Analysis of a claim; Are cryptocurrency projects scams?

The issue of fraud is raised wherever capital is involved. The world of digital currencies has witnessed such discussions from the beginning. The bear market of 2022 has made old issues about the future of digital currencies hot again among investors and critics of the field. However, it should be noted that this is not the first cryptocurrency bear market; Because in 2018, Bitcoin lost more than 80% of its value for the third time in its 10 years. It seems that the same thing happened this year.

Regardless of the numbers, what I see is that we are in another bear market; Because Bitcoin’s fall below $20,000 has disappointed investors. Some of these desperate investors are talking about “scams” and “the death of digital currencies” and “fear, uncertainty and doubt” as the total value of the digital currency market has fallen from over $2 trillion to under $1 trillion. With this introduction, in this article we will take a look at the important claims that have been made in the field of digital currency fraud until today and we will check their authenticity. We suggest you stay with us until the end to get to know these claims.

First claim: Digital currencies have no backing

“Unsupportedness” is a popular claim that has a lot of fanfare among critics of digital currencies. One of the reasons for the popularity of this claim is that it is true! Digital currencies are mostly unsupported by fiat currencies or rare physical goods such as gold or silver; Therefore, digital currencies are only backed by the trust that people have in them.

Many believe that Bitcoin does not need any backing due to its unique monetary quality, i.e. scarcity and unforgeability. These are the main features of Bitcoin that allow it to succeed without having to be backed one-to-one with gold.

Read more: What is the value of digital currencies and what is their support?

Now the question is: Does it matter if Bitcoin has a physical backing? Even though the US dollar has been off the gold standard for decades, why do people still use this argument for digital currencies? In response, we must say that all of this comes back to people’s definition of the value of digital currencies.

The term “value” has two meanings: one meaning refers to any desirable thing or service that someone is willing to pay for, and the other meaning is in the financial field, which is related to valuing something with monetary units. The second meaning can be used to explain why Bitcoin fans consider it a better alternative to fiat currencies.

Unlike the fiat currency system, Bitcoin works in a decentralized manner; For this reason, supporters of digital currencies believe that these currencies have better monetary characteristics. Now let’s take a closer look at fiat currencies. Some popular fiat currencies such as the US dollar are evaluated annually and regularly. Data compiled by the Finbold website shows that the real value of the US dollar has fallen by one-seventh over the past 50 years.

If we consider the value of one dollar in 1972 as one dollar, now in 2022 the same dollar is equivalent to 14 cents ($0.14). The dollar, one of the world’s most powerful currencies, has lost its value over time, even though it is supported by a government; For this reason, we should not be surprised by the fluctuations in the price of digital currencies.

It is natural that whenever there is good news such as the expansion of the adoption of digital currencies or institutional investments in this area, the price of these currencies increases, and on the other hand, when bad news such as hacking attacks or fraud is heard, the prices decrease. So we can conclude that digital currencies have no physical or governmental support; But this does not mean that these currencies are not valuable.

Second claim: Cryptocurrencies are used for illegal activities

This claim also has many supporters; But it is not the whole truth. Digital currencies can be used for illegal activities such as money laundering and drug trafficking; But doesn’t this apply to all currencies in the world?

After all, it’s not like illegal activities are the only use of digital currencies. These currencies are also used for legal activities such as buying coffee or investing in projects; But the reason for the popularity of this argument is that it is easy to use the emotions of users and produce news with headlines like “use of digital currencies in drug trafficking”.

Fiat currencies like the US dollar are also used for illegal activities. In 2021, Chainalysis published data showing that between 800 million and 2 trillion dollars in fiat currencies are laundered annually in the world outside the Internet. This is despite the fact that in digital currencies, only 0.05% of transactions in this area are related to money laundering.

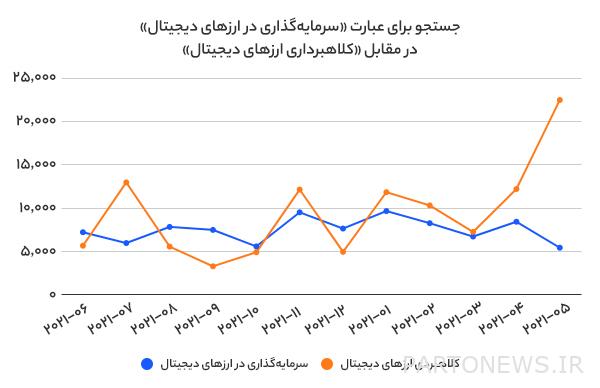

The important point that we should mention here is that digital currencies are a fraud is a narrative that is generally presented by the media; Because it brings more traffic for these media to Armaghan. The website Similarweb recently revealed in a report that phrases like “investing in digital currencies” or “how to invest in digital currencies?” received fewer views than negative phrases such as “is digital currency a scam” or “is digital currency a scam?”.

