After 6 years, allocation of salary is prohibited

According to the economic reporter Iran is an economistOne of the events that happened after the revolution was the nationalization of banks, due to the nationalization of banks, the need to monitor the country’s banking system decreased. This issue continued until the fifth development program and the issue of central bank supervision was raised in this program. This issue coincided with the formation of private banks because at that time the need to strengthen the central bank’s supervisory tools was felt.

One of the challenges of Iran’s economy from the banking system is high inflation and macroeconomic indiscipline, inflation and liquidity are also related to each other. Basically, to control inflation, liquidity growth must be stopped. The reason for the continued growth of liquidity is the imbalance in the public and private sectors. Some sectors have the possibility of disagreements that are connected to the central bank.

If the government can impose its dissatisfaction on the central bank, it will increase liquidity. On the other hand, banks are also important because due to the possibility of creating money, if proper supervision is not done, the growth of liquidity will increase.

Countries were able to experience low inflation that controlled liquidity growth. There are holes in economics that we need to print money to fill. These cases are government budget imbalance, quasi-government sector imbalance and banking system imbalance.

In the discussion of regulation and supervision of banks, it should be noted that the dissatisfaction of banks has spread to the central bank and has grown in recent years. In terms of accumulated losses and the health and stability of the banking system, banks are not in a good condition.

The ratio of capital adequacy of banks in different countries is very significant, while according to the report of the Majlis Research Center, capital adequacy in our country is negative. According to some experts, although a number of banks show positive capital adequacy in their financial documents, only five to six banks in the country have positive capital adequacy.

The issue that causes accumulated losses of banks is non-current claims. This means that part of the bank’s facilities will not be repaid. Some estimates show that 50 to 60 percent of the facilities paid are non-current claims.

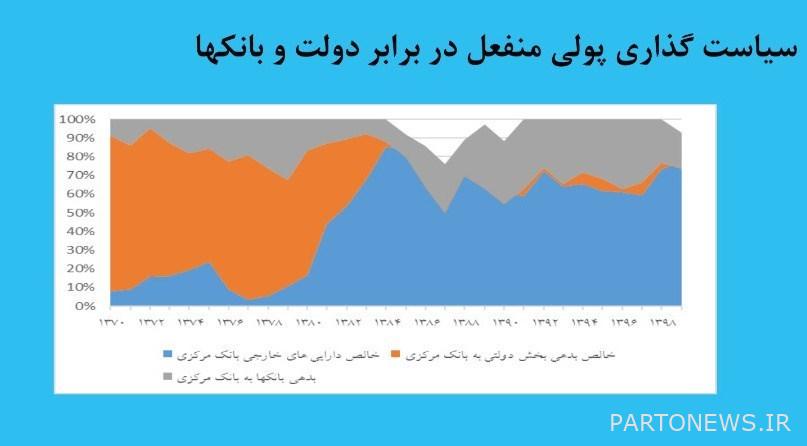

A look at the passive monetary policy towards the government and banks shows that over a long period, the share of the central bank’s net foreign assets in the monetary base components was about 70%. This is while the share of the public sector’s debt to the central bank has been very limited in recent years, and on the other hand, the share of the banks’ debt to the central bank has grown somewhat, and about 20-30% of the implementation of the monetary base is related to this index.

It should be noted that countries usually establish a central bank that does not have the current situation that exists in our country, so it can be said that we did not have a central bank during this period, because if there was, these events would not have happened.

Regarding regulation and supervision, there are religious and precautionary discussions; In the monetary policy department, we are facing the problem of the limitation of central bank tools and nominal anchor. In our country, the currency acts as an inflation anchor, while the central banks have moved the nominal anchor to the interbank interest rate.

It should be noted that the banking system has various problems regarding currency policy. In this part of the organized market and the supervision of the central bank, the government’s currency dominance over the central bank, the duty of the central bank to buy the government’s currency and non-adherence to the managed floating currency system are among the basic issues. Our experience is like this for several years exchange rate We keep it constant and after a while the inflation pressure increases and witness the shock exchange rate We are and this is also a matter that needs to be done.

The structural problems of the central bank in the field of supervision/inspector have no clue to detect violations

In the governance structure, there is a conflict between the interests of the central bank and the government and banks. The financial dominance and budget deficit that the government has can spread to the central bank. The second case is the conflict of interest with banks. There are many examples of conflict of interest in the banks’ disciplinary board. One of the banks is present in the disciplinary board and has the right to vote. This issue includes the revolving doors between central bank managers and commercial banks.

