Analysis of the housing market in 1401

Elham Samadzadeh/ According to Tejarat News, Bazar Housing In a year that has passed, he could not even live up to the empty promises of the Minister of Petroleum and Housing. According to the official statistics of the Central Bank, housing prices have increased by 26% in the past year, but according to the first vice president of the Real Estate Union, housing prices have increased by at least 40% in the past year and at most in some areas between 80 and 100%.

The high cost of housing in the past year affected the national housing, and the minister’s prediction to house the low and middle deciles of the society was far from the goal. Thus, the price of national housing suddenly became more expensive and the applicants were forced to bring more, which was practically not possible in the economic conditions prevailing in the society. Therefore, many applicants gave up. Although the minister promised to increase the national housing loan up to 700 million, but this matter remained only a promise until today.

The decrease in construction in the country due to the high cost of construction materials and the increase in the cost of building permits also had an effect on the housing market becoming more and more disturbed. According to statistics announced by the Statistics Center this year, housing construction in Tehran alone was less than 5,000 residential units, which is a huge difference compared to last year when more than 33,000 construction permits were paid.

National housing in the past year

One of the first promises made by Rostami at the helm of the Ministry of Roads and Urban Development was the construction of one million housing units per year, which is not feasible. According to the conditions of the housing market in the country, the government cannot play a significant role in the field of construction, instead, it only has the task of providing land and providing the necessary incentives. A process that has been implemented to some extent in land supply.

Rostam Ghasemi said that in the field of housing, our plan is to build one million housing units in the country every year, and we are trying to ensure that materials such as cement and rebar are not used through brokers, but through direct purchase from the factory, so that the units can be obtained at the lowest price. reach people But after a year, this promise was not fulfilled and it is planned to hand over 100,000 national housing units to the applicants by the end of September this year. It is interesting to know that some experts and officials have unofficially announced many times that the national housing is actually a complement to the Mehr housing and the same mistakes of the Mehr housing are actually being repeated.

On the other hand, it should be noted that the high cost of construction materials broke the national housing market. Some experts believe that the national housing will suffer the fate of housing.

Inflation growth in the housing market

According to the official statistics announced by the Statistics Center, housing exceeded inflation in the first 5 months of this year. In other words, price growth in other markets could not keep up with inflation. But in this situation, real estate hit the inflation record and stood out in the market with a growth of 1% more than inflation. For example, the profit of a coin buyer was 13% until the end of August, but this profit in the housing market has always been reported to be more than 29%.

