Atrium Price Analysis: Has the recent uptrend been a trap?

Although Atrium has recently overcome many key resistances, the situation of intra-chain data and derivative markets seems contradictory; But can it be said that the recent uptrend has been a price trap to hurt buyers?

To Report Kevin Telegraph: Some traders have examined the Atrium chart and concluded that the digital currency’s quarterly downtrend has ended for some reason. Atrium is currently in the $ 3,100 price range and has grown 43% in just 15 days. Another very important point is that Atrium was able to break the resistance of the descending channel on its chart on February 7 (February 7).

Should investors celebrate the beginning of Atrium’s uptrend and wait for the price of this digital currency to reach $ 4,000 or more? The answer to this question depends on the position of the micro traders and the intra-chain characteristics of the Atrium network. For example, we need to know whether a fee of more than $ 30 for an Atrium network affects the use of decentralized applications, or Dapps. In addition, we need to know what other factors can stop the growth of Atrium prices.

Atrium prices fell 55.6 percent to $ 2,160 on January 24 at $ 4,870. In addition, Bitcoin failed to break the $ 45,500 resistance the day before, and traders concluded that the digital currency is likely to face a 12% correction.

On February 7, Canadian KPMG, one of the world’s four largest auditing firms, announced that it had invested in Bitcoin and Atrium. According to Benjie Thomas, one of the company’s executives, KPI believes that other digital currencies have reached the necessary maturity and growth.

Derivatives market data show something else

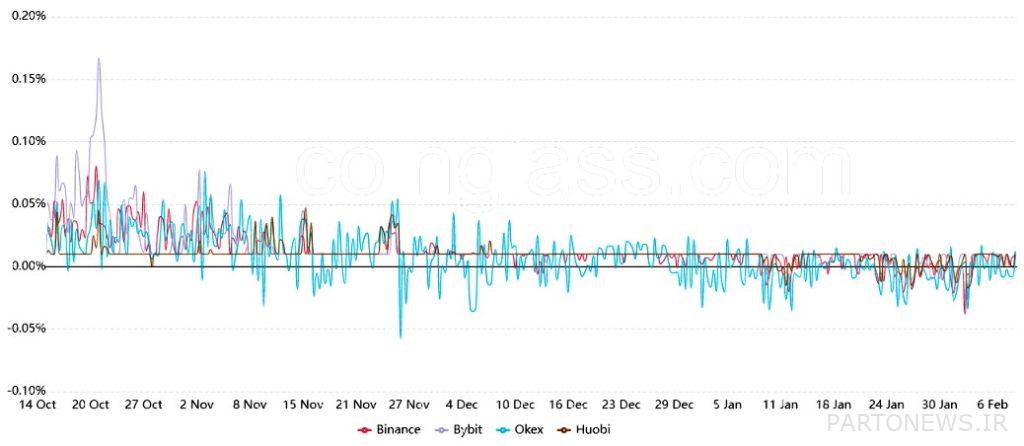

To understand how confident traders are in improving Atrium prices, we need to analyze data on permanent futures. The problem is that small traders often prefer to use these financial instruments; Because the price of these contracts often follows the price of instant markets.

In the futures market, the volume of long (buy) and short (sell) trading positions is always the same, but the amount of leverage used in them is different. Exchanges in such transactions receive money from each party (buyers or sellers) who use more leverage and pay it to the other party. This fee is called the capital raising rate.

The Capital Rate Index shows whether small traders are excited or not. If small traders are excited, the index will rise above 0.05 percent (equivalent to 1 percent per week). This rate has been negative in recent months; That is, traders tend to the downtrend. At present, there is no indication that retail traders are confident enough to enter into a leveraged trading session.

In addition, we need to look at the data inside the Atrium network to see if this uncertainty is specific to leveraged transactions. For example, while there is no clear relationship between the price of Atrium and the rate of use of the network, the decline in the price of Atrium, while reducing the volume of transactions and the number of active users of the network, can be worrying.

