Analysis of the weekly trend of the stock market / the fall in the value of transactions again

According to Tejarat News, the total index of the stock market was at 1,443,000 units last Wednesday, and this week it reached the level of 1,437,000 units and finally registered a 1.35% drop.

Alireza Mohammadi, a capital market expert, told Tejarat News: The stock market was in a downward trend for the seventh consecutive week. But after the drop of 17,000 units of the main market indicator at the beginning of the second week of August, we saw an improvement in the trading process in the last days. The total index has given an important and supportive level of one million and 440 thousand units. But it seems that if the current conditions continue and the value of transactions increases; We can see the relative improvement of the stock market situation.

He continued: This week, the total index fell to the point of 1 million 427 thousand units after losing the height of 1 million 440 thousand units. But the relative improvement of the trading process in the final days of the week caused the market thermometer to return to the height of 1.437 thousand units. At the end of this week, unlike the first days of the beginning of August, the total index of the Tehran Stock Exchange registered only 3,500 points, a decrease of 0.2%.

This capital market expert explained: Of course, the equal weight index had different conditions and with a decrease of 3000 units, it dropped by 0.8%. At the beginning of the week, it was at a height of 387,000 units and it corrected to a height of 379,000 units. But in the end, the improvement of the trading process, especially on the last trading day of the week, caused this indicator to stop at the point of 384,000 units.

The impact of inflation on financial markets

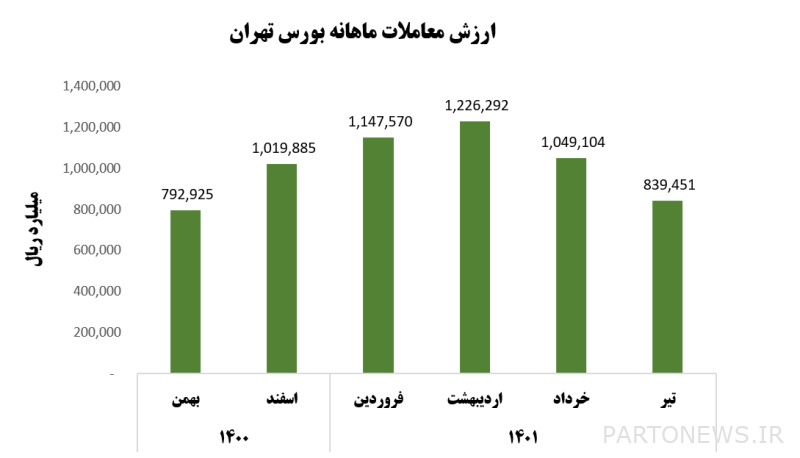

Mohammadi further stated: The sad story of these market days, like last year’s autumn and winter, is the significant drop in the value of transactions. According to the information of the Tehran Stock Exchange, the value of transactions of this stock exchange last month decreased by 20% compared to June. That is, from 1,049,104 billion Rials to 839,451 billion Rials. In fact, uncertainty in the trend of macro-economy components as well as expected accelerated inflation in other parallel markets, especially housing, have strongly affected the value of transactions in the stock market.

This capital market expert said: At the same time as the significant drop in the value of stock market transactions, we are witnessing the withdrawal of real money from the trading cycle. According to the available information, the outflow of real money has continued for the past twelve weeks and intensified since the beginning of summer. In the first two weeks of August, about 3 thousand billion tomans of real people’s money was withdrawn from the stock market. In addition to this, the increase in the share of investment funds from the value of daily transactions also shows the excessive reluctance of shareholders to work in the stock market.

Stock market stagnation continues

He explained: The share of the value of investment funds’ transactions from the value of daily transactions in the spring season was about 25% on average. But this ratio has increased since the beginning of last month and is around 35%. This issue is another sign of the decline in the value of market transactions and one of the reasons for the recessionary atmosphere prevailing in the investment atmosphere in the stock market.

Mohammadi finally said: In any case, considering the end of the assembly season and also the publication of the performance status of the companies in the spring season (according to the available information, the net profit of the companies in the spring season of 1401 compared to the same period last year with an increase of more than 45% to 157 thousand billion tomans Receipt.) It seems that valuable and attractive prices can be found in the stock market considering the current macroeconomic conditions. However, lack of assurance to the stock market participants from monetary and financial policy makers will lead to a decrease in the value of the transactions and ultimately a stagnation in the stock market.