5 altcoins that revolutionized digital currencies in 2022

2022 was a very difficult year for Bitcoin, Ethereum and other digital currencies in the market. However, cryptocurrency traders are still hopeful that 2023 will bring new developments in the direction of price growth for these assets.

Regardless of the turbulent price conditions of digital currencies, there are a few altcoins that continue to play a positive role in the digital currency industry, and thanks to the continued development of the Ethereum ecosystem, “altcoin” is no longer considered a pejorative term.

In the continuation of this article based on a note Written by Kyle White, author of the Coin Telegraph website, we’ll introduce the top altcoins that have revolutionized the cryptocurrency space over the past year.

Ethereum and Eternal Shine

On January 2, 2022 (12 Jan 1400), the annual price peak of Ethereum was recorded at $3,835, and then, while the overall market conditions were bearish and several fundamental factors put pressure on the prices, Ethereum several times for He tried to recover his position. Ethereum will undoubtedly be called the biggest project in the digital currency space in 2022. This title is not for Ether’s price performance, which refers to the successful upgrade of the Ethereum network mechanism from proof-of-work to proof-of-stake to this blockchain; A huge change that the cryptocurrency ecosystem has been waiting for for years.

The historical update of Ethereum Merge was done on September 15 (24 September) and while many were worried about the problem in the process of changing the mechanism of the Ethereum network, this move was done perfectly.

One of the obvious advantages of the proof-of-stake model compared to proof-of-work is the lower energy consumption in blockchains based on this structure; Because in proof-of-stake networks, there is no need to use expensive and high-use hardware (miners) to verify transactions. This lowers network usage costs for users and makes the overall state of the blockchain more stable. At the same time, the movement of Ethereum towards a more scalable network is also dependent on this change of mechanism. It should be noted that estimates show that the update of Marj Ethereum has reduced energy consumption in this network by 99.9% compared to before.

Also Read: Proof of Work and Proof of Stake, Concepts and Differences

Some analysts considered the post-apocalypse era to be a bullish era for Ether, and their argument was that with this change in the mechanism, the supply speed of Ethereum will be greatly reduced and the inflation rate of this digital currency will eventually become negative; An idea that, of course, turned out to be true to a large extent. Although Ethereum’s inflation rate was negative at times, it has now turned positive again, and the price of Ether is still a long way from its early 2022 peak.

Now, for 2023, investors hope that the increase in activities and the number of transactions of users of the Ethereum network will lead to the growth of the price of this digital currency.

Lido; Ethereum staking for everyone

The revolutionary move made by Lido is to make it easier to participate in Ethereum Proof of Stake network validation for users who do not have the required 32 Ethereum units to directly stake in the network and become an independent validator.

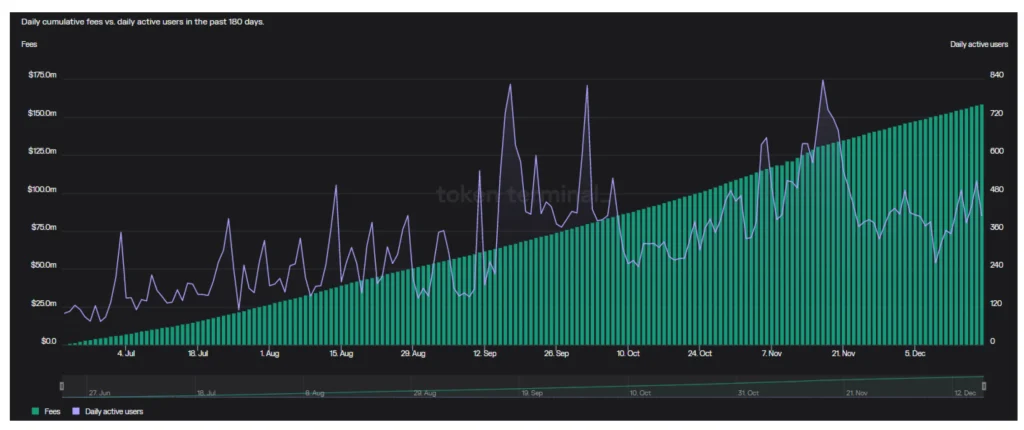

Since Lido’s launch, the project has earned $158.8 million in fees from its Ethereum staking protocol, and even had 823 daily active users at one point on September 17.

