5 things you should know about the price reaction to Bitcoin halving

The halving, the most important event on the Bitcoin network that halves the reward for mining each block over 4-year intervals, will happen in about 4 months. Since changes in the value of Bitcoin directly affect the trend of other digital currencies, knowing the price behavior of Bitcoin in the months near the halving and the period after it will be of particular importance to all traders and investors active in the market. We have reviewed this article.

Bitcoin halving event will happen in about 128 days at block number 840,000. During this period, the reward for extracting each block will be reduced from 6.25 to 3.125 units. Analysts consistently cite halving as a long-term bullish factor, as it slows down the supply of new units to the network and, as a result, can make the asset more valuable over time. Of course, it should be kept in mind that the other side of the supply reduction story is the amount of demand, and the theory that halving makes Bitcoin more valuable over time is based on the assumption that the demand for this digital currency does not decrease significantly over time. ; It means to remain almost constant or increase.

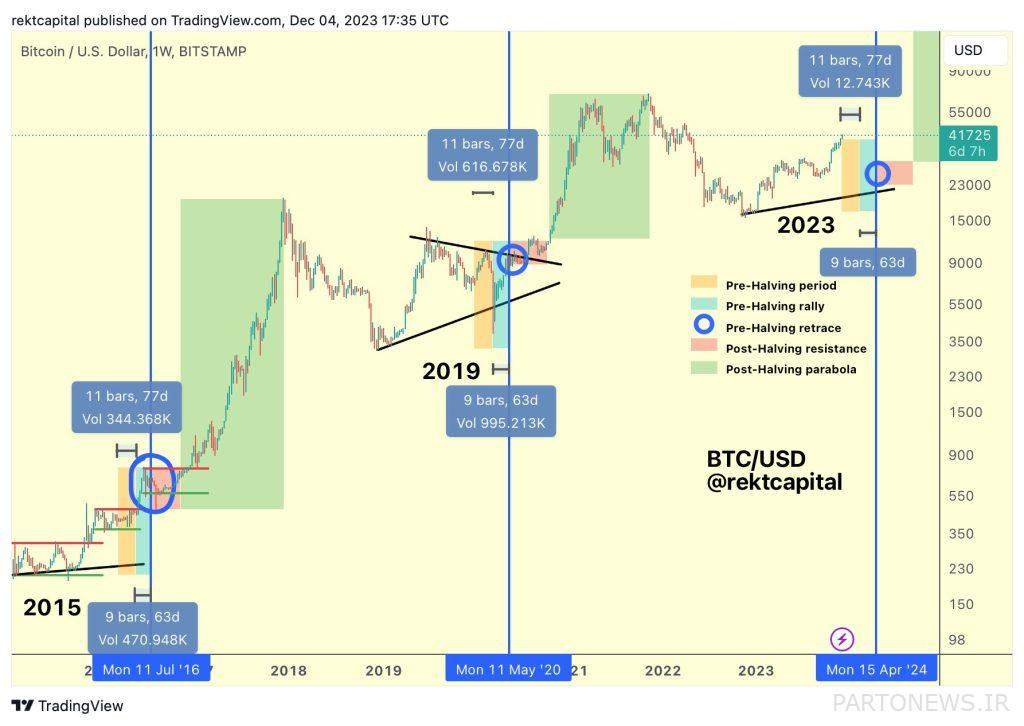

Since the first halving on November 28, 2012, the price has reacted almost the same in different periods to this event and it can be said that it has drawn a constant pattern. Considering the importance of this event in determining the direction of the entire digital currency market in the coming months, Rekt Capital, a well-known and active analyst on Twitter who has his own style and constantly compares the price behavior of Bitcoin with the past, in the form of a Post He has pointed out significant points regarding the changes in the market situation, before and after the halving.

He has divided the price behavior before and after halving into 5 phases, with a phase titled Pre-Halving period Starts. According to Racket Capital, in the pre-halving period we’re in now, any dip in price to lower levels can historically be a good opportunity to buy Bitcoin and generate good returns in the months after the halving.

In the second stage turn to Pre-Halving rally arrives. Racket Capital says that 60 days before Bitcoin’s halving (blue area on the chart below), there is a possibility of a new uptrend. He justifies this prediction with the theory of “buy the news and sell the rumor” and says that part of the investors start buying at this stage to sell shortly after the halving and by receiving the expected return from the price growth. As a result, we may see an upward trend in this particular period of time.

Pre-halving retrace The third stage is introduced by Rect Capital and according to this analyst’s definition, it usually happens in the days close to the halving or even after it. The pre-halving correction in 2016 was associated with a 38% price drop, and in 2020 this happened again with a 20% drop. Rect Capital says that this makes investors somewhat skeptical about the positive effect of halving on the price.

The fourth stage Re-Accumulation Is. According to Rect Capital, many investors will be disappointed or even exit the market during this phase, which could last several months, due to the lack of significant growth in Bitcoin’s path.

The final stage that Bitcoin investors have been waiting for for years. Parabolic Uptrend Is. At this stage, the price is out of the re-accumulation phase and has a chance to move its historical record with a rapid growth.

Although Rect Capital’s prediction of the market seems somewhat logical despite the arguments it presents, there is no guarantee of repeating the pattern that the market has followed in the past, and unexpected events can always change the course of the financial markets in a very noticeable way. Therefore, it is better to smoothly assess the risk of your investments and make decisions about your assets with full knowledge.