2022 Year of Bitcoin and Gold

A Bloomberg expert believes that Bitcoin could outperform other asset classes in 2022.

To Report Crypto Slate Inflation around the world seems to be out of control. The UK inflation rate has reached 9% and the supply of liquidity “M1” has also grown. M1 refers to coins and banknotes in the hands of the people and other monetary equations that can easily be converted into cash. Stock markets, meanwhile, have been hit hard, with more than $ 7 trillion in capital lost on the Nasdaq in the past four months.

Mike McGlone, senior analyst at Bloomberg Intelligence, said:

If the stock market falls, bitcoin, gold and bonds can dominate the financial markets.

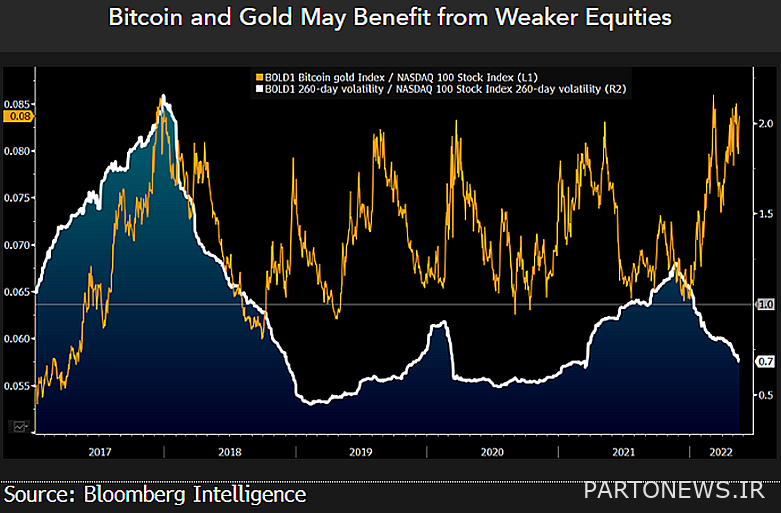

It is worth mentioning that he shared the following chart to explain his claim.

The chart shows the yield on 10-year US Treasury bonds in orange, and compares the performance of Bitcoin and the Nasdaq 100 index, with the numerical ratio between the two forming the white index. It should be noted that these data are related to the last four years so far. As you can see, when Bitcoin hit rock bottom around 2018, it created a twin bottom (white circle at the bottom left of the image) with a ratio of 0.5. This ratio (Bitcoin performance compared to the Nasdaq index) increased to 2.0 by the beginning of 2021.

Bitcoin maintained a 2.0 ratio since January 2021, showing that it performed better than the Nasdaq in the midst of its first potential downturn. It is worth noting that the last long-term global recession is related to the financial crisis of 2008, which was a year before the launch of Bitcoin.

Bitcoin has been in a booming global economy since its inception and has been able to grow under such conditions. The outbreak of the Corona virus in the early 2020s added trillions of dollars to the world’s money supply, and a significant portion of it entered the digital currency market. Given that the world is currently dealing with the effects of rapidly increasing money supply, the Bitcoin trend seems to have been relatively stable compared to other risky investments.

According to McGlown, a bigger risk to the world economy in the next year or so may be the fall in asset prices. However, he feels that bitcoin and gold could outperform other asset classes in the near future.

He said:

Given that the stock market has performed well over a long period of time, its correction period may be extended as well. This can create good conditions for gold and bitcoin. The “BOLD1” index (a combination of gold and bitcoin) and the Nasdaq 100 stock index are synchronized only in bullish and volatile markets.

The chart below shows that since 2019, the fluctuations of the BOLD1 index against the Nasdaq 100 index have decreased. The yellow wave also indicates the Nasdaq 100 index.