6 thousand billion tomans withdrawal from the stock market in a recent month / Know the factors affecting the growth of the capital market

According to the economic correspondent of Fars News Agency, the stock market also started a downward trend in January and the capital market went red for 18 months. In this regard, shareholders disappointed with the change in the stock market trend are leaving this market and entering parallel markets. Restore some of their lost capital.

The 13th government still needs time to calm down the capital market, which fell by more than 75,000 units in January this year. From the stock market.

The decline in retail transactions in the capital market also shows that real shareholders are not interested in trading until the market situation is determined.

* Fluctuation of law firms

Of course, an examination of the entry and exit of law firms into the capital market shows that these companies have also limited their fluctuations on the range and range of their profit and loss limits, and in the past month we have seen that sometimes even with profits of 2 to 3% are withdrawn from the shares.

On the other hand, the rial value of transactions is relatively low compared to the market index and the rial value of the market, and the average value of 2,500 billion tomans of retail transactions in the past month, in the first place shows people’s fear and distrust of the capital market. This issue, shareholders are still waiting for the outcome of domestic, foreign political, international and economic events; These events can have a profound effect on the country’s economy and various industries, and as a result, have a great impact on the operating income of companies.

Financial ratios show the attractiveness of the stock market

If the capital market fails to attract investment, money enters parallel markets and we have to wait for liquidity to flow to these markets, this can also challenge the country’s economy, the value of transactions still indicates a market downturn. This has reduced the market retrograde P / E and P / S ratios to 7.9 and 2.7.

If this money does not leave the capital market, it can be hoped that both the liquidity problem in the capital market will be solved and the total value of trades and small trades will increase and a change in the stock market trend will occur; In other words, the non-withdrawal of money from the stock market and the increase in demand for the purchase of stocks, and as a result, increase the market value of stocks and ultimately increase the overall capital market index.

Surveys show that now, with the decline in stock trading, shareholders are more inclined to buy defensive shares and mutual funds, and due to the declining market, investors have sharply reduced their risk and fixed-income funds and banks are the destination of money. Shareholders will.

* Money continues to flow out of the stock market?

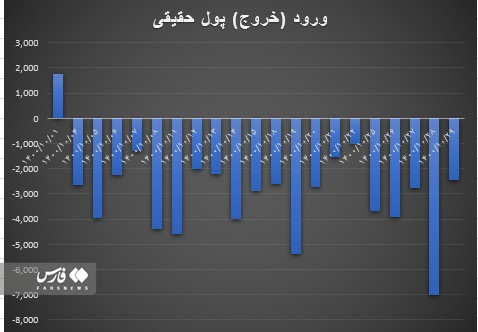

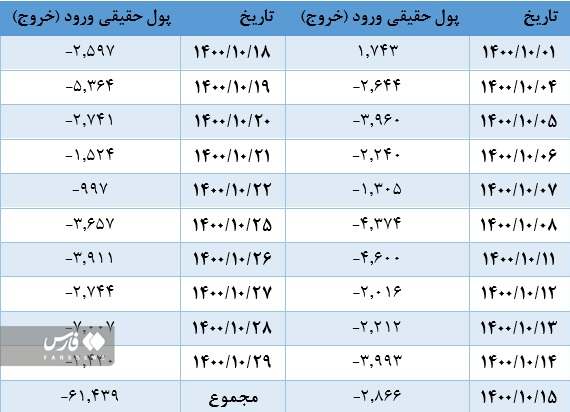

Despite the sharp price correction of most market symbols in recent months, we still see the pressure of sales and the outflow of liquidity from real people from the market. In a recent month, the outflow of money from the capital market has been extremely worrying, and only on the first day of January, we have seen the entry of money into the market, and in all days of January, we have seen the outflow of money from the capital market.

In January, an amount of more than 6 thousand billion tomans has been taken out of the market, while the market is thirsty for liquidity and if the slightest support for shares is provided, the market will face a change in trend and can return to a balanced situation. .

Factors affecting capital market growth

In January, most of the stock exchange companies started their quarterly and 9-month reports. It seems that the best quarterly reports belong to the metal-mineral group, followed by the refinery group; Registered. In the smaller groups, the pharmaceutical group has been associated with growth in profitability due to the increase in the major income of the companies in this group.

The trend of the dollar exchange rate in recent weeks has grown significantly despite the negative fluctuations of the free dollar exchange rate and is very good news for export-oriented groups.

In world markets, oil continues to grow and metal products are also experiencing positive fluctuations. Rising oil prices promise to increase the prices of petroleum and petrochemical products, which could make petroleum refining groups more attractive.

Fluctuations in interbank interest rates are also closely monitored by market participants, which if the rate is below 20% of the capital market will be highly attractive for investment and can be a serious stimulus for future growth of the stock market.

Finally, capital market participants should be aware that in the medium term, they will see better conditions in the stock market than they do today.

End of message /

You can edit this post

Suggest this for the front page

.