3 reasons for Bitcoin to jump to the peak price of the last 9 months

The price of Bitcoin reached the highest level of $26,514 yesterday, which shows a 35% growth of this digital currency since it fell below $20,000 on Friday, March 10 (March 19); But what happened that made Bitcoin experience such a spectacular growth after a long time?

1. Reimbursement of Silicon Valley Bank’s customer deposits

To Report Cryptopotato, the main reason for the fall of Bitcoin last week was the uncertainty of the banking partners of companies active in the field of digital currencies. Silvergate, Signature Bank and Silicon Valley Bank are among these banking partners. Silicon Valley’s bankruptcy was triggered by the withdrawal of $42 billion in deposits from the bank’s customers on Tuesday, after which the Federal Deposit Insurance Corporation of America ordered the bank to stop its operations and confiscate customer deposits.

This event, which was accompanied by hitting Bitcoin and removing the stablecoin “USDC” from the price link with the dollar, received a suitable response from the Central Bank of America and it was decided that all the deposits of the customers of this bankrupt bank will be refunded to them without any deficit. The announcement bodes well for companies associated with the bank, including Circle, Blockchain, Ripple, Pentra Capital, and YogaLabs.

The U.S. central bank emphasized that the repayment of Silicon Valley Bank’s customer funds will not cost taxpayers anything. According to many, this issue was considered a sign for this change, that the Federal Reserve intends to inject more liquidity into the American economy. In general, more liquidity means higher prices for risky assets such as stocks and digital currencies.

Robert Kiyosaki, author of the book “Rich Dad, Poor Dad”, also expressed the same idea on his Twitter on Sunday, after the price of Bitcoin jumped.

He wrote:

Payment of financial aid has started. Now more fake money is going to flow into this sick economy. My advice remains the same. Buy gold, silver and bitcoins. be careful. The fall is ahead.

2. Continuation of inflation

Although Bitcoin’s growth started after the announcement of the Silicon Valley Bank bailout, the upward trend continued with the announcement of February US inflation data.

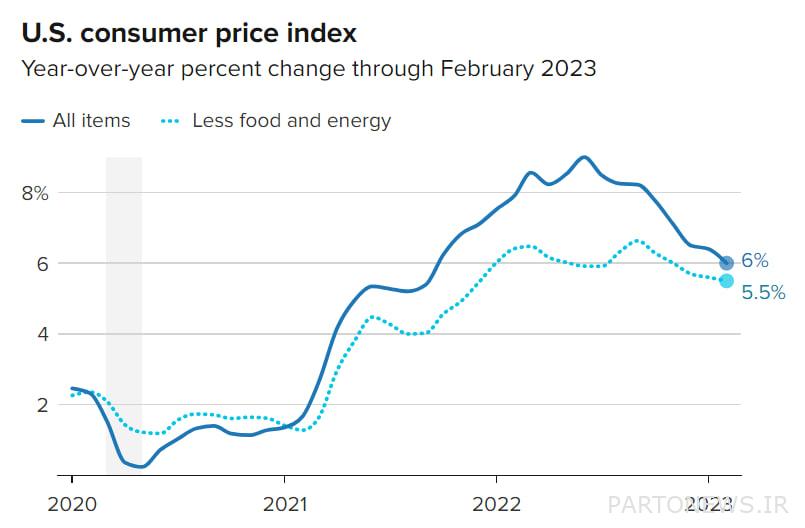

Statistics show that the inflation rate in February 2023 increased by 6% compared to February last year, which is lower than 6.4% in January this year. The monthly inflation rate for February this year is 0.4%, which is lower than 0.5% in January. In contrast, Core CPI, which measures changes in the prices of goods other than food and energy, grew by 0.5% in February, up from 0.4% in January.

Last year, the Central Bank of America initiated an increase in bank interest rates with the aim of curbing inflation, which severely affected both the stock market and the digital currency market. The existing signs of a decrease in inflation could mean that the central bank is also preparing to stop the interest rate increase process; This is a bullish signal for digital currency investors.

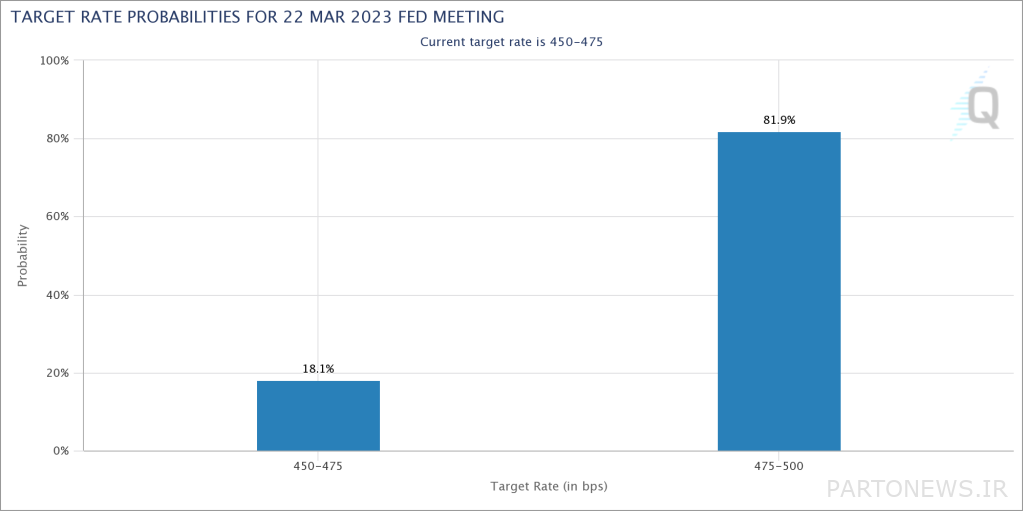

The “Fedwatch” tool of the Chicago Mercantile Exchange shows that traders have an 18% chance of stopping the process of increasing bank interest rates at the next meeting (April 2) of the Federal Reserve.

3. Binance switching to buying bitcoins

Binance, the world’s largest cryptocurrency exchange, has also likely been part of Bitcoin’s recent surge. Changpeng Zhao, the CEO of this group, recently announced that in order to avoid banking crises and problems related to stablecoins, they will convert the 1 billion BUSD in their recovery fund to Bitcoin, Ethereum, and Binance Coin. After Zhao’s announcement, on-chain data showed thousands of bitcoins deposited into Binance.

Purchases on this scale can move the market on their own. For example, when the Luna Foundation was buying large sums of Bitcoin in spring, it was able to help the price of this digital currency rise to nearly $50,000 despite the downward pressure in the market.