3 digital currencies back from the dead in 2023 + price analysis for 2024

The digital currency market saw a significant price recovery in 2023, and for example, Bitcoin, as the market leader, has experienced a 160% growth since the beginning of this year. With the beginning of the bull market, many altcoins also faced an increase in price, and the growth rate of some of them is surprising in its own way.

In this article based on a report Written by the Coin Telegraph website, we take a look at the biggest bullish recoveries of digital currencies in 2023 and provide an analysis of the price movements of these assets for the year ahead.

Solana and the best performance among the market giants

Solana has the most successful upward price recovery among the major currencies of the market and has experienced a 1,215% jump from the bottom of $8.27 in December 2022 (Azer 1401). The price of this digital currency against Bitcoin has also increased by 485% from the bottom of 0.00004952 units related to June 5 (June 15).

Solana experienced a 95% drop in 2022 and had one of the worst performances of that year; Falling below $10, which was mainly affected by the bankruptcy and scandal of the cryptocurrency exchange FTX.

The growth of Solana in 2023, while the assets of the bankrupt FTX exchange are being sold, shows the high resilience of this digital currency, the significant increase in the use of decentralized applications based on this network, the increase in market demand for SOL and the stability of the better performance of the network in It is the same as the increase of activities in this blockchain.

Also read: Reasons for Solana’s price jump; Does the upward trend continue?

The emphasis of Solana and its related projects on improving the mobile user experience in using this ecosystem (or in other words, eliminating the need to use a computer) and the extraordinary scalability has made new users and developers attracted to this network and as a result the position of this project. in the market and its acceptance rate is improving.

Solana price analysis for 2024

Despite Solana’s impressive growth over the past months, the cryptocurrency’s weekly chart paints a bearish picture of price action at the start of 2024.

Solana’s weekly Relative Strength Index (RSI) remains above the 70 level (saturation of buying), which indicates the potential for price to return to lower levels for the coming weeks. In addition, the failed attempt of this digital currency to close its weekly candlestick above the 0.5 Fibonacci retracement level at $132 strengthens the scenario of a simultaneous exit of some traders from the Solana market.

The resistance of $132 earlier in March 2022 (Esfand 1400) had prevented Solana from continuing its upward trend, and then it was accompanied by a 94% price drop. There is a risk of Solana price falling in the first half of 2024, and the possible target of this downward movement is the support of the upward trend line (purple line in the picture) around $40.

However, the second half of 2024 could be the starting point for Solana’s rise again after testing the weekly chart’s uptrend line support. Further, the jump to the previous record price of $265 will be possible by the end of 2024.

1,270% return of Tron from Black Thursday to today

During the bear market between 2018 and 2020, TRON lost 98% of its value. Since registering a price floor of $0.0076 after the collapse of the digital currency market following the Corona epidemic around the world, however, the price of TRX has grown by about 1,270%. 100% price return in 2023 is also considered a part of this significant recovery.

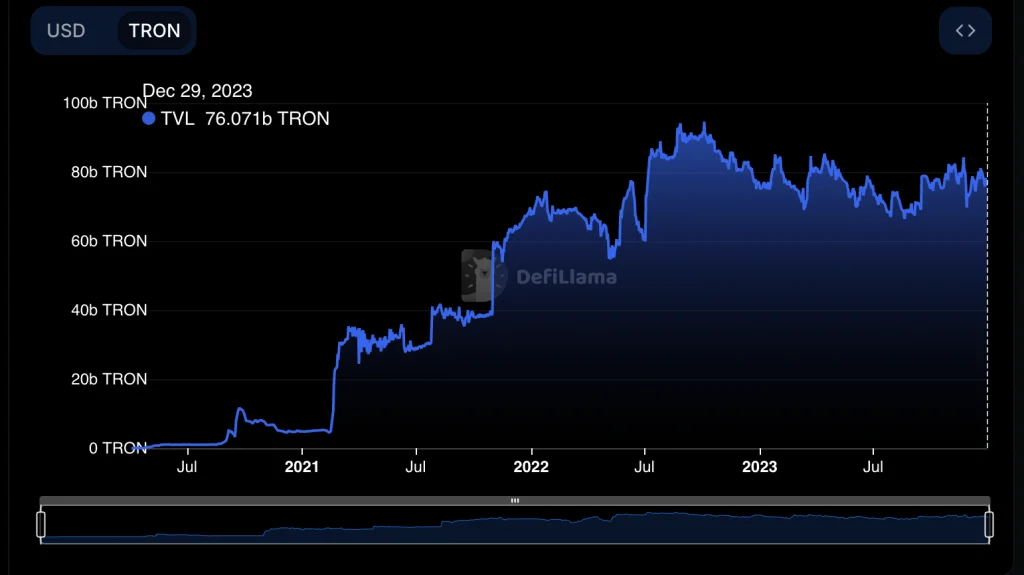

Tron’s stunning recovery is largely driven by the ecosystem’s strong performance in the decentralized finance (DeFi) space. The total value of assets locked in the TRON network has increased from 30 million TRX in April 2020 to more than 76 billion TRX (equivalent to $8 billion) in December of this year.

