Anchin’s Analysis: How Can Bitcoin Miners’ Selling Be a Bullish Sign?

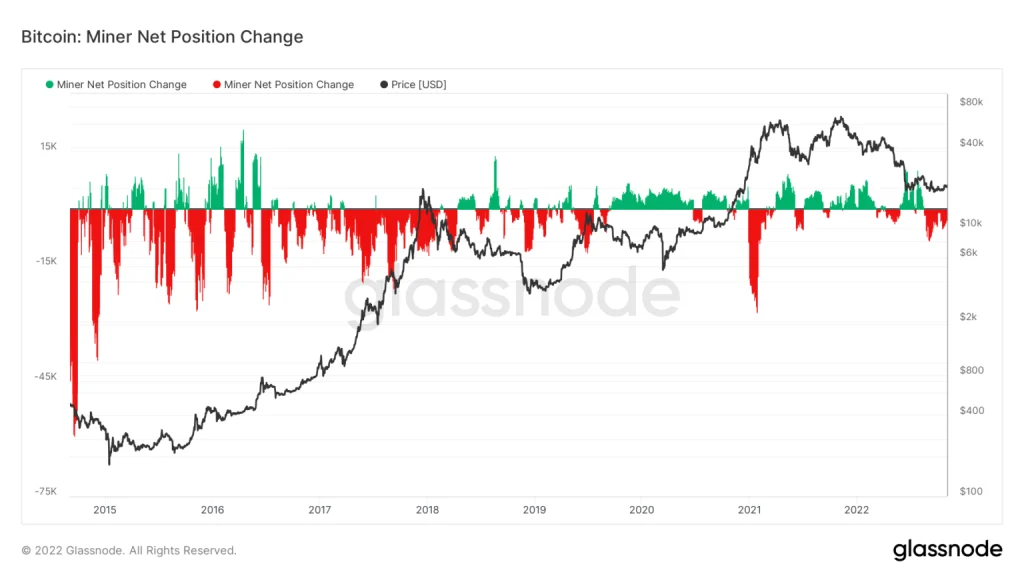

As can be seen from on-chain data, most of the time, when miners have been selling their holdings in concert for a certain period of time, the price of Bitcoin has started to rise in the months after that.

To Report Crypto Slate, Bitcoin Miner Inventory is currently at levels not seen since the beginning of 2021. In addition, the process of reducing miners’ inventory (Bitcoin sales) has been so long that we have not seen it since 2017.

Miners have been selling their holdings continuously for the past three months, and their reason for doing so is likely to cover expenses such as energy bills and borrowings.

Since 2020, the net change in the balance of Bitcoin miners has been negative in 5 different intervals. In 4 of these 5 events, the price of Bitcoin increased in the months that followed. In addition, miners had created a continuous selling period during the bull market of 2017.

A concerted selloff by miners can be seen as a sign of underperformance in the market, and given the past, this event has usually been a precursor to the start of an uptrend for Bitcoin.

The only period in which the accumulation of miners occurred alongside the formation of bullish sentiments in the market is May 2020 (May 2019) and after the fall of the digital currency market under the influence of the Corona virus epidemic; Of course, until the price of Bitcoin reached its historical peak in November 2021 (Aban 1400).

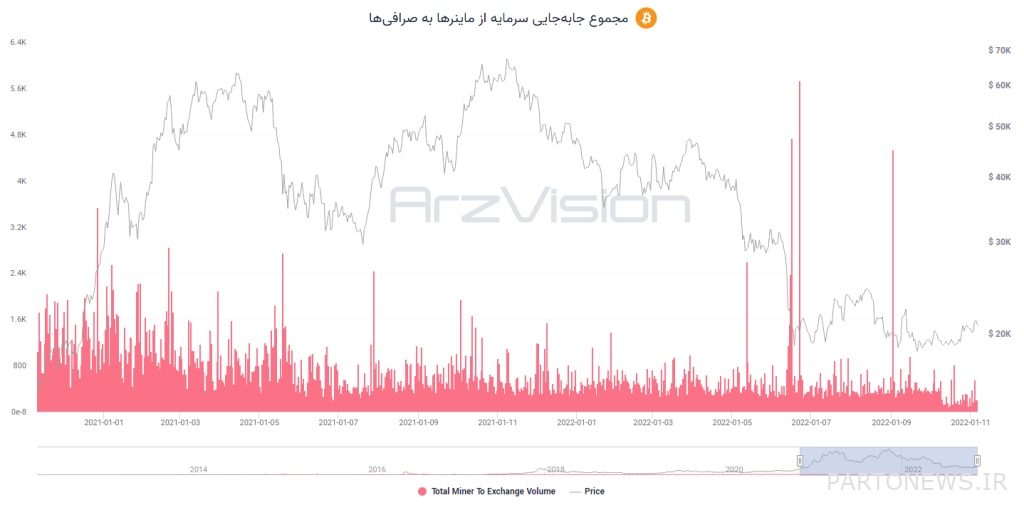

Recently, the deposit of bitcoins from miners’ accounts to exchanges has decreased somewhat. The reason for this could be the decrease in trust in centralized exchanges during the current bear market or the easier access of miners to peer-to-peer transactions in the form of over-the-counter (OTC).

The graph above shows the amount of Bitcoin deposits from miners to exchanges since the beginning of 2021. As you can see, Bitcoin deposits from miners to exchanges during 2022 have not been increasing overall, but these transfers have been happening consistently.