Anchen data analyst: Bitcoin is nearing the peak of its down cycle

Bitcoin news

Bitcoin has mostly been hovering around the $16,000 range after falling more than 20% in the last 3 weeks. Now, a prominent analyst, citing the historical data of an on-chain model, believes that Bitcoin is nearing the peak of its downward cycle; However, to start a new trend, it must fall further.

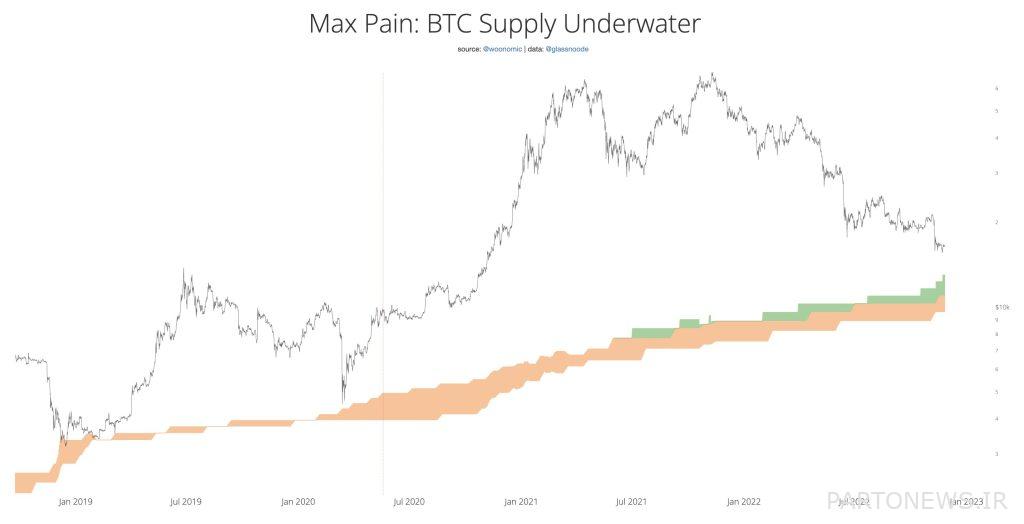

To Report DailyHoddle, the famous Chinese analyst Willy Woo has a Max Pain model that identifies the price floor of Bitcoin at the peak of a down market cycle.

- The air temperature in this city reached minus 5.2 degrees!February 3, 2024

Wu told his one million followers on Twitter that in the maximum pain model, he estimates the price floor by looking at the price at which 58-61% of all bitcoins are below the purchase price or at a loss.

Wu says:

The price floor of Bitcoin is approaching below the level of the maximum pain model. Historically, the price of Bitcoin reaches the bottom of its bear cycle when 58-61% of the coins are in loss (orange shade). The green shade is also adjusted for coins locked in the Grayscale Bitcoin Trust (GBTC) fund.

If we take a closer look at the chart, the model shows that the price of Bitcoin can still fall to around $12,000.

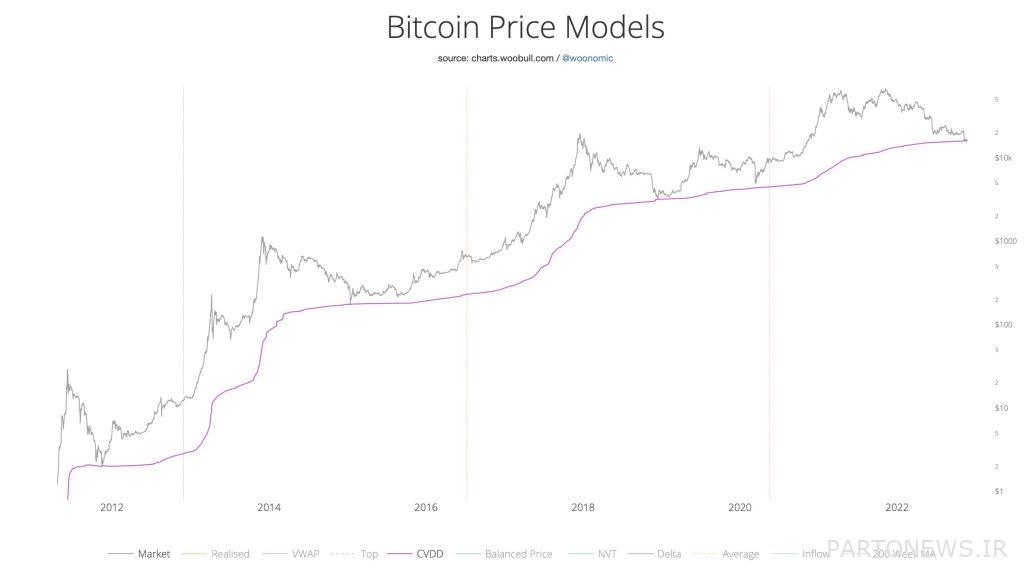

In another less strict model, Wu says Bitcoin is testing its price floor based on the Cumulative Accumulation Daily (CVCDD) indicator.

This analyst explained:

When coins are transferred from old investors to new investors, each transaction has a dollar value and also eliminates the time of the previous investor hoddling. The daily index of cumulative wasted accumulations is the cumulative total of this time value destruction as a ratio of market age, which is divided by 6 million to rank the coefficient.

Wu says the day model of wasted accumulations is based on the idea that Bitcoin tends to create new price floors as a new generation of investors enter the market.

Wu said about this:

Bitcoin is testing its price floor based on the daily pattern of lost cumulative accumulations. [این مدل] It uses the age and value of bitcoins transferred to new investors to create a price floor. Theory: When old coins (for example, purchased at $100) are transferred to new investors (for example, at $16,000), the market experiences a higher price floor.

Nothing found.