Bitcoin falls below the average purchase price of holders; Now is the time to buy?

Bitcoin has now reached its 18-month low and is trading below the average holding price of holders. Although many traders hope that Bitcoin has reached the end of its downtrend at this point, there is still a possibility that the price of this digital currency will fall further.

To Report Coin Telegraph On June 13 (June 23), after the price of Bitcoin fell to its current level and briefly reached $ 22,600, the overall trend of the digital currency market fell. It is worth mentioning that the current price of Bitcoin is the lowest level since December 2020.

Existing indicators and price records show that the bitcoin market is currently in a state of saturation and is likely to close. At the same time, the price of Bitcoin is currently lower than the realized value calculated for this digital currency. The realized value actually represents the average purchase price of all units of the Bitcoin network.

While the impact of the sell-off on the entire digital currency ecosystem cannot be ignored, the only thing that has given some tired traders some hope is that the market has probably gone through the worst possible downturn and we will probably not see a bigger one. Was. Market trends in the coming days will show whether this theory is correct or not. If this prediction is correct, small and large investors can enter the market using the “buy on the price floor” strategy.

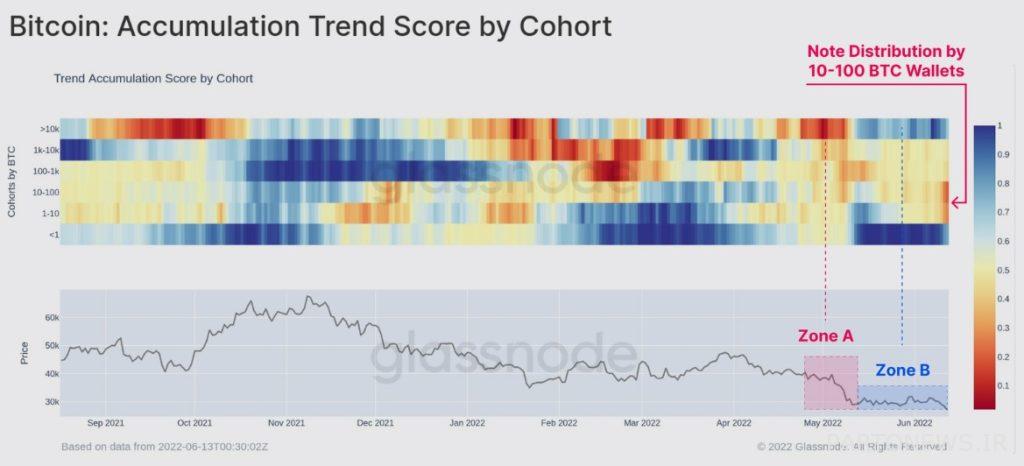

Small and large holders are both shopping

Intra-chain data show that not all investors are worried about Bitcoin falling to its lowest level in a year. Small holders (with less than one bitcoin balance) and whales (with more than 10,000 bitcoins in stock) have been accumulating new units since the fall of Terra in early May.

According to Glassnode, the number of bitcoins in the wallet of small holders has grown by 20,863 since the fall of Luna on May 9. It is worth mentioning that the current inventory of these addresses is 96,300 units higher than their inventory when the price of Bitcoin reached its historical peak in November 2021 (November 1400).

Whales have also been busy during this time, adding 306,358 bitcoins to their stock since their peak in November 2021. The 30-day inventory change index of this group has reached its highest level in the positive 140,000 units during this period.

Is the price lower than $ 20,000?

One of the reasons for the rapid growth of bitcoin sales pressure on June 13 (June 23) was the low demand for this digital currency in the range of $ 20,000 to $ 27,000. In the image below, you can see the chart “Adjusted distribution of bitcoin units based on realized price”. This index actually shows at which price levels the Bitcoin network addresses have made the most purchases by inventory.

As can be seen from the chart above, large quantities of bitcoins have been purchased between $ 30,000 and $ 40,000, but the volume of units purchased is very low between $ 20,000 and $ 27,000. As a result, with the fall in the price of Bitcoin in the early hours of June 13 (June 23), there was little support for this digital currency.

As the saying goes, the darkest moment of the night is just before dawn, and several market indicators suggest that the bitcoin trend may improve soon.

