Analysis of banking stocks in the stock market on September 19, 1401| Tejarat News

According to Tejarat News, the banking industry is considered one of the most important industries affecting the stock market, and because of this, a capital market analyst has analyzed this industry.

Sam Hamzaei, a capital market analyst, wrote in an analysis of the banking industry for Tejarat News: The banking industry in the capital market is one of the most challenging stock market industries for analysts. Banks can be considered the most important economic institutions that have played a decisive role in the economy of countries since the past. This rule is not an exception in Iran.

Banking can be complicated. A bank is an institution whose current operations include granting loans and receiving deposits from people. Banks also play an important role in allocating capital in the economy.

A well-developed functionally compatible financial system significantly facilitates the allocation of household consumption resources. Appropriate allocation of physical capital to the most productive part of the business. Hence, it is reasonable to expect an efficient and profitable banking sector to lead to an effective financial system.

In this regard, the efficiency of banks results in the economic growth and development of a country. The ability of the country’s banks to meet the challenge of efficiency and performance determines their sustainability. The banking industry in Iran’s economy plays a major role in providing financial resources due to the lack of capital market.

As a result, the possible deficiency in the structure and function of this department may cause possible disturbances in other departments. This means that a careful understanding of this policymaking sector is essential. Also, after the lifting of sanctions and after the JCPOA, Iranian banks must have the necessary efficiency to be present in the world arena. Therefore, improving the efficiency of Iran’s banking sector can play a significant role in the development of the country’s financial system and economic growth.

History of banking in Iran

Banking in our country since 1266 with the arrival of the foreign bank New Bank of the East, whose activity center was in London. Its field of operation was in South Asia, without obtaining permission from the government, it started its work with 6 branches all over Iran.

In 1304, the first Iranian bank was established with a capital of 3,883,950 rials from the balance of the military pension fund. On the 24th of March of the same year, the first Sepeh Bank branch was opened in Rasht, and in addition to military transactions, it opened credit for merchants and commercial transactions.

Iran Mortgage Institute was established in 1305 using the funds of the country’s pension fund. Initially, this institution operated under the supervision of the Ministry of Finance and provided loans to people with a low interest rate in exchange for collateral. This institution was handed over to Bank Melli after the establishment of National Bank of Iran and was renamed to Kargoshai Bank.

Now Sepeh Bank with about 1700 branches plays a very important role in realizing the macro economic goals of the country. Banking in the country has had many ups and downs in the last few years. After the loss of banks and the strictness of the central bank in the mid-nineties, the industry has improved in recent years. Various factors have been effective in improving this situation.

Among these factors, one can take the reserve of past due, delayed and questionable receivables in the past years, reducing interest rates and reducing competition in interest rates with the intervention of the central bank in weak banks, changing the method of paying interest from daily to monthly, and increasing fees. and the currency balance pointed out.

If we want to classify the banking industry, this industry can be classified into two sectors: private and public banks. The first private banks in the country entered the banking industry in 1380. The banking industry entered the capital market from the beginning of the 80s with the arrival of the Entrepreneur Bank. After that, New Economy Bank came to the capital market as the second private bank.

The impact of JCPOA on the banking industry

The banking industry has attracted the attention of capital market people due to JCPOA negotiations. Generally, most capital market activists are of the opinion that with the signing of JCPOA and the improvement of international relations of our country, banks will enter into relations with international banks and as a result, the operations of this bank will be improved, but to what extent is this hypothesis correct?

For dealings with international banks, regardless of the FATF issue, our banks must meet the standards of wings 1, 2, and 3.

Basel (is one of the sub-committees of the Bank for International Settlements, which is considered the highest international institution involved in banking supervision. This committee is composed of senior representatives of the central banks of a number of countries, including Germany, England, Italy, France, America, Switzerland, Sweden, Japan , Canada and Luxembourg, which is usually formed every three months by the Bank for International Settlements as its permanent secretariat in Basel, Switzerland.

Because of the aforementioned meetings in Basel, this committee is known as the Wing (Basel) Committee. The Basel Committee has no legal power, but most member states are implicitly obliged to implement its recommendations.

The most important quantitative criteria for evaluating the financial status of a bank are:

- Capital adequacy ratio

- The quality of assets and financial structure of the bank

- profitability

- Liquidity

- Sensitivity of operations to market risks

- Other basic criteria

One of the weak points and the Achilles heel of the country’s banks is the capital adequacy standards, which is one of the most important quantitative criteria.

capital adequacy ratio ratio adequacy capital

In short, the meaning of capital adequacy is that the bank has enough capital to deal with possible crises so as not to be in a situation of closure and bankruptcy. In order to reduce the risk of losses to depositors, it is necessary to observe minimum capital adequacy ratios. Capital adequacy ratio in international banks is 12. But the central bank considers the number 8 as the standard for the country’s banks.

