A stock index shows that the price of bitcoin will reach $ 100,000 in two years

Analysts believe that if Bitcoin can break away from global stock markets and operate independently, it could reach $ 100,000 in the next 24 months. Bitcoin, on the other hand, has done much better so far than stocks of companies operating in the stock market.

To Report Kevin Telegraph, Tuur Demeester, founder of Adamant Capital Investment Company, said that if the correlation between Bitcoin and the Nasdaq Composite Index was broken, the digital currency could reach 100 in the next 24 months. Bring $ 000. The Nasdaq Composite is a stock index that includes stocks of companies listed on the Nasdaq Stock Exchange and is of particular importance, like the S & P500.

Bitcoin performs better than shares of technology companies

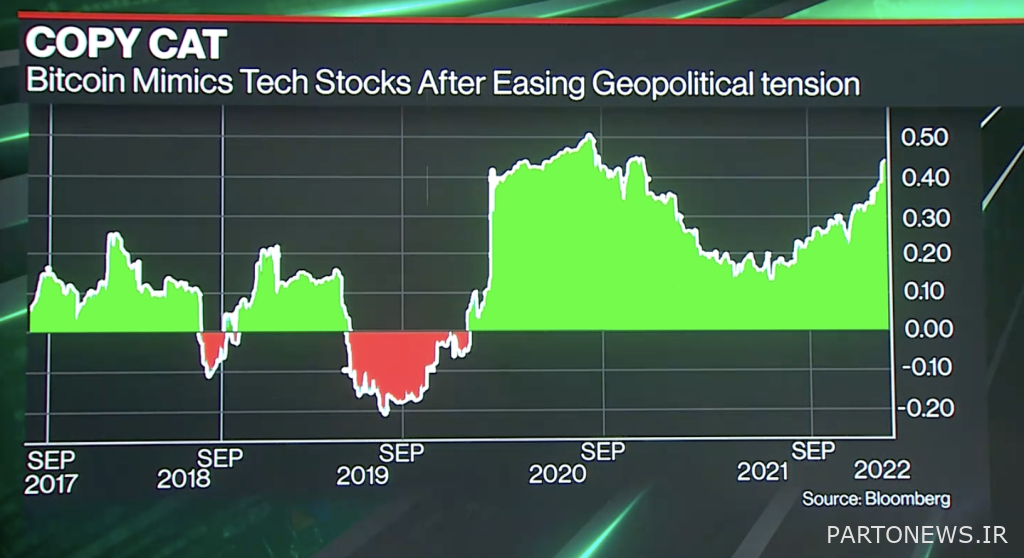

Demister uses the chart below to compare the growing market value of Bitcoin with the stock index of US tech companies. According to the chart below, Bitcoin is raising its price after long periods of stabilization, and this may happen in the next 24 months.

More than a decade has passed since the introduction of Bitcoin, and its price has risen from $ 0.06 to $ 69,000.

As you can see in the image below, the price of bitcoin has increased by about 64.50 million percent since 2010. The return of the Nasdaq index in the same period was 650%. As a result, the market value of Bitcoin has reached $ 755 billion and the market value of the Nasdaq port has reached $ 28.68 billion.

Can Bitcoin again separate itself from technology companies?

Bitcoin has had significant correlations with shares of US tech companies over the years. For example, at the beginning of this month, the correlation efficiency of Bitcoin with the Nasdaq index reached 73%, which is close to its 50-year peak of 74% in 2020.

In the midst of last month’s risky market, the price of bitcoin fell below $ 33,000 from a high of $ 69,000. Along with this price reduction, the US Federal Reserve also decided to rapidly raise bank interest rates in 2022 for the article with the staggering inflation that has reached its highest level in the last 40 years.

Matthew Sigel, head of digital asset research at VanEck Associates, predicts that bitcoin prices will fall, along with the Nasdaq and other US stock indexes. According to him, the price of bitcoin may be even lower than the stock market index. In addition, he said that although bitcoin price fluctuations have declined in recent years, the Nasdaq 100 index (the top 100 shares on the Nasdaq Stock Exchange) has deviated more than its five-year average.

This shows that the bitcoin situation has gradually improved and has become a safer and more reliable asset against rising inflation. As a result, its correlation with risky assets such as stocks of technology companies may decrease in the future.

James Butterfill, head of research at analytics firm CoinShares, said that Bitcoin and the shares of technology companies are currently correlated, and that the digital currency’s performance is highly sensitive to rising interest rates.

Butterfly added:

What happens if the authorities make a mistake in implementing monetary policy? For example, what if the Federal Reserve raises interest rates too quickly in the face of rising inflation in the United States, or if it does not act quickly enough? Such a situation is more likely to benefit Bitcoin and, to a lesser extent, the stock market.

In addition, Joey Krug, CEO of Pantera Capital, a digital currency risk hedge fund, predicts that in the coming weeks, the link between Bitcoin and the shares of technology companies will disappear and the digital currency will become an independent trading channel. It starts itself.

Bitcoin $ 100,000 goal

According to Demister, one of the reasons that Bitcoin can move towards the $ 100,000 price target is that despite the pressure from the correlation with the Nasdaq index, it has been able to stabilize near the $ 50,000 range.

Goldman Sachs also predicted that bitcoin would reach this price target by the beginning of 2022. The large investment company, which manages $ 1.2 trillion in assets worldwide, has stressed that if Bitcoin gains a share of the gold market, it could reach $ 100,000. It is worth mentioning that currently the market value of Bitcoin is less than 6% of the market value of gold.