2 reasons why the market value of digital currencies does not exceed 1.1 trillion dollars

As it can be seen, digital currency traders are currently not very confident about the future of the market and the demand for capital entry into this market has almost stopped. This is despite the fact that the total value of the digital currency market has not risen above the level of 1.1 trillion dollars for the past few days.

To Report Cointelegraph, the market value of digital currencies has long failed to cross the $1.1 trillion resistance; The level that was last seen in the market 54 days ago. Bitcoin has lost 2.5% of its value in the last 7 days and Ethereum has experienced a slight growth of 0.5%. The poor performance of the top two digital currencies in the market during this period has hindered the growth of the overall value of the digital currency market; But on the other hand, there are some altcoins that have appeared powerful in the same period of time.

The market value of digital currencies decreased by about one percent between July 29 and August 5 (August 7-14) and has now reached $1.07 trillion. On August 4 (August 13), the digital currency market was affected by the news related to the beginning of the investigation of the American Exchange Commission into the activities of all digital currency exchanges in this country.

While major market currencies failed to register a positive performance this week, traders’ desire to enter the altcoin market was not affected. One of the positive news this week was the cooperation of Coinbase exchange with the world’s largest capital management institution, BlackRock. It should be mentioned that Blackrock has a total of about 10 trillion dollars in capital. Through this cooperation, customers of Blackrock will be able to directly invest in Bitcoin through the Coinbase exchange.

This Coinbase exchange service, which is called Coinbase Prime and will be used by BlackRock customers, is an investment solution in an enterprise scale that allows trading, custody, funding and investment with more than 300 different digital currencies. Provide.

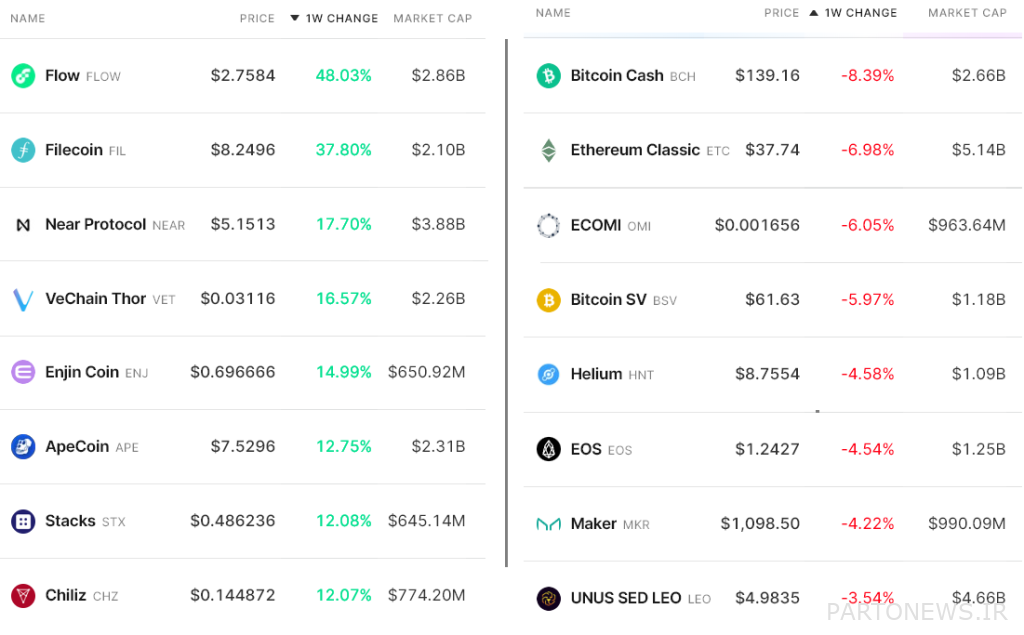

Among the first 80 digital currencies of the market, those that had the most growth and fall in price last week, 10 currencies showed different performance and grew by 12% or more.

