Bitcoin continues to fluctuate near 23,000 dollars; Will the assignment of the market be determined this week?

Bitcoin has been fluctuating around $23,000 for a few days, and as it turns out, traders are waiting for the announcement of the new interest rate by the Federal Reserve Bank of America and the comments of the officials of this organization on Wednesday of this week; The comments that may include the time of the end of the bank interest rate increase in this country.

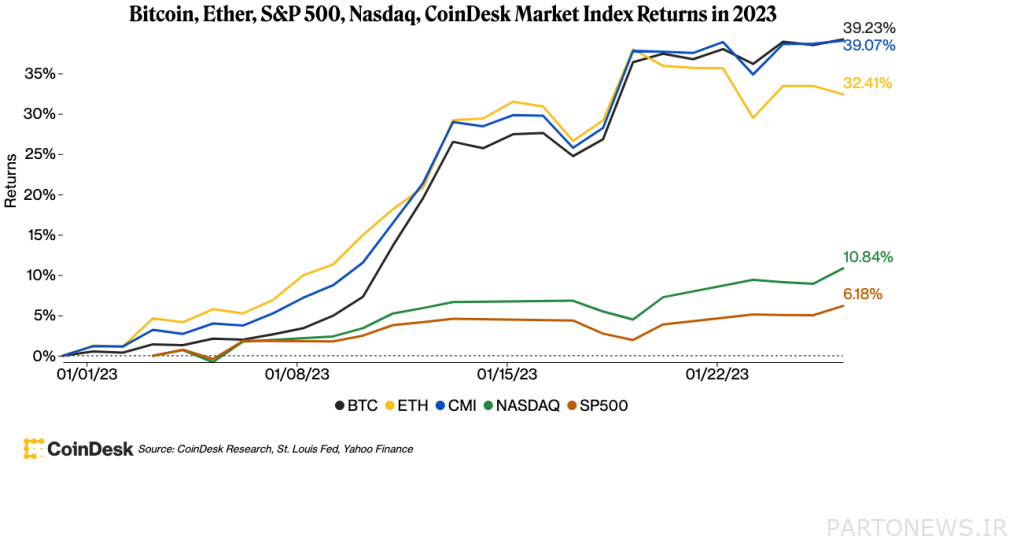

To the report CoinDesk, Bitcoin has experienced a 40% growth since the beginning of 2023, and during this time it has recorded the highest price level since August 2022 (August) by crossing $23,000. The important point for traders, however, is that after crossing this level, the price has not had a significant jump or correction and the market has shown very little volatility.

Edward Moya, analyst of Oanda Group, says:

Bitcoin will remain in the price stabilization phase until the announcement of the decision of the Open Market Committee of the Federal Reserve Bank of America on the rate of interest rate increase in this period. In addition, there is a risk that if the authorities of this organization adhere to the continuation of the process of adopting contractionary monetary policies (refraining from reducing the rate of interest rate growth in this period), the price will face a fall.

The jump in the price of Bitcoin in the new year occurred following the publication of reports that showed the improvement of the US inflation situation at the end of 2022; Exactly the same goal that the Federal Reserve pursues by increasing the bank interest rate in this country. In addition, the CME FedWatch tool of the Chicago Mercantile Exchange Group shows that traders expect a 98% chance of a 0.25 percentage point increase in the bank interest rate during this period; It means an increase equal to half of the previous period (0.50 percentage points).

While Bitcoin and Ethereum have increased in price by more than 30% since the beginning of this year, the S&P500 and Nasdaq Composite indices have grown by 6% and 10%, respectively.

Joel Kruger, strategist of “LMAX Digital” exchange, referring to the technical situation of Bitcoin, said that this digital currency is now in a state of overbought, and the position of the relative strength index also confirms this issue.

According to Kruger, the next resistance in front of Bitcoin is the level of $25,200 and it is based on the price peak of August. He has not ruled out the possibility that the price of Bitcoin will reach $10,000 in the first half and jump up to $50,000 in the second half of this year.

Kruger also said:

There is potential for the market to move either way and I am curious to see if we will see another dip in the market before the next big uptrend begins.