80% of investment fund inflows last week were related to Bitcoin short products

The latest statistics on the activity of investment funds in Bitcoin and digital currencies show that 51.4 million dollars of the 64 million dollars of money that entered these financial products last week belonged to short Bitcoin funds; The incident that shows the desire of institutional investors to trade in order to reduce the price of this digital currency.

To Report Cointelegraph, a major institutional investor active in the cryptocurrency market, last week poured $51.4 million into products designed to short trade Bitcoin.

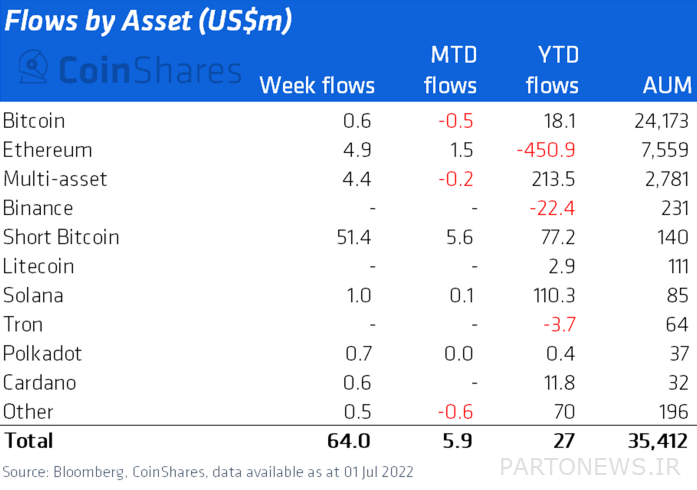

CoinShares’ weekly report on the activity of institutional investors in Bitcoin and digital currencies shows that last week between June 27 and July 1 (July 6 to 10), a net amount of 64 million dollars was invested in digital currency investment products, and this in Meanwhile, 80% of this amount was the share of short Bitcoin products.

The share of American institutions from this inflow was 46.2 million dollars, and their demand for investing in short Bitcoin products was also significant. It should be noted that the ProShares investment institution officially launched the first short bitcoin exchange-traded fund (ETF) in the history of the United States on June 22 (July 1). The shares of this fund are traded with the symbol “BITI” in the American stock exchange, and by using futures contracts, it provides investors with the possibility of earning profit in the direction of the fall in the price of Bitcoin.

Also Read: All About Bitcoin ETFs In Simple Language

The text of Kevin Shears’ report reads:

Apart from the Americans [که در این مدت عمدتاً روی صندوقهای شورت سرمایهگذاری کردهاند], long investment products (buying) in countries such as Brazil, Germany, Canada and Switzerland, have seen the arrival of 20 million dollars of money last week. This shows that part of the investors are buying at the current prices, and the issue of welcoming short trades is more likely due to the launch of the first Bitcoin short exchange fund in America than because of the change in market sentiment.

Short bitcoin products have received a total of 77.2 million dollars in capital since the beginning of 2022, while the inflow of multi-currency funds and Solana special funds has been 213.5 and 110.3 million dollars, respectively, since the beginning of this year.

Ethereum investment products saw $4.9 million inflows last week. This is the second week in a row that Ethereum funds have seen inflows after 11 weeks of outflows. It should be noted that, despite the trend change in the last two weeks, Ethereum investment products have seen a total outflow of $450.9 million since the beginning of 2022.

The rest of this $64 million is divided between multi-currency funds ($4.4 million), Solana special funds ($1 million), Polkadata ($700,000), Cardano ($600,000) and Bitcoin ($600,000). will be

The reception of Bitcoin short products occurs while two weeks ago $423 million was withdrawn from investment funds in digital currencies; This figure is the highest level since the publication of Kevin Shears’ reports. Two weeks ago, short bitcoin funds had an inflow of $15.3 million, while long bitcoin products faced an outflow of $453 million at that time.