For example, Flow has increased in price by 48% during this period, which is obviously influenced by the news of Instagram supporting Flow’s blockchain through Dapper Wallet. It should be noted that this support is related to the NFTs section of the Instagram social network.

The Filecoin digital currency has also experienced a 38% growth during these seven days, which is influenced by the release of the “v16 Skyr” update on this network. This update strengthens the security of the FileCoin network and makes the protocol more resilient to potential vulnerabilities.

The 16.5% jump in the price of VeChain this week also happened after some news sources mistakenly published a report about the network’s cooperation with Amazon Web Services. The Wei China Foundation explained a little later that the news of the collection’s collaboration with Amazon Web Service was actually related to a research project, the original of which was first published on May 9 (May 19).

Tether premium index drop; A bearish sign?

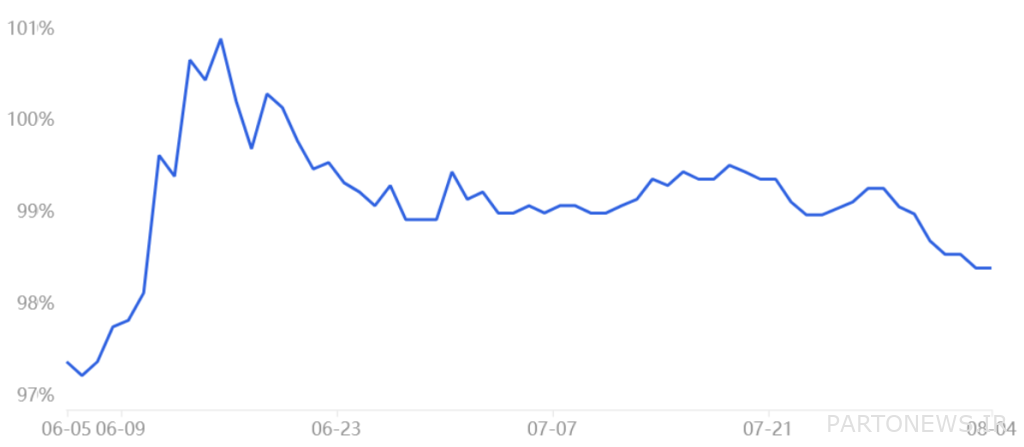

The Tether Premium index, which measures the difference between the price of Tether in peer-to-peer transactions in China with the daily value of the US dollar (in yuan), is a good tool for measuring the demand of Chinese retail investors.

The increase in demand for buying Tether has brought this index above the 100% level, and in the course of bearish markets, the value of Tether has decreased in China and the premium Tether index has dropped by 4% or more.

Currently, this index is at 98.4%, which is the lowest level since June 10. In general, it can be said that this index is currently far from the conditions that indicate the extreme fear of retail investors; However, during the last week, its situation has worsened to some extent.

Let’s also add that the lack of demand among retail investors is not a very worrying thing and it can be said to some extent that it is consistent with the 69% decrease in the value of the entire digital currency market since the beginning of 2022.

Dispersion of emotions in the digital currency market

Perpetual futures contracts, also known as “reverse swaps”, have a fixed rate (fee) that usually changes every 8 hours. Exchanges use this fee so that the market does not go out of balance.

The positivity of this rate (funding rate) shows that long (bullish) traders have more demand to use trading leverage, and its negativity shows that short (bearish) traders are in such a situation.

As can be seen from the image above, the seven-day cumulative capital supply rate in various exchanges is positive or almost neutral. This data shows the balance between long and short traders.

Considering the lack of demand to buy Tether in Asian markets and the dispersion of capital supply rates among different exchanges, it can be said that while the market value is trying to cross the hard resistance of $1.1 trillion, investors are not confident about the current market conditions. As a result, it should be said that currently, despite the serious entry of American lawmakers into the digital currency space in this country, sellers and traders who have a bearish view will have more control over the market for the time being.