149% increase in repayment of principal and interest of financial bonds in the 13th government

According to Iran Economist From the Ministry of Economic Affairs and Finance, this ministry has always faced challenges in the field of collection of public resources of the government, in line with the assigned tasks based on the annual budget laws of financing up to 60% of the government’s general budget. After the establishment of the 13th government and the emphasis on the control of inflationary approaches, of course the issue of non-inflationary financing and avoiding basic monetary resources to cover budget imbalances became the priority of the Ministry of Economic Affairs and Finance.

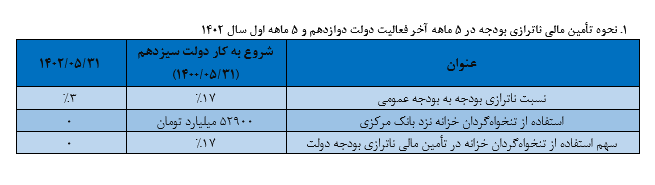

The 2-year performance of the 13th government in the field of financing indicates that the application of necessary policies and measures, especially in the field of promoting stable incomes on the one hand, and on the other hand, promoting financial discipline through regularization of the accounts of the executive bodies in the form of creating a single treasury account and paying The final beneficiary has led to the reduction of the government’s budgetary imbalances, along with the reduction of reliance on basic monetary resources in providing for these imbalances, even though they are small.

So that in the first 5 months of this year, despite the legal permission to use the Central Bank’s reserves (to the extent of 3% of the government’s general budget), the government’s use was zero, which of course can play a significant role in curbing inflation and realizing the slogan of the year.

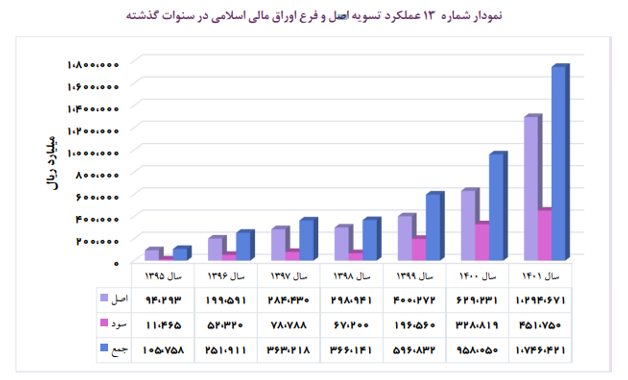

Another important point that can be considered in connection with the promotion of financial discipline of the 13th government is the effort and emphasis of the government in repaying the debts (in the form of repayment of the principal and interest of the bonds issued in the twelfth government) inherited from the previous government in this period.

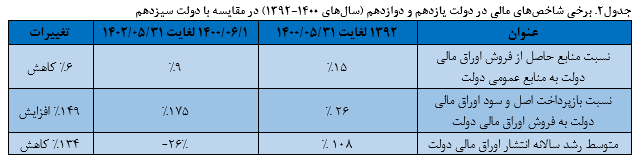

As can be seen from table (2), the ratio of committed resources (including issued and sold financial bonds) to the government’s general budget has decreased from 15% on average during the years of the 11th and 12th governments to 9% since the beginning of the 13th government. which means less reliance of the budget on borrowing sources in this government. Despite the decrease in the use of the aforementioned resources in the general budget of the government, the share of principal and interest repayment of financial bonds to the total resources from the sale of financial bonds has increased from 26% in the 11th and 12th governments to 175% in the period of the 13th government. It indicates the determination of the government to reduce the obligations on the governments after the issuance of the bonds, along with the increase in the amount of repayment of the principal and interest of the obligations due to the issuance of these bonds from the previous governments.

Reducing the ratio of bond sales to GDP

Another measure of the government’s reliance on borrowing for financing is the ratio of the sale of debt securities to GDP at current prices. According to the table below, in 2019, the ratio of bond sales to GDP reached 5.08%, but in 1400 and 1401, this ratio decreased to 2.8% and 2.1%.

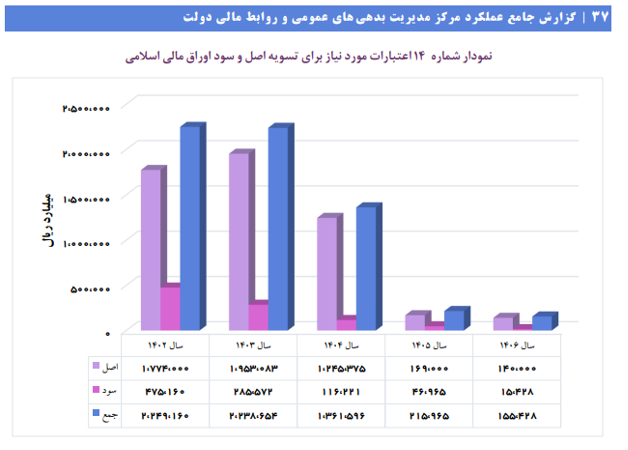

In addition to this comprehensive report of the government’s debts and claims until the end of 1401, it shows that it is more important to pay attention to the publications made during 1401 and timely settlement of the resulting obligations. In determining the maturities of issued bonds, it is always tried not to impose a significant financial burden on the country’s treasury by properly distributing the maturity months. The credits required to settle the principal and interest of government bonds are as follows.

As can be seen in the table, the amount required to settle the principal and interest of the bonds in 1402 is 224,916 billion tomans.

The sums needed to settle the principal and interest of the bonds with the government’s guarantee until the end of 1406 amount to 622 billion and 80 million tomans, including 528 billion and 145 million tomans for principal and 93 billion and 934 million tomans for interest.