Anchin’s analysis: When will long-term holders of Bitcoin start selling?

Bitcoin is on the verge of registering its fourth bullish candle in the last 6 weeks, and many people hope that it can continue its upward trend. Meanwhile, an examination of such (on-chain) data on the behavior of long-term holders suggests that we may be gradually approaching the end of the bearish cycle in the price of Bitcoin.

To Report Determining the length of each market cycle requires examining the past behavior of its participants. When it comes to Bitcoin, long-term holders and short-term holders are the two main streams that can change its price movement.

In Anchin’s analysis, long-term holders (LTH) are addresses that have held their bitcoins for more than 155 days. They are often referred to as “smart investors” because they typically resist market volatility, buying at lows and selling at highs.

Short-term holders (STH) are addresses that have held bitcoins for less than 155 days. These people are known as the “price sensitive” group who are significantly affected by fluctuations.

Read more: What is such analysis or in-chain analysis?

Examining the behavior of long-term and short-term holders also confirms this opinion. Since 2010, long-term holders have bought at every dip and sold at almost every peak.

Recent changes in the position (behavior) of long-term holders suggest that they have now given up. Bitcoin’s slump in value, caused by the collapse of the Terra network and the crisis of the Celsius lending platform, has forced many long-term holders to sell their trading positions.

However, the selling of bitcoins by long-term holders is usually a sign that the price has bottomed.

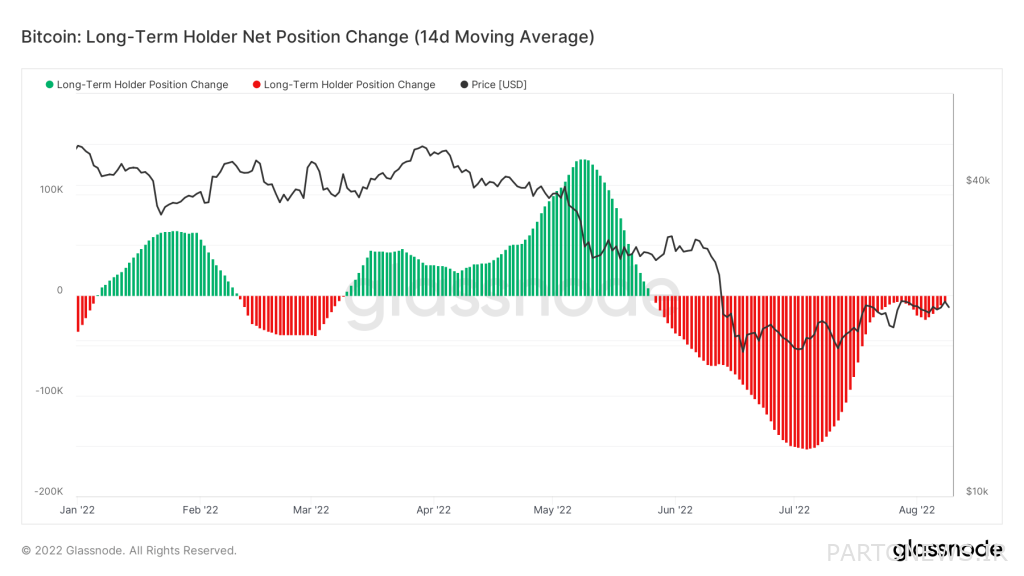

According to Glassnod data, the downward price trend is the result of selling pressure that started in May and reached its peak in July; But this downward momentum is now slowing down. The chart below shows the changes in the position of long-term holders. Red areas indicate a decrease and green areas indicate an increase in the assets of this group of holders.

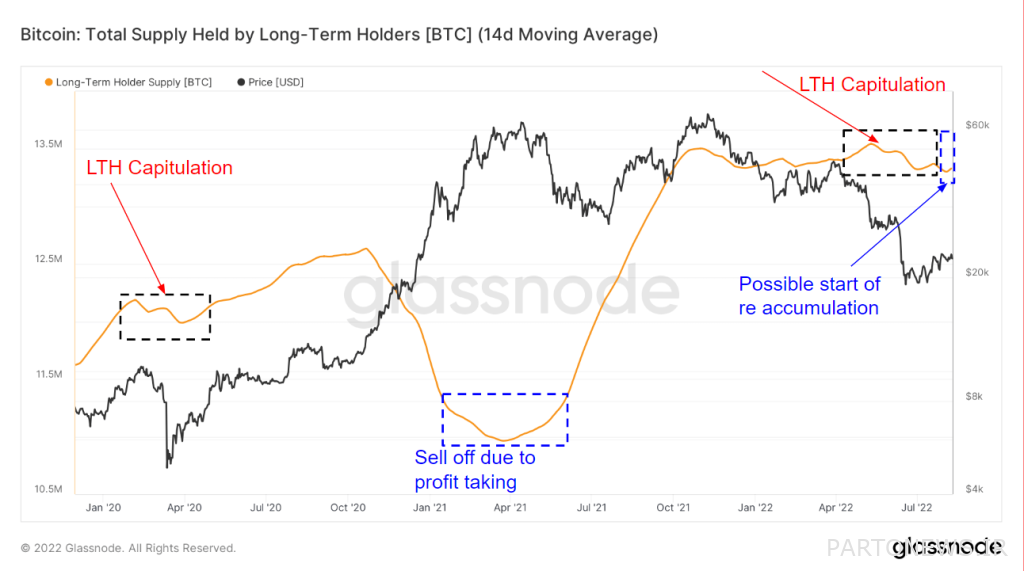

A review of such data reveals other periods that prompted long-term holders to sell their holdings. When the start of the Corona epidemic in March 2020 (Esfand 98) shattered global markets, long-term holders surrendered due to fear and uncertainty about market conditions. This event caused a sharp drop in the price of Bitcoin, which continued until July of the same year.

The next big Bitcoin sale took place between January 2021 (Day 99) and May 2021 (May 1400). The sell-off came at a time when Bitcoin was in an uptrend, meaning long-term holders made significant profits.

The surrender that we have witnessed since April 2022 (April 1401) is still going on. This surrender, like the one that happened in March 2020, has created a downward trend and reduced the price of Bitcoin to $20,000 in the summer season. Also, while we have seen a decrease in selling pressure since the beginning of August, the accumulation rate of Bitcoin is still low.

However, we still have to wait to see if this is the start of another accumulation period and whether the slight increase in Bitcoin’s accumulation rate will ease the selling pressure. If the previous bearish cycles are repeated, the price of Bitcoin can gradually take an upward trend, and the amount of assets accumulated by long-term holders will increase.