The financial statement structure of banks in Iran

The structure of the financial statements and incomes of banks are different from other manufacturing and investment companies, and in Iran, due to Islamic banking, the financial statements of banks, especially the profit and loss statements, are fundamentally different from foreign banks. An important issue in the analysis of banks is the common income and the bank’s share of it. In Islamic banking, the bank is the agent of the depositor and the interest paid on account.

The profit from banking operations resulting from the use of deposits and bank resources is called common income. The bank can collect a percentage of this interest as attorney’s fees from the depositors. The resulting surplus is divided between deposits and bank resources according to the standard ratio. Both short-term and long-term investment deposits are subject to attorney’s fees, and current deposits are among the bank’s resources. The limit of attorney’s fees is 3%.

If the depositors have more shares at the end of the year, the surplus will be paid to them in the form of a fixed profit (Bank Mellat received up to 5% of the surplus profit in 2019). In case of deficit, the bank is responsible for compensation and cannot claim from the depositors, and the accrued interest for the depositors is certain. Practically, the profit in excess of attorney’s fees goes to the depositors, and unfortunately, no share goes to the shareholders. In the foreign exchange sector, all profits from banking operations related to foreign currency deposits and facilities belong to the bank.

What is common income?

The common income of banks is obtained from the sum of the interest of the granted facilities and the profit and loss from the investments. The fee is for currency exchange and other consulting activities of banks.

In the past, due to the large difference between the interest rates received and the interest paid, banks earned most of their income from the difference between the interest received from the facility and the interest paid to depositors, but in recent years due to the reduction of the difference between the interest rates Receipts from facilities and interest rates paid to depositors. Also, the desire of customers for investment deposits and as a result, the increase in the cost of money, the operational profit margin of the banks from the common revenues has been greatly reduced, and it has caused the banks to not have much desire to earn money from the common revenues.

In contrast to earning income from non-recurring incomes, due to receiving fees in cash and as a result, creating cash flow for the bank, as well as low risk compared to common incomes, most banks have turned to such incomes. The existence of overdue claims and the banks’ strong need for new sources of income have caused the non-recurring income of banks to increase day by day.