With the launch of the Shanghai Ethereum update scheduled for March of this year, the network will kick off the first quarter of 2023 with a bang, after which it will be possible to harvest ethers staked on the blockchain. Aztec Connect, the consortium that launched the Lido protocol, recently raised $100 million in a crowdfunding event to launch a new blockchain.

Poligan and cooperation with technology giants

Like it or not, the widespread adoption of digital currencies in the world requires the cooperation of the sector with large traditional companies and brands. Paligan’s focus in 2022 was also on this kind of cooperation, which includes cooperation with major institutions such as Warner Music, JP Morgan, Instagram and Nubank; A neobank backed by legendary investor Warren Buffett.

All these companies use the Polygan network in a different way, which includes connecting Polygan to their own infrastructure and using this network to apply distributed ledger technology to various products and services.

So far, major legal and natural persons have chosen Polygon to launch their NFT collection, including Donald Trump, the social network Reddit, Deadmau5, the famous songwriter, and the world’s sporting goods giant, Nike.

Some optimistic analysts expect the Polygon price to make an upward jump in 2023 under the influence of the on-chain activities of this layer 2 protocol and positive fundamental factors related to this project. Despite Polygan’s significant growth over the past year, Ethereum mainnet still has a much higher position than Polygan in terms of fees received.

Polygon’s adherence to Web 3.0 principles, along with their collaboration with the aforementioned big names, makes this project one of the top altcoins of 2022.

Dao Maker with exemplary flexibility

In a year that everyone remembers with the collapse of famous algorithmic stablecoins like TeraUSD (UST), Dai (DAI), the algorithmic stablecoin of the Dow maker, proved its resilience. Unlike centralized stablecoins such as Tether, Dai is a decentralized stablecoin that has important features such as greater transparency, resistance to censorship, and no dependence on traditional financial systems.

Although Dai is not considered a new project, the decision of this digital currency community to reduce risk among its backing assets, such as the use of treasury bonds and corporate bonds, places this stablecoin among the top altcoins of the past year. Sebastien Derivaux, a digital currency analyst, says that this important decision is a guarantee for 75% ($600 million) of the total revenue that the Dai project has.

Cool cosmas and updates

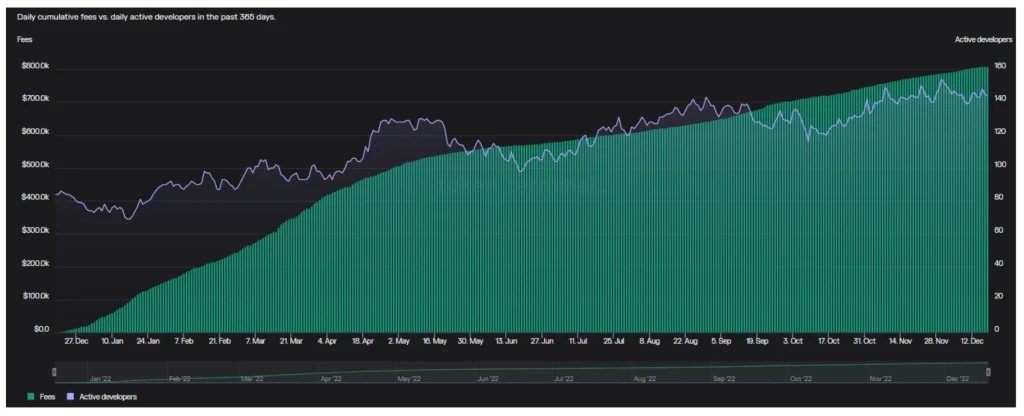

Cosmas 2022 focused on the issue of interoperability and challenges related to communication between blockchains. On the first day of 2022, Cosmas had 74 active developers, and this number reached 154 developers on November 30 with a significant growth.

The launch of the Cosmas Interblockchain Communication (IBC) protocol was the project’s most significant move in its 2022 interoperability-focused path. The success of this project drew the attention of large institutions such as Delphi Digital and VanEck Capital Management Company to Cosmas.

Also read: What is Cosmas? All about blockchain interoperability protocol

All in all, Cosmas has the potential to be one of the important infrastructure layers of the digital currency ecosystem, helping to transfer value and information between different blockchains, paving the way for a more collaborative future in this space.

Many cryptocurrency investors might like to forget 2022, but it was this year that saw many technological advancements in the cryptocurrency space. Altcoins whose main purpose is to create new ideas will shape the future of this industry in 2023 and beyond.