Auction of one thousand and 857 billion tomans of central bank bonds in the stock market

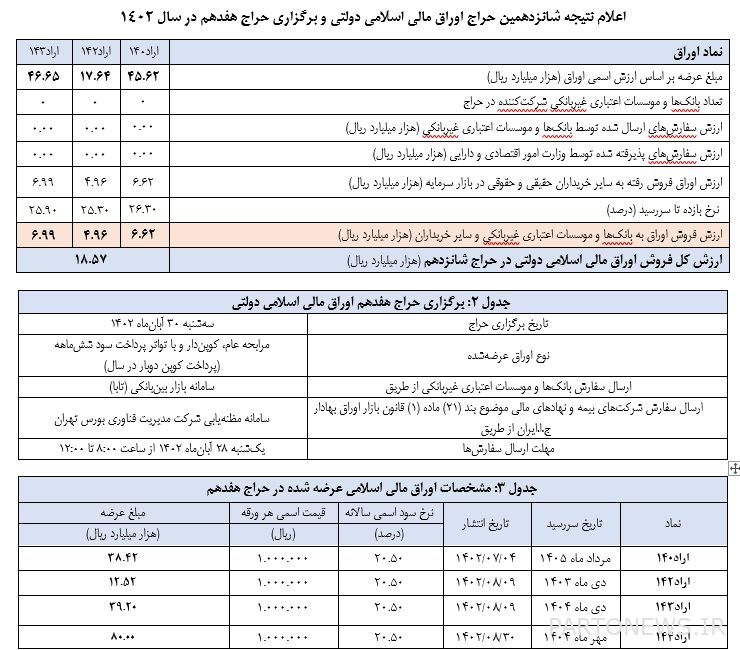

According to Iran Economist, the 16th stage of the auction of government Islamic financial bonds was held in 1402 (on November 23, 1402).

These bonds are issued by the central bank to implement economic policies and government programs and can be redeemed by the operating banks; In addition, the central bank guarantees the principal of the money and its profit for the buyer, and this factor gives more confidence for asset injection.

In the 16th stage of bond sales, the Central Bank has sold 1,857 billion tomans worth of bonds in the primary market, the stock exchange; The rate of return of these bonds was from 25.30% to 26.30%. This is the fifth consecutive week that the central bank has raised bond interest rates. Previously, the yield rate of these bonds was from 25% to 26.10%.

The details of this report are as follows:

The bonds sold at this stage, in order to provide the liquidity needed for the purchase of goods and services of the executive bodies subject to expenditure and construction credits listed in table number (7) of the budget law of the year 1402 of the whole country with a maturity of 5 years, with an annual interest rate and with payment dates 6 months, published and offered on the Iranian exchange.

In the first stage of this auction, 13 thousand billion Tomans and in the second stage 5 thousand 337 billion Tomans of bonds were sold. In the third, fourth, fifth and sixth stages, respectively, 871 billion tomans, 1456 billion tomans, 1580 billion tomans and 2 thousand billion tomans of bonds were sold by the central bank.

In the seventh stage, 1,588 billion Tomans worth of bonds were sold. In the 8th, 9th, 10th, and 11th stages, 11,266 billion tomans, 1,482 billion tomans, 1,812 billion tomans, and 506 billion tomans of bonds were sold by the central bank in the stock market.

In the 12th, 13th, 14th and 15th stages, 2,219 billion tomans, 13,243 billion tomans, 1,800 billion tomans, and 4,735 billion tomans were auctioned by the central bank in the stock market.

The central bank sends the proposals received from banks and non-banking credit institutions to the Ministry of Economic Affairs and Finance for decision-making, and this ministry determines the winning orders. According to paragraph “A” of Note (5) of the budget law of 1402, the central bank is only allowed to buy and sell government Islamic financial bonds in the secondary bond market.

The brokerage of this bank, while providing the infrastructure for transactions and conducting auctions, has no obligation regarding the volume and price of the government Islamic financial bonds sold and will not purchase the aforementioned bonds in the primary market in order to finance the government.

Also, the 17th auction of the mentioned papers will be held on November 30 of this month.

end of message/