The weak part of the central bank’s supervisory authority includes the circles of violation detection, investigation and deterrence. The structure of the disciplinary board is such that the inspector has no role in it, as a result, there is no incentive to discover the violation. From 1995 to 1996, the inspection organization was established in the central bank and discovered a series of bank violations.

This shows that the process of detecting violations in the Central Bank is difficult. In the investigation section that you enter, the general secretary is in charge of the disciplinary board, and the members of this board are not appointed in such a way that they have the necessary ability to deal with specialized violations. Now, the bank can file a complaint against the central bank in the ordinary court during the investigation stage. This process means that the central bank does not have the necessary authority.

It may be said that, for example, it is enough to add six new tools to the powers of the central bank to solve this problem, but this happened in the law of the sixth plan. The central bank received the restraining powers, but until today, it has not used these powers because the regulation has not been approved by the disciplinary board. This shows that if the structure is not modified, no matter how much authority we give to the central bank, it will not have results.

It should be noted that regarding the decision-making system of the country’s banking sector, there is a Money and Credit Council in which unrelated ministers are present, while the decisions taken are not appropriate to the economic situation. Naturally, if a wrong decision is made, no fee will be paid for it.

There are two issues regarding the Money and Credit Council; First, expert people should enter it and be there permanently. In some periods, we saw the presence of the Minister of Education in the Money and Credit Council, and this minister had the right to vote. In addition, meetings are held every two weeks, which slows down the decision-making process.

Details of the four basic defects of the central bank structure and the changes in the parliament’s plan

In the main structure of the Central Bank plan, the General Assembly is at the top, and the Supervisory Board, the Supreme Board, and the Jurisprudence Council are under its supervision. The supervisory board must follow up on the approvals of the general assembly. The Minister of Economy, the head of the Program and Budget Organization and the head of the Central Bank are also present in the Supreme Council, who form the executive members.

Also, there are four non-executive members who are elected with the proposal of the Central Bank Governor and the approval of the President. This issue causes five people aligned with the Central Bank to be present in the Supreme Board, and this board has replaced the Money and Credit Council. In fact, the decision authority will be in the executive field of this board.

The Supreme Council must have regular meetings, and if the Minister and Head of the Program and Budget Organization cannot attend, they must have nominated a representative in advance.

Regarding the independence of the central bank, it should be noted that the president is appointed by the president and the non-executive members are also appointed with the approval of the government. In fact, in the second wave, the central bank’s independence has been reduced in the plan. When this independence is weakened, the possibility of monitoring also decreases. The Jurisprudence Council has also been placed in the framework of the Central Bank in the second chapter.

The table of defects and changes applied in the structural framework of the Central Bank is as follows:

Within 6 years, only 4 resolutions of the Money and Credit Council were published.

In the discussion of solutions, the first thing is transparency and accountability of the central bank. Currently, we do not have an independent central bank. In addition, there is no accountability to supervisory institutions such as the Court of Accounts. In addition to these cases, accountability to the parliament is included in the plan to amend the law of the central bank. In the plan, the principle is non-confidentiality of the Supreme Board’s approvals. From the beginning of 1992 to 1999, only four resolutions of the Money and Credit Council have been posted on the central bank’s website.

In the field of transparency, it is stated in the plan that the votes of the members of the Supreme Council, the names of those present and absent, and transactions with banks should be transparent. Regarding the control of conflict of interest, it is stated in the plan that all employees of the central bank cannot enter the banks until three years after the end of their service in the central bank, besides, people cannot be shareholders of banks, have deposits in banks or receive facilities from banks. . There is no will to deal with some cases due to this conflict of interest, which will reduce such cases with this regulation.

In the discussion of the structure of the police board, there are three people in the trial and appeal board. One person is present as the chairman of the board. The bank representative has also been removed. The judge is also responsible for writing the verdict. The other two are also specialized experts. The judge of the disciplinary board is appointed based on the proposal of the head of the central bank and the approval of the head of the judiciary.

After the two stages of the trial court and appeal, it is possible to continue the proceedings in the Supreme Court. In the detection of violations, banks must also deliver data to the Central Bank in the form of a dashboard, as a result of which this issue reduces the cost of processing. This is the part that private banks objected to and based on that they consider this plan bad.

The central bank is no longer required to pay salaries to the government/ after 6 years, the allocation of salaries will be prohibited

In the field of regulation and regulation and issues related to the authority of the central bank in the plan to amend the law of the central bank, the lack of law evasion and bankruptcy of banks and credit institutions, the incompatibility of the duties and powers of the supervision department of the central bank and the disciplinary board, the inadequacy of the supervisory punishments of the monetary law and banking and the conflict of interest of the central bank is mentioned. There are some obstacles in the field of applying supervisory tools, such as the conflict of duties seen in the plan.