The status of intra-chain indicators is worrying

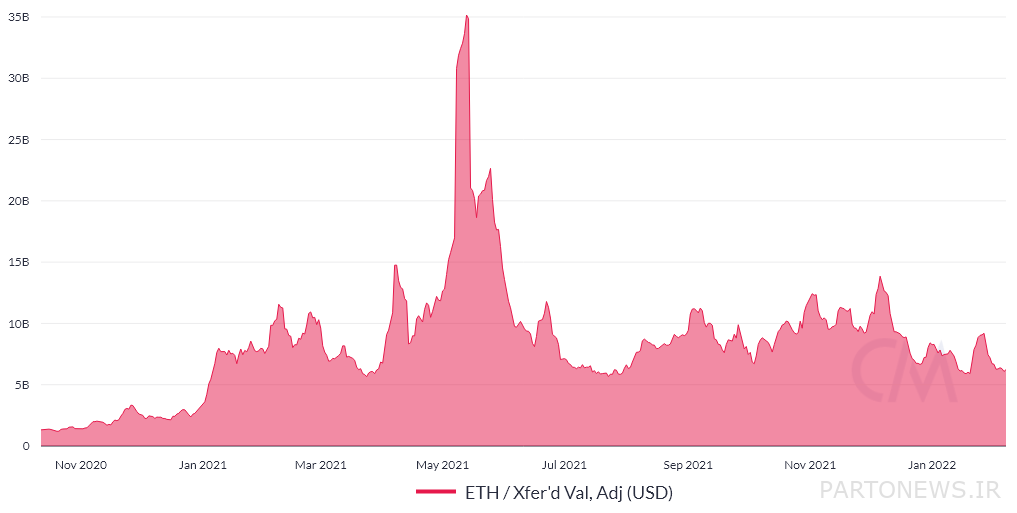

By measuring the value of Atrium network transactions, we obtain a reliable index that shows whether traders have used this digital currency effectively. Of course, if we consider the acceptance of this digital currency in the second-tier scalability solutions, its accuracy will decrease. In any case, this index is still a good starting point for us.

Atrium currently averages $ 6.2 billion a day, up 55 percent from its peak in December. To be realistic, we also have to consider that $ 6.2 billion is not far from the $ 5.6 billion annual’s floor. Therefore, we can say that this index, at least in the main Atrium network, shows no sign of price growth.

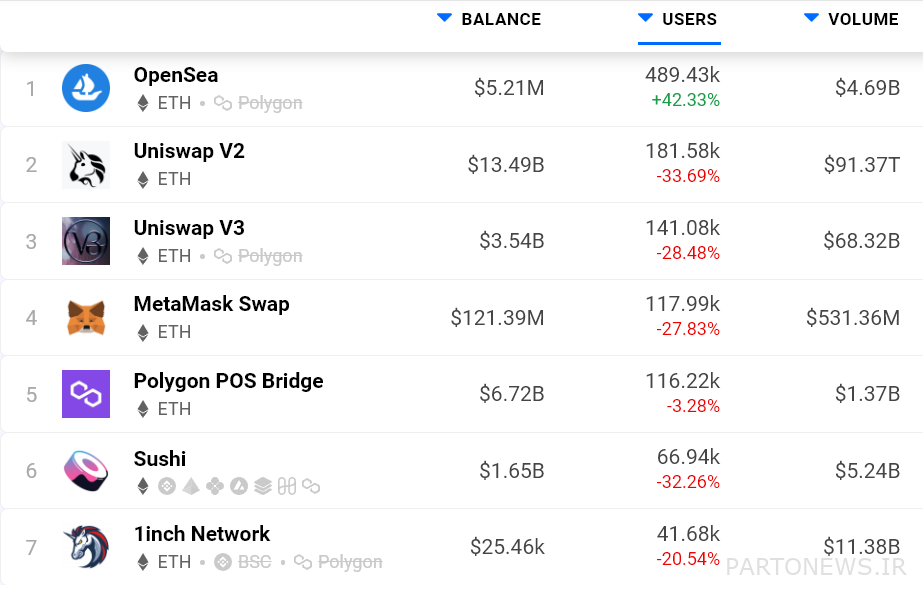

In addition, analysts should consider the extent to which decentralized applications are being used. It is worth noting that the main focus of the Total Locked Capital (TVL) value index is on lending platforms and decentralized exchanges (DEX). As a result, by measuring the number of active addresses in these protocols, we can better assess the situation.

Excluding the Opensea NFT, the number of active addresses in Atrium Decentralized Applications has dropped by 28% in the past month. This is somewhat disappointing; Because Atrium is specifically designed for decentralized applications.

In general, investors see the recent rise in Atrium prices above $ 3,000 as a trap. This only makes sense if Atrium transaction metrics and usage in decentralized applications increase. Looking at the activity of small traders, the neutrality of the capital supply rate can be considered as a sign of an increase in the price of Atrium; This is because these traders usually enter the leveraged buying positions after a strong uptrend.