5 reasons for Bitcoin to fall to $10,000; The final fall hasn’t happened yet?

Investors in the digital currency market are still looking for answers to the question of where the bottom and end point of Bitcoin’s downtrend is. In answer to this question, it should be said that many indicators show that the price floor of Bitcoin is somewhere around the $10,000 range.

To Report Cointelegraph History has shown that traders face many challenges in bear markets. Furthermore, the “reliable” indicators that are supposed to determine entry points cannot predict how long the digital currency winter may last.

With the recent rise of the price of Bitcoin above $20,000, which is considered an important psychological resistance, many traders thought that this digital currency had reached its bottom. However, the available data suggests that Bitcoin’s short-term rally is probably not enough to change its overall trend.

A recent report by research firm Delphi Digital suggests that traders should be more cautious. According to this report, “before we know for sure that the market has reached its bottom, we have to suffer a little more”.

Everyone knows that traders have suffered huge losses since November when Bitcoin hit a new all-time high. However, by comparing the correction trend of Bitcoin since November (Aban 1400) and the correction trend of 2017, we come to the conclusion that the price of Bitcoin is likely to decrease even more in the near future.

During previous bear markets, the price of Bitcoin is down almost 85% from the peak of the cycle. According to Delphi Digital, if history were to repeat itself, Bitcoin would “reach just above $10,000 and fall about 50% from its current price.”

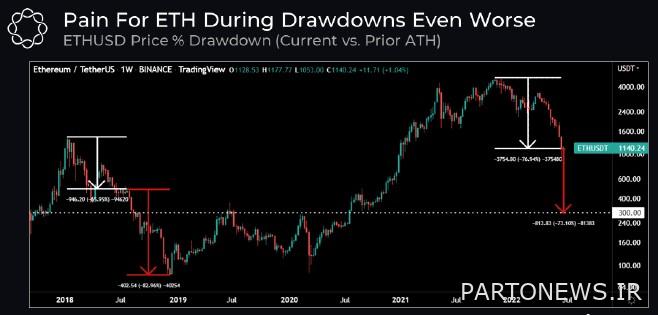

Predictions for Ethereum are even worse than for Bitcoin; Because the price of this digital currency had decreased by 95% compared to its peak in the previous bear market. As a result, if the same thing happens again, the price of Ethereum may drop to $300.

Delphi Digital wrote about this in its report:

The risk of a repeat of the previous crash is greater than most people anticipate; Especially if Bitcoin fails to maintain its support in the $14,000-$16,000 range.

The oversold situation continues

The available data suggests to traders who want to know the bottom of the current down cycle that the end of previous downtrends coincided with the market entering an oversold condition.

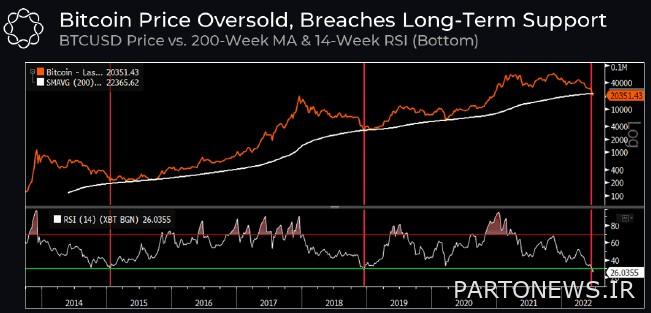

As you can see on the weekly chart below, Bitcoin’s Relative Strength Index (RSI) recently fell below 30 (the oversold zone) for the third time in its history on a 14-week view. It should be noted that in the previous two series when this happened, the price of Bitcoin was near the end of the downward trend.

While some may see this as a signal to re-enter the market, Delphi Digital cautioned those who expect Bitcoin to grow quickly, saying that “in the previous two cases, Bitcoin stayed in a range and channel for several months. It was volatile and after that, it was able to recover and start its strong uptrend.

An examination of Bitcoin’s 200-week Simple Moving Average (SMA) raises the question of whether the cryptocurrency’s historical support will hold again.

In recent days, Bitcoin fell below its 200-week moving average for the first time since March 2020. It should be mentioned that in previous downtrends, Bitcoin traded below this level for several weeks. As a result, this suggests that the market’s largest digital currency may soon find its bottom.

The final fall hasn’t happened yet?

Right now, the digital currency market is looking for the final selling wave of traders. History has shown that this happens at the end of a downtrend and at the beginning of the next cycle.

Although the frustration of traders has now reached its highest level since the market crash in March 2020 due to the spread of the Corona virus, it is still less than the frustration of traders in 2018.

Delphi Digital wrote about this:

We may need to endure more pain before trader sentiment begins to improve.

Although the digital currency market has generally weakened since the end of 2021, the real driving force behind its decline has been rampant inflation and rising bank interest rates in the US.

Financial markets usually face corrections when bank interest rates rise, and given that the Federal Reserve plans to continue raising interest rates, Bitcoin and other risky assets are likely to face further corrections.

Another indicator that shows that the “final trickle down” has not yet occurred is the share of units in the profit from the supply of Bitcoin circulation. It is worth noting that in previous bearish markets, this rate has dropped to 40%.

According to Glassnode website data, this index is currently at 54.9%. As a result, it can still be argued that the market will experience another downtrend before reaching its true bottom.