In the new plan, the goals of the central bank have been determined, which include economic growth and inflation control. The conflict of interest with the banking network has been resolved in the plan, as a result, there is a possibility to strengthen the supervision of the central bank. The specialization of monetary policy has also become important, and one of the deputy chiefs will be appointed for the monetary area, and a monetary policy committee will also be formed.

Esteghlal Central Bank has 7 departments, one of which is financial independence. This means that the government should not be financially dependent on the central bank and finance its purchase of currency or salary from the central bank.

It is mentioned in the plan that the central bank within the framework of its monetary policies Can pay the government otherwise there is no requirement for it. Three percent of the public budget can satisfy the government and it will decrease by half a percent annually. This means that after 6 years, the central bank’s salary allocation will be practically removed from the public budget structure. In this case, other facilities should be given to the government, such as the possibility of using bonds with short maturities.

The central bank does not have the right to pay rials before receiving government currency (oil exports).

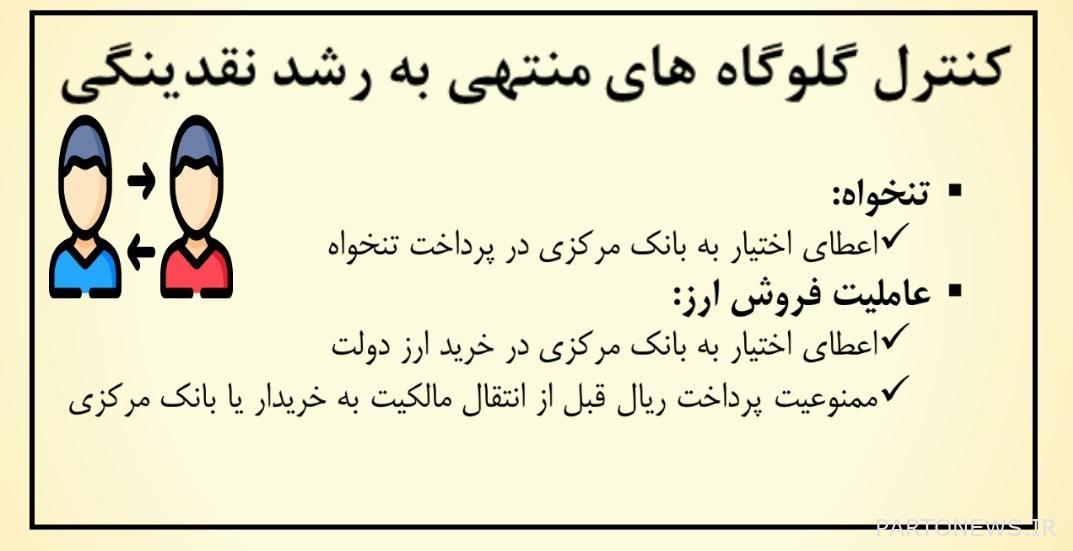

It should be noted that the government obliges the Central Bank to receive foreign currency and pay its Riyal even if it was not possible to collect foreign currency. In the plan to amend the law of the central bank, it is said that the central bank has the authority to accept the agency of the government’s currency, and another point is that it is emphasized that the central bank cannot give rials to the government until the currency is collected.

The table of measures related to controlling bottlenecks leading to liquidity growth is as follows:

The point is that if the removal and installation of the main members of the central bank is the responsibility of the government and the central bank does not use its powers to support the government, the governor will be removed. The issue of central bank independence is important because this bank can play a proper role in the field of inflation control.

Currently, the plan to amend the Central Bank Law is in the floor of the parliament, and the proposals of the representatives are being presented in this regard. In line with the discussion of independence and strengthening it, suggestions will be made because the central bank will not have independence in this plan either.

Of course, it should be noted that there are limitations regarding the complete independence of the central bank, which include Article 60 of the Constitution (according to the interpretation of the Guardian Council) and also Article 110 of the Constitution (according to the resolution of the Expediency Council). In the world, the head of the central bank is appointed by the opinion of the Senate or the House of Commons or an organization outside the government.

At present, among the suggestions that have been made regarding the strengthening of the independence of the Central Bank plan is that the dismissal of the Governor General of the Central Bank should be with the approval of the Supreme Leader, which is unlikely to be approved by the Parliament, and another proposal is that the dismissal of the Governor General of the Central Bank with The approval of the heads of the three branches of government will happen, but due to the contradiction with the constitution, this issue needs the approval of the Expediency Council, which is unlikely to be approved. Considering these conditions, it should be seen how the central bank’s independence issue will be approved by the parliament members.