Comparative criteria Similarob It shows that in May 2022 (April and June 1401), pages containing the term “Scam” in the Google search engine had 353% more search traffic compared to 6 months before. Meanwhile, the volume of titles similar to “how do I invest on crypto” (how do I invest in digital currencies?) has decreased by 28.9%.

Third claim: Digital currencies are volatile

This claim is partly true. Digital currencies are volatile and this can be both good and bad; But it depends on your perspective on the existing conditions. Some people find swing useful; Because volatility means more profit. Others consider fluctuation harmful; Because they think that volatility means more loss.

However, in both cases, volatility does not make digital currencies a scam; Because those who invest in the stock market and bonds also deal with volatility. Fluctuations in stocks and bonds, like digital currencies, can be beneficial or harmful.

In the digital currency market, it is possible to benefit both from the increase in the price of currencies and from its decrease. Digital currency traders and investors have different methods and strategies for this. One of these methods is volatility, which with a little reading, you can have a better understanding of the positive aspects of volatility in the digital currency market. So if our only argument is that digital currencies are a scam because they are volatile, we have to accept that the stock market and bonds are also a scam!

Fourth claim: Digital currencies are not regulated

This claim is somewhat true. Governments have not yet enacted extensive legislation for digital currencies like what has been done about fiat currencies; But it’s not like there are no laws for digital currencies. The regulation of cryptocurrencies is mostly enforced by the programming code that controls their protocol and can be seen by anyone.

On the AruzDigital website, you can learn about the laws related to the use and taxation of digital currencies in Iran and other countries in the legislative news section.

Most of the countries in the world have not yet set regulations specifically for digital currencies; But regulation in this area has been done in different ways. Also, you can see how the internal regulations of digital currencies are coded in the blockchain protocols by reading the articles in the blockchain introduction section.

Fifth claim: Digital currencies are bubbles

you guessed right! This claim also has some truth. Digital currencies, like other trends in the world of technology, have signs of being a bubble and will finally burst one day; But again, this does not mean that digital currencies are scams.

In financial markets, bubbles are common phenomena. The dotcom bubble (Dotcom) in the late 1990s and the housing bubble in the early 2000s in America are examples of this; But when these bubbles burst, not all websites went down and not all real estate became worthless.

Read more: What is a price bubble or an economic bubble? Explanation in simple language

Finally, digital currencies are the same. Some of them survive and thrive.

People’s reputation is not a proof of the truth of their claim

In conclusion, we must say that even if a very experienced person claims that all cryptocurrencies are scams, you should not take his word for it. While many prominent figures in finance, such as Warren Buffett and Bill Gates, are not bullish on Bitcoin, some entrepreneurs, such as Elon Musk and Sam Bankman Fried, strongly support digital currencies and their technology.

However, it should not be forgotten that digital currencies are speculative investments and you should only invest as much as you can afford to lose. This is the same law that applies to stocks and all other types of investments.

Undoubtedly, digital currencies are volatile assets and their prices may fall. Also, since digital currencies aren’t as tightly regulated as the stock market, if you lose money, you can’t get it back. If you want to invest in digital currencies, you have to be very risk-averse. Needless to say, even high risk does not mean that digital currencies are scams.

Conclusion

In this article, we talked about the arguments that are put forward to prove that digital currencies are fraudulent. In this context, we evaluated five claims and determined that all of them reflect only a small part of the reality about digital currencies. Those who conclude from these claims that digital currencies are scams are actually highlighting part of the truth and hiding another part.

It is true that digital currencies have no backing, are used for criminal activities, are volatile, unregulated, and are bubbles, the fact is that this is true of all fiat currencies and all financial markets.

Finally, those who intend to invest in this market should not consider the reputation of individuals as a basis for the correctness of their claims. The digital currency market is a risky market and those who want to enter this market should have enough knowledge about it to avoid the negative aspects of this market.