An event that could destroy the digital currency market, but no one is talking about it

The article you read below is a translation a note From Pavel Marinkovic, an active writer on Medium, this is not an “eurodigital” perspective.

It was only a few months ago that Binance CEO Changpeng Zhao questioned the financial health of the digital currency exchange FTX, encouraged customers of the platform to withdraw their funds, and then acted as if he was going to buy the group. It was a strange time; isn’t it?

After this incident and at the beginning of 2023 AD, the following news was published in the media: 👇

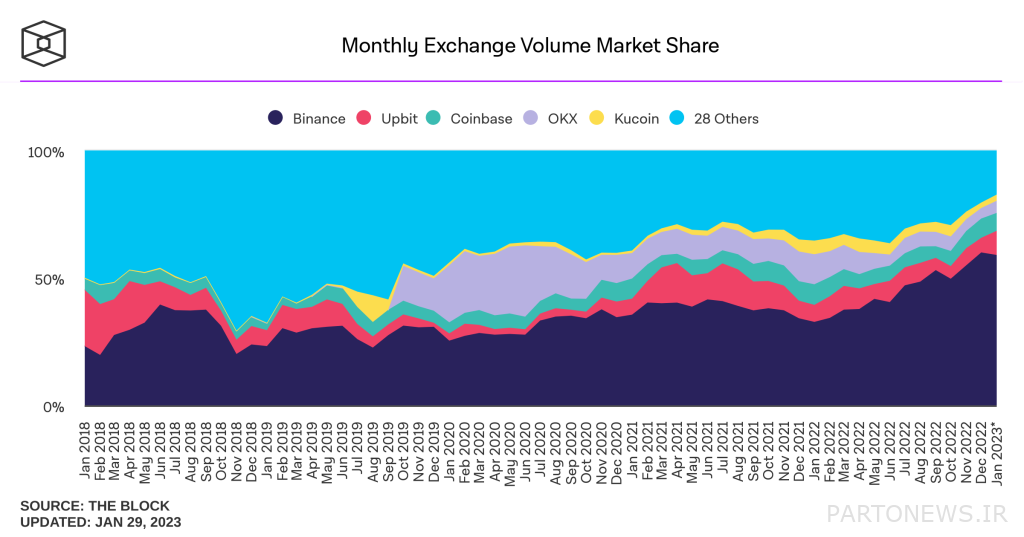

If any other project had such dominance in the market, people would be surprised; But for a number of reasons, Binance’s monopoly on Bitcoin trading comes as no surprise.

Are these words just to worry traders?

Imagine what will happen if Binance crashes?

Last year, a number of companies that were active in the space of digital currencies went bankrupt; Celsius, Voyager Digital, Three Arrows Capital (3AC), FTX, BlockFi and many more unfortunately.

All these chain bankruptcies will be nothing against the collapse of the Binance Group.

Is Binance too big to fail?

We used to think the same about FTX and look at what this exchange has become now.

On December 14, Zhao said in a space (audio conversation) on Twitter:

If you ask people to personally hold their digital currencies, 99% will eventually lose their holdings. This is true for most people.

Zhao’s comments came just hours after media reports of his warning to his employees to prepare for the tough months ahead.

Why do you think Zhao said this?

To prevent more money from leaving this exchange after withdrawing 3.6 billion dollars of capital from this platform in just one week.

The main slogan of the digital currency space is that if you don’t have the private key of your wallet, you don’t know about your digital currencies (Not your keys, not your coins), and the world’s largest exchange says the opposite.

An exchange should be considered a place to trade, not a place to store your digital currencies.

Do you know what happens to the money in it if one of these exchanges collapses? They disappear.

Unfortunately, the cryptocurrency market today is basically Binance.

The statistics are self-explanatory. Let’s think about it this way; If a certain country owned 92% of the bitcoin mining rigs, then could you say that the bitcoin blockchain is a secure network? In such a situation, there may come a day when the policies of that particular country change, and in this case, only 8% of the network capacity is left.

I imagine that in this hypothetical situation, the price of Bitcoin could fall to $300 within a second, and people would no longer be willing to participate in the Bitcoin network as before.

Need for legislation

In 2021, 14 billion dollars of digital currency was stolen in various scams; That means a 79% growth compared to 2020.

ChinaAlysis has yet to release its 2022 report and statistics, but with all the weird things that happened last year, the growth is expected to be even higher.

In cases where these illegal activities involve users, nothing can be done and this has caused users’ frustration. Some time ago, I wrote in another article about digital currency insurance, which can be a way to increase investor confidence and wider acceptance of this space.

Why shouldn’t we have insurance policies in the digital currency market similar to those in traditional financial markets? We could create something similar to the Federal Deposit Insurance Corporation in the US or the Financial Services Compensation Scheme in the UK for this space.

Binance is like our banking system

Binance currently has a 66.7% share of the digital currency spot trading market in centralized exchanges; Without a single serious competitor. There is only one small Coinbase, which has taken the second place by force with a share of 8.2%.

It is not true. In fact, the space of digital currencies was not supposed to be like this. If Binance goes down, it will take the cryptocurrency market down with it. At the very least, it will take an unimaginable amount of time for the market to rebuild itself. Regaining people’s trust in digital currencies will also be painfully slow.

final word

Instead of eliminating the main player, we should move towards a more balanced distribution of market share to restore the health of the industry. Any part of our body that does not receive enough blood will fail. The same thing happens in the digital currency market. It is not a stable situation that one exchange is busy sucking all the capital, while the rest play with small capitals in this market.

We need legislation as well as competition. Otherwise, we will be like the same financial system that we have been fighting against for years.