the final weeks of this year and months. The beginning of next year is hopeful.

End of message /

You can edit this post

Suggest this for the front page