2 key indicators that show the downward trend of the digital currency market continues

Data on futures markets and declining demand for Tetra show that the digital currency market may continue to decline and prices may continue to fall to lower levels.

To Report The Kevin Telegraph, the digital currency market value index, has been fluctuating above an uptrend line over the past three months. The $ 1.75 trillion level is the last support that was tested three days ago on April 27th. The test of this support coincided with the fall of Bitcoin to the level of $ 38,000 and the reduction of the price of Atrium to $ 2,800.

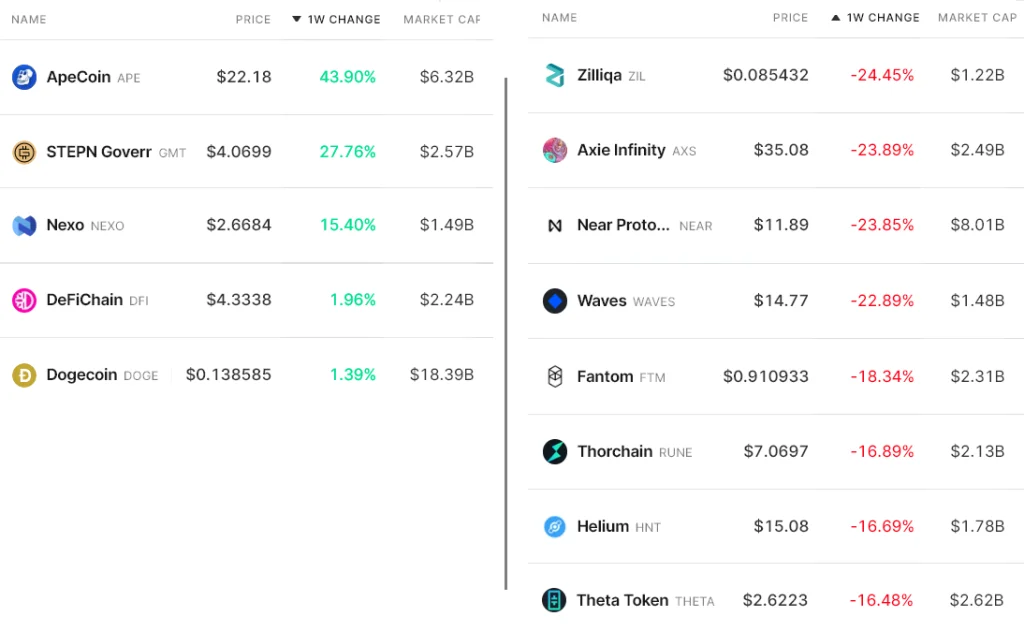

The market value of digital currencies has decreased by 3.5% in the last 7 days, with the largest price decreases related to Ripple (18.8%), Cardano (10.2%) and Polkadat (9.7%) tokens. have been.

Examining the situation of other market coins gives analysts a more balanced perspective. Some tokens related to Chinese block games and protocols active in the field of Metavars have increased in price by more than 25% during this period.

The price of Apecoin has increased by 44% in seven days on the eve of the start of the sale of Otherside lands. Metavars Adreside is made by Yuga Labs, Animoca Brands and the Bored Ape Yacht Club project development team, and NFT market investors have been waiting for it for a long time. The sale of the fields of this project is scheduled to start at 5:30 am tomorrow (Tehran time), May 4th.

Along with AppQueen, the price of the STEPN token, which has caught the attention of many users with the idea of ”walking for money,” has risen 28 percent in the past week. The leap came after Kevin Bass, the largest digital currency exchange in the United States, announced plans to add a Step (Token) token to its trading market.

The 15 percent jump in Nexo prices is also largely due to the launch of the token in the Bainance exchange market and the plans of the Nexo team to build a credit card in which they are used as collateral in daily payments instead of selling digital currencies.

In contrast, Zilliqa has corrected part of its 380% jump in late March during these seven days. The leap came after the Zilika team announced on March 25 that it planned to launch a transformational project powered by Nvidia, one of the world’s largest hardware makers.

The price of Axie Infinity game tokens has also reached its lowest level in the last 9 months, while the number of users and transactions related to this game has decreased by 15% in the last 30 days.

Premium Tetra shows a lack of demand among buyers

The OKX Exchange Tetra Premium Index measures the difference between the price of Tetra in Peer-to-Peer transactions within China at the current value of the US Dollar (in yuan).

Excessive demand for Tetra pushes the index above 100%. On the other hand, during the downtrend, the demand for Tetra is declining and the Tetra Premium Index is 4% or more away from the 100% level (moving downwards).

The Tetra Premium Index reached 102% on April 28, which is the highest level in 2022. The move was accompanied by a jump in bitcoin to over $ 40,000. The price of Bitcoin fell below $ 40,000 again later that day. The Tetra Premium Index has recently reached 100%, which can be considered as a sign that the emotions of small market traders are neutralized.

Dual feelings in futures markets

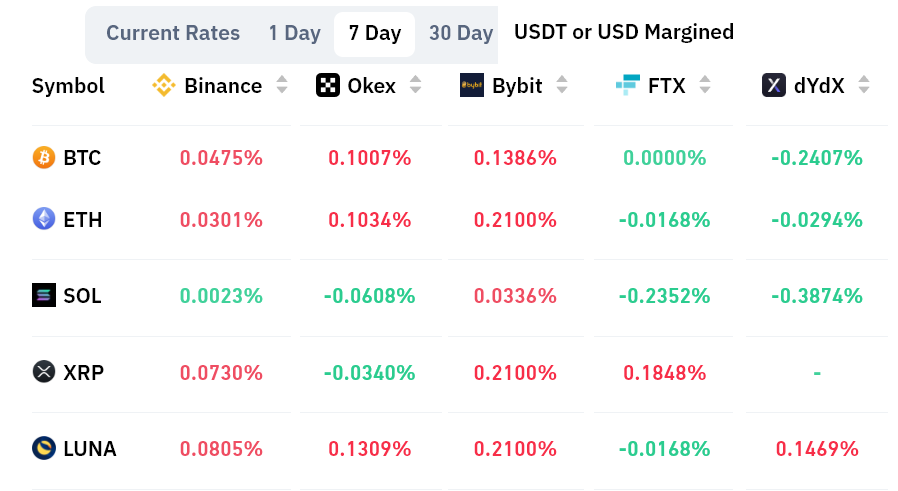

Perpetual futures contracts have a fixed fee, the rate of which is usually updated every 8 hours. The purpose of exchanges receiving this fee, known as the Funding Rate, is to prevent market imbalances.

A positive rate of return on capital means that long position traders use more leverage, and a negative position indicates that short position traders have such a position.

As you can see from the picture above, the weekly funding rate for Bitcoin and Atrium is slightly positive. In general, buyers use leverage somewhat more than sellers, and this is not something that forces market participants to exit their trading positions. For example, Luna’s weekly financing rate is positive at 0.15% (equivalent to 0.6% in 30 days), which certainly can not worry futures traders.

The neutrality of the Tetra premium index and the financing rate indicates that the demand of small market traders to buy digital currencies is low. At the same time, the digital currency market is currently trying to maintain its total value above $ 1.75 trillion.