After falling prices, three-quarters of bitcoin holders are still in profit

The latest statistics on the status of bitcoin holders show that about 75% of all addresses with this digital currency are still profitable, despite the fall in prices since yesterday. Meanwhile, 67% of long-term holders and only 7% of short-term holders are now profitable.

To Report Coin Telegraph: Despite the fall in the price of bitcoin in recent days, data from the analytics company Glassnode show that 75% of the wallets of bitcoin holders are still profitable.

The company in its weekly report on April 11 (April 22) surveyed the number of investors who have bitcoins and are profitable. Finally, it is estimated that about 70 to 75% of these addresses are in unrealized profit status. Unrealized profits mean that traders have not yet sold their bitcoins, and as the price of this digital currency changes, their profits will increase or decrease. The number of these wallets is much higher than the declining market in 2018, when 45 to 50% of the wallets were in profit.

Analyzing their findings, Golsnood analysts said that the current downtrend is much better than the previous downtrend.

They said:

The current downtrend is not as turbulent as the worst stages of previous cycles. Only 25 to 30 percent of market participants are now at unrealized losses. It remains to be seen whether more sales pressure, as in previous cycles, will cause the market to fall further and investors to lose more.

Long-term bitcoin holders are very unlikely to lose, according to Golsnood. This group of investors are those who have been holding this digital currency for more than 155 days and more than 67.5% of them are in unrealized profit situation. Only 7.88% of short-term bitcoin holders who have held the digital currency for less than 155 days are now making a profit.

Bitcoin is now back in the downtrend, hovering around $ 40,000. Some analysts have speculated that the price of Bitcoin could fall as low as $ 30,000. However, available data show that some traders are trying to bring the price back to $ 50,000.

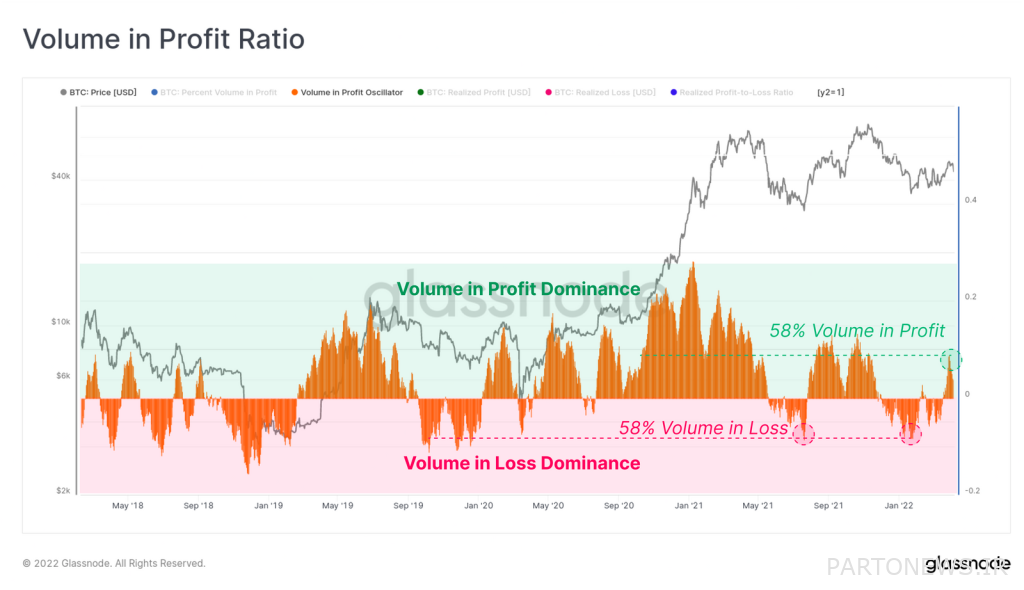

According to the report, 58% of the units in the Bitcoin network are in profit; That is, they were purchased at a lower price than the current prices. It should be noted that this has never happened since December 2021 (Azar 1400).

According to Glesnood, downtrends often lead to long periods in which traders lose money. During this period, when large volumes of bitcoins in the network are profitable, traders’ feelings may change; Because buyers’ demand can meet the sales pressure created.

However, Golsnood wrote in his report:

The fact that prices are still not rising indicates that market demand is somewhat weak. However, market power, no matter what, [اکثر] Investors are still in profit.

Analysts at the site added that since mid-February (February 1400), about 13,300 bitcoins have been in profit. In addition, although 20,000 bitcoins were in the loss range in January (December 1400), the number of these bitcoins has now dropped to 8,399 units.

According to Golsnood, while a large portion of bitcoin transactions and addresses are profitable, the number of users and network transactions of this digital currency is still declining.

The number of daily transactions of this network is currently the size of the declining market from 2018 to 2019, ie about 225,000. Although the number of these transactions has been increasing since mid-2021, analysts say that this amount is still far from the previous uptrend cycles.