2 key metrics that show the price of bitcoin will not go below this

The activity of professional traders in the Bitcoin market shows that after the price fell last week, the feeling of fear in the market is now over. Two key criteria related to bitcoin derivatives markets also confirm this.

To Report Coin Telegraph Since the fall of prices on December 4, Bitcoin has always tried to maintain support at $ 47,500. The terrible fall at the beginning of last week caused the $ 840 million long trading position (buy) in the Bitcoin futures market to be liquid. The crash came after the discovery of a new strain of the corona virus, the omicron, and shortly after it was announced that inflation in the United States had peaked in the past 40 years.

New investors may have feared a 26 percent drop in prices over the past month, but whales and opportunistic investors like Micro Strategy have used the opportunity to boost their bitcoin stocks. Microstrategy announced on December 9 that it had bought 1,434 new bitcoins and increased its inventory to 122,478 units.

According to some analysts, the main reason for the recent fall of Bitcoin is the fear of bankruptcy of Evergrande, the Chinese real estate industry giant, which on December 9 (December 18) for the first time revealed that it had not paid one of its dollar debts. The $ 1.1 billion Bitcoin Option contract matured on December 10, which experts say could also be influential; Because traders who signed a sell-off contract made $ 300 million on their trading positions on this day.

Professional traders are still bullish

In Margin markets, traders have the opportunity to borrow more digital currency from their inventory by borrowing Stable Coins or other currencies from exchanges, and to trade with leverage. Professional margin traders use bitcoin as a guarantee in short (sell) positions when they borrow bitcoin from an exchange, which means they will make a profit if the price continues to fall.

That is why some analysts monitor the amount of bitcoins and stable coins borrowed in the margin market of exchanges in order to assess whether investors’ views are more bullish or bullish. Interestingly, Bitfinex margin traders had reduced their long trading positions before prices fell on December 4.

Also read: Margin Trading Guide for Bitcoin

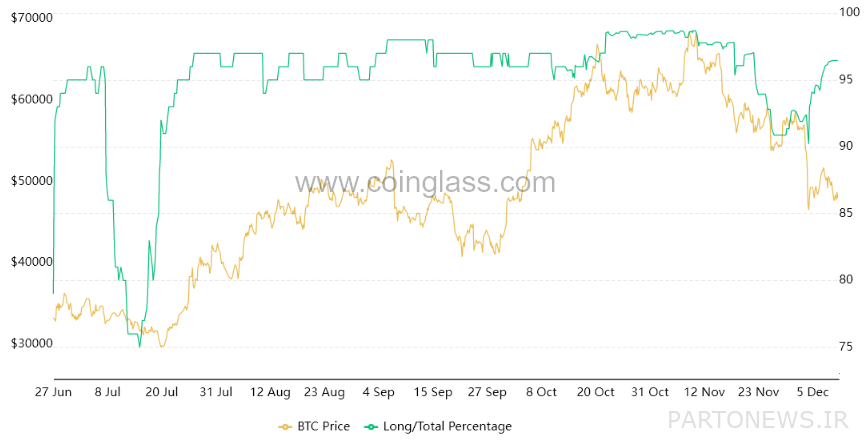

As can be seen from the image above, this index has maintained its position above 90%, which means that only 10% of the funds borrowed from Bit Phoenix were related to stable coins. In addition, 24 hours after the fall in prices, the bitcoin long position has risen to 94%. This means that even if investors are surprised by the fall in prices, most of them have maintained their trading position during these fluctuations.

To find out if this move was limited to marginal markets, we need to look at the Bitcoin options market. The Skew Delta Index compares 25% of trading positions. This indicator will enter the positive zone when the market fear is overwhelmed and the premium of sell-off contracts exceeds the buying-risk contracts with the same risk. Premium in the option market refers to the cost that traders have to pay to register an option contract.

On the other hand, when market participants are bullish, the 25% skew delta index enters the negative area. Positioning this index between positive 8 and negative 8% is also usually considered neutral.

Prior to the fall of the Bitcoin price on December 4, the skewed delta index fluctuated 25 percent near the 6 percent level, which is considered a neutral zone; But in the next three days, when the index reached 10%, it was seen that market participants in bitcoin contracts and whales were somewhat scared. Currently, this index is at the level of 3% and the neutral zone.

The Bitcoin Long Positions Index in the Bitcoin Phoenix Exchange Margin Market Index and the 25% Delta Skew Index, one of the main benchmarks in the option market, show that there is not much anxiety in derivatives markets. Given that more professional traders are active in these markets, it can be assumed that the price of Bitcoin will reach a new historical peak in early 2022.