25.8% increase in payment facilities of banks

According to Iran Economist from the central bank; This bank set a 30% liquidity growth targeting program for the year 1401 and was able to increase the legal deposit ratio at the level of the banking network by half a percentage point by adopting operational measures such as controlling the creation of bank money through the regulation and serious application of controlling the growth of the banks’ balance sheets. Directing the interest rate in the interbank market around the policy rate and within the corridor of the interest rate of the interbank market will control this variable considerably.

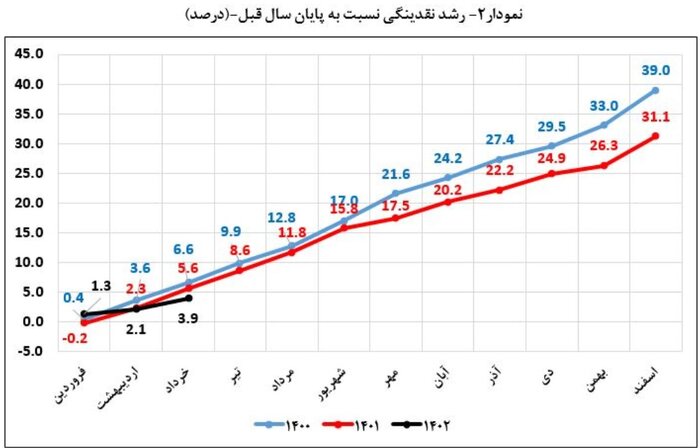

According to this report, liquidity growth at the end of 1401 was equal to 31.1%, which is a significant decrease compared to the last two years (liquidity growth in 1399 and 1400 was equal to 40.6 and 39.0%, respectively) It shows and tells about the relative realization of the monetary plan set for the year 1401.

In continuation of the plans of the government and the central bank to control the growth of liquidity and inflation, and in line with the slogan of the year, “inflation control and production growth”, the target of the growth rate of liquidity for the year 1402 is equal to 25%.

The preliminary statistics of 1402 also show that in the first quarter of this year, liquidity has grown by 3.9 percent, which is even significantly lower than the target liquidity growth for the first quarter of 1402.

The twelve-month liquidity growth rate at the end of June 1402 decreased by 8.8 percentage points compared to the same period of the previous year (equivalent to 37.8% in June 1401) and reached 29.0%, which indicates the central bank’s effort and focus on the implementation of quantitative control policy. The growth of banks’ balance sheets and the control of the growth of banks’ money creation and consequently the growth of liquidity this year.

Following the formulation and implementation of the monetary plan and setting the liquidity growth target for the years 1401 and 1402, in addition to the serious pursuit of the policy of controlling the growth of banks’ balance sheets and fining banks that violate the limits by increasing the ratio of legal deposits, the twelve-month growth of liquidity has decreased significantly. And from 42.8% in October 1400 to 29% in June 1402.

Monitoring programs of the central bank in order to control inflation

Regarding the policy of controlling some balance sheets of banks and credit institutions and the revisions and amendments made in it, it is necessary to explain that in the year 1401, the Executive Board of the Central Bank, in its meeting dated 05/08/1401, “Regulations for the control of some assets of the country’s banking network” notified through Circular No. 421929/99 dated 27/12/1399) and notified to the banking network through Circular No. 127050/01 dated 24/05/1401.

Based on the aforementioned amendment rules, the monthly net growth limit of the total assets of each bank/credit institution is determined and communicated in proportion to the score calculated based on the banking health indicators and based on the targeting liquidity.

Also, in this circular, according to the approval dated 05/04/1401 of the Money and Credit Council, regarding the permission to increase the legal deposit ratio up to 15% for unsound banks and credit institutions that violate the regulations and rules governing the growth of their balance sheets by the Central Bank Is mentioned.

Further, due to the growth of debts outside the regulatory standards of some banks despite the permitted growth of their assets, the central bank’s board of directors has decided to approve alternative regulations under the title “Regulations for controlling the amount of balance sheets of the country’s banking network” including the rules for controlling the amount of assets. and the debts of banks and credit institutions (approved by the 49th meeting dated 03/10/1401 of the Executive Board of the Central Bank) and its notification through Circular No. 263882/01 dated 21/10/1401 for implementation to the banking network.

Adding the issue of controlling some debts, changing the basis of calculation from average monthly growth to the allowed monthly amount and imposing restrictions on granting/creating facilities/large and related obligations of the wrong bank/credit institution are among the most important changes compared to the previous criteria.

25.8% increase in payment facilities in the first three months of 1402

It should be noted that while controlling the growth of liquidity (within the framework of the monetary program), the central bank has not neglected the financing of the economy and specifically the productive sectors of the economy and the policies of directing credit towards productive economic activities and financing business owners and households. put on the agenda. In this context, we can refer to the total facilities paid by the country’s banking network to various economic sectors during 1401, which has reached 44485.3 thousand billion rials with an increase of 45.3% compared to last year.

Also, the total facilities paid by the country’s banking network to various economic sectors during the first quarter of 1402 was equal to 9213.5 thousand billion Rials, which shows an increase of 25.8% compared to the figure of the same period of the previous year. 85.2% of the total payment facilities during the mentioned period belonged to business owners and 14.8% to the final consumer (household). It should be noted that 66.5% of the total payment facility in the mentioned period was used to finance the working capital of production units. Also, 82.5% of the total facilities paid in the said sector were spent on the working capital of industrial and mining units.