In addition, Tron has taken measures to burn tokens in this network, which has reduced the active supply of TRX, along with increasing the value of assets locked in this ecosystem.

The Tron network is the largest host of the popular Tether stablecoin, and more than half of all Tethers in the market, i.e. about $49 billion, are transferred on the Tron blockchain platform, which is an important advantage for this network compared to its competitors.

Tron price analysis for 2024

In the one-week time frame, Theron is about to reach the end of a giant symmetrical triangle pattern. Therefore, the first quarter of 2024 could be associated with price swings between the upper trendline (around $0.108) and the lower trendline (around $0.095) of the triangle.

Like all cryptocurrencies, TRON’s performance during 2024 will largely depend on key market factors such as the approval of Bitcoin Cash ETFs in the US, the Bitcoin halving in April (April 1403), and the overall state of the global economy.

The closing of the weekly candlestick and TRX’s decisive jump to the top of the like pattern could lead to a price jump to $0.20. Conversely, if the price falls below the symmetrical triangle trend line on the weekly chart, there is a risk of the market falling to $0.056, which is the 0.236 Fibonacci retracement level and the 200-week exponential moving average (EMA 200 – blue line on the chart). ) overlaps.

Avalanche with a jump of 370%

The price of Avalanche has increased by about 370% since the record low of $8.65 in September this year. This recovery came after a 94.25% price drop, which is one of the biggest price drops among cryptocurrencies in the recent bear market.

The interesting thing about Avalanche is that the price recovery of this digital currency occurred while nearly 19 million AVAX units were released in the second half of 2023. This shows that the market has absorbed the extra supply of Avalanche well.

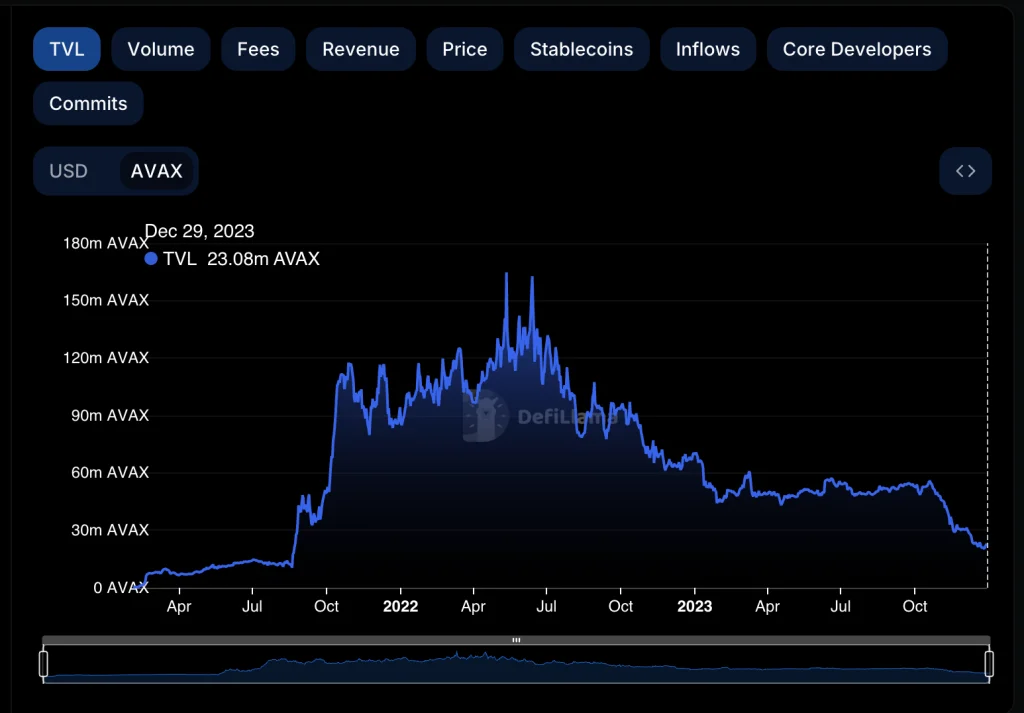

Despite this, indicators related to the network show a weak demand for this digital currency. For example, the total value of assets locked in the Avalanche ecosystem has decreased from 55 million AVAX in September to 23 million units in December this year.

Avalanche price analysis for 2024

The weakness of the uptrend is evident from the growing divergence between the rising price and the falling volume of AVAX. Price growth without significant trading volume indicates the absence of a strong support for price movements. This could mean that fewer and fewer traders are participating in the digital currency market, and those who are still active may not be entirely sure of the continuation of the upward trend.

The Avalanche’s uptrend recently stopped near the 0.618 Fibonacci retracement level resistance around $50.50. The price now appears to have begun a decline to the next Fibonacci retracement level at $29.50, which is expected to be completed in the first quarter of 2024.

A continuation of the downtrend below $29.50 could also lead to AVAX falling to the 50-week EMA 50 – red line on the chart at $20.16.