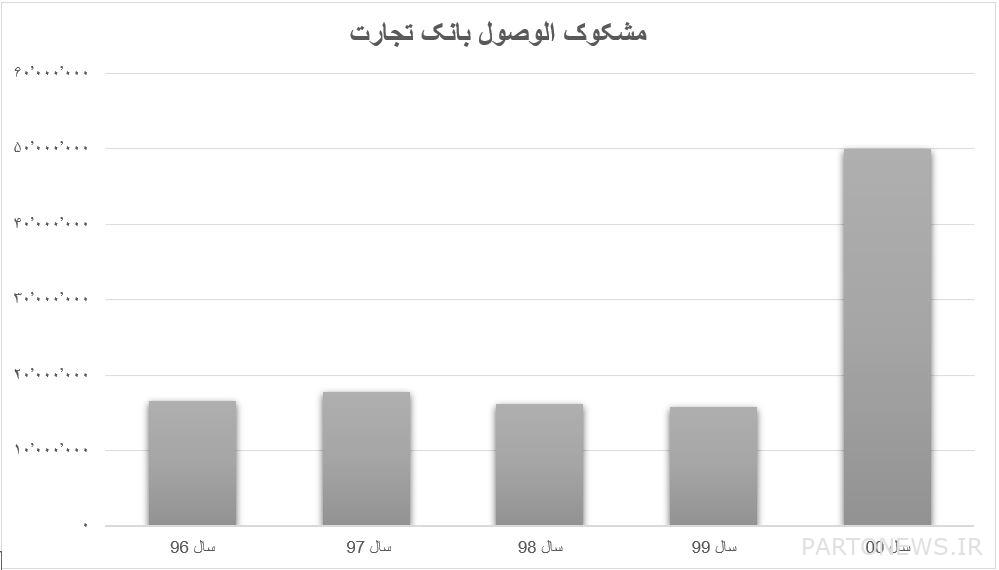

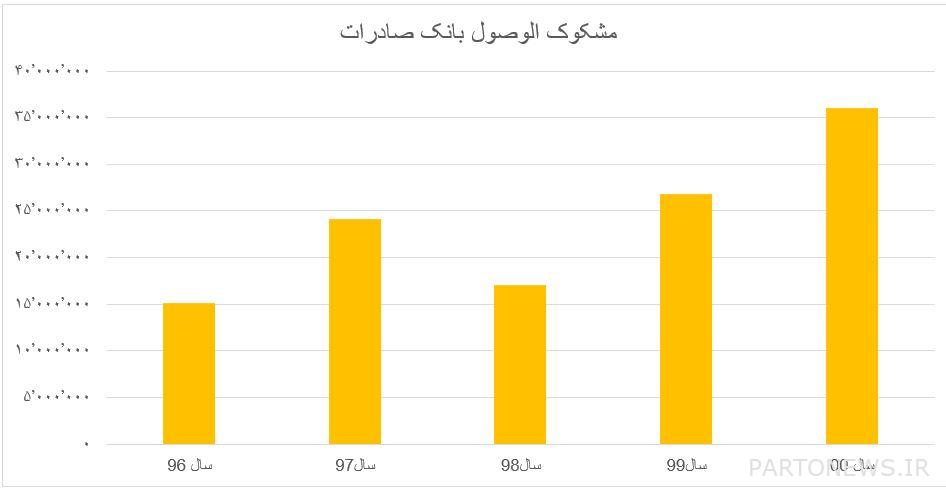

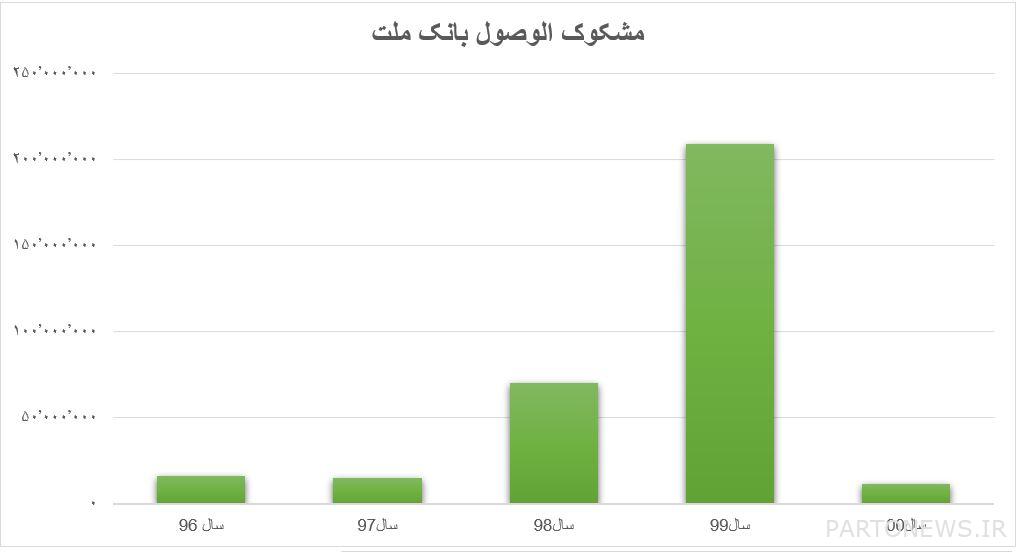

Doubtful receivables are one of the weak points of banks, which in recent years have seen a resurgence after its short-term control in the mid-90s.

influencing variables

Many factors affect the profitability of banks. Among these factors are interest of facilities, bank interest, general and administrative expenses, percentage of doubtful facilities, exchange rate, liquidity of investments and the structure of deposits, assets, etc. In the prepared table, a number of these variables have been examined.

Risks in banking

Law on removing production barriers; Under this law, banks must divest their non-banking assets, including investments and real estate, or else be taxed at very high rates based on the current value of those assets. This issue has led to the imposition of heavy taxes on bank shareholders due to the non-transfer of assets by banks.

Increase in interest rates

One of the risks of the banking industry is the increase in interest rates, which creates the fear that a number of banks will lose again with the increase in interest on deposits.

Homework facilities

Government debt facilities are generally considered one of the biggest risks for banks, because usually the interest rate of these facilities is far from the general rate of facilities in banks, on the other hand, this type of debt facility puts a lot of pressure on banks in terms of liquidity. and causes a shortage or severe reduction of financial resources

Exchange rate

In recent years, the country’s economy is facing a strange phenomenon, that is, the difference in currency exchange rates among banks and all industries in the country, which is not compatible with any logic or economic science, and unfortunately, the king is that every year, banks are 20 to 30 percent below the number The exchange rate of other sectors of the economy will exchange their foreign exchange resources, which will cause the loss of the rights of the shareholders of the banks.

Finally, summarizing the banking industry, it should be noted that the signing of the JCPOA agreement can help to improve the operations of banks to some extent. But it is necessary to point out that the JCPOA agreement will not make a significant difference in the financial statements of the banks. Banks reaching the Basel standard as well as Iran’s joining the FATF are essential for cooperation with major global banks and banks’ use of international relations.

The JCPOA agreement can affect the bank group only psychologically, and it will take at least 1,000 efforts for the banks to meet the Basel standards and improve the disagreements. Finally, due to the analytical reason, the bank industry can have a lot to say in the coming years.