The slope of housing price growth

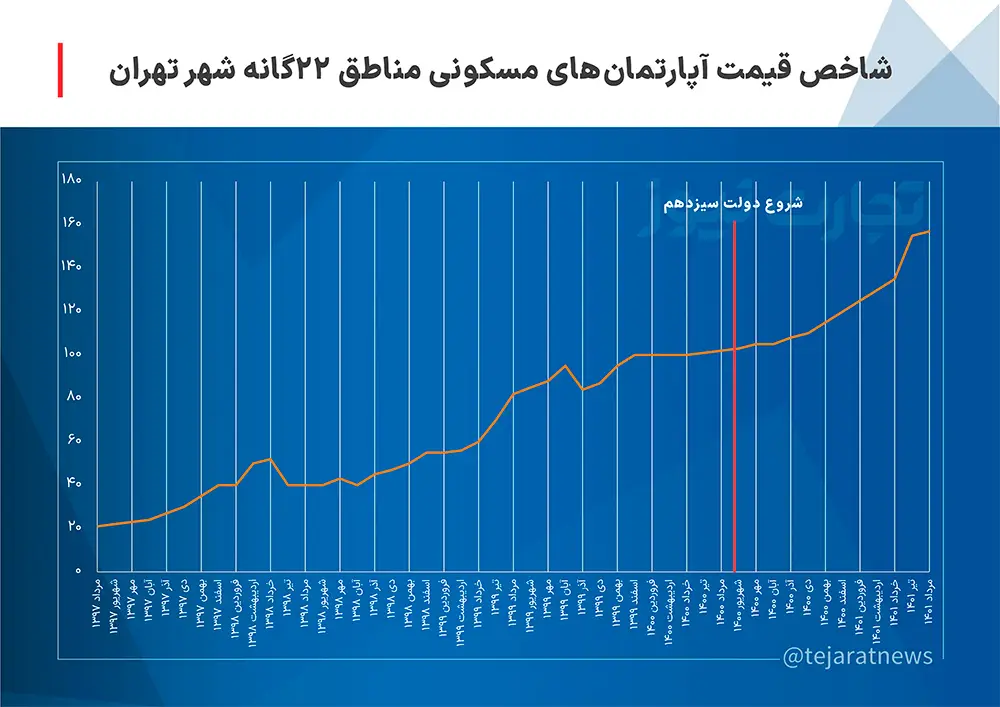

The annual housing inflation of the whole country was 22.6% and 28.8% in June 2019 and 1400, respectively. But in June this year, this number reached 27.5%. Although the price increase was observed in all markets this year, the prices of some goods faced growth in June this year. The numbers indicate a 4.5% drop in annual housing inflation. It should be noted that housing prices have increased by 79% in the last three years.

Between 1396 and 1401, housing prices in Tehran have grown by more than 600 percent, and currently housing prices have reached more than 42 million per square meter. Although under the influence of the strong decrease in the power of applicants, the growth rate of housing prices has somewhat slowed down in the last year and has reached 26%; While in 2019, the housing market of Tehran recorded an annual inflation rate of 99%.

Increase in the rate of construction inputs

During the spring quarter of this year, the “Glass” group had the highest inflation with 92.1%, and the executive group “Irons, rebars, door, window and fence profiles” had the lowest point-to-point inflation with 18.2%. The cement, concrete and sand group has increased by 69.7%, iron and rebar by 18.2%, and the service group by 60.7% compared to the same season last year. And the construction was accompanied by a strange decline.

A look at the statistics of housing facilities in the past year

Housing facilities have a share of 8.4% in the total banks’ facilities. In 1990 and 1991 and before the beginning of the long period of housing recession, the share of this economic sector reached up to 15% of the total bank facilities; In other words, in recent years, the share of housing in the total payment facility has been reduced to half.

The price of Tese bonds also increased in the past year. As far as the increase in the price of Tese bonds with the decrease of the applicant and

Statistics of housing transactions

The analysis of the distribution of the number of residential units traded in Tehran by building age in July 1401 indicates that out of the total of 10,294 residential units traded, units up to 5 years of construction have the largest share with a share of 1.30%. However, compared to July of the previous year, the mentioned share has decreased by 3.4 percentage points, and on the other hand, the share of long-lived units in the “11 to 15” and “over 20” years of construction groups has increased. In general, the statistics Transactions this year were down.

Housing transactions in old buildings were increasing compared to the previous year, and compared to new buildings or up to 5 years old, there was a 3% decrease this year.

The number of residential apartments traded in Tehran in August 1401 reached about 7.8 thousand residential units, which shows a 24% decrease compared to the previous month and a 42.3% increase in the same month of the previous year. Meanwhile, the growth of this rate was 91.7, 69.7, 56.6 and 43.7 percent in April, May, June and July 1400 respectively.

Surprising growth of rent in one year

Last year, the average cost of renting an apartment in Tehran jumped by 60% compared to 2019. This growth rate compared to the average annual rental inflation of the last three decades was 22%, which shows a completely unusual and inflamed situation in the rental market.

For this year, the President’s government continued the previous government’s policy of increasing the rental rate up to 25%, but this process was doomed to failure, because it was not properly implemented in the previous government. In general, the rental and housing market cannot be controlled in an orderly manner, and the adoption of this type of policy only increases the incentive to increase the price.

According to Central Bank statistics, in the last two years, housing rent in Tehran increased by 83.3%. However, the maximum increase in the rental rate should be 45%. According to the Central Bank report, in July this year we saw a 47.4% increase in housing rent in Tehran compared to July last year and 52.3% in all urban areas. Also, the monthly growth of housing rent in July 1401 compared to June of this year was 4.5% both in Tehran and in all urban areas.

In the end, it should be noted that the performance of the 13th government in the field of housing is very weak based on official statistics. The continuation of this trend can lead to an increase in inflationary stagnation in the market. According to the published statistics, the period of buying a house is expected to be over 70 years. Continuing this trend will bring the housing market into a coma. Therefore, the establishment of applicable and expert policies and the government’s relinquishment of the housing market may give a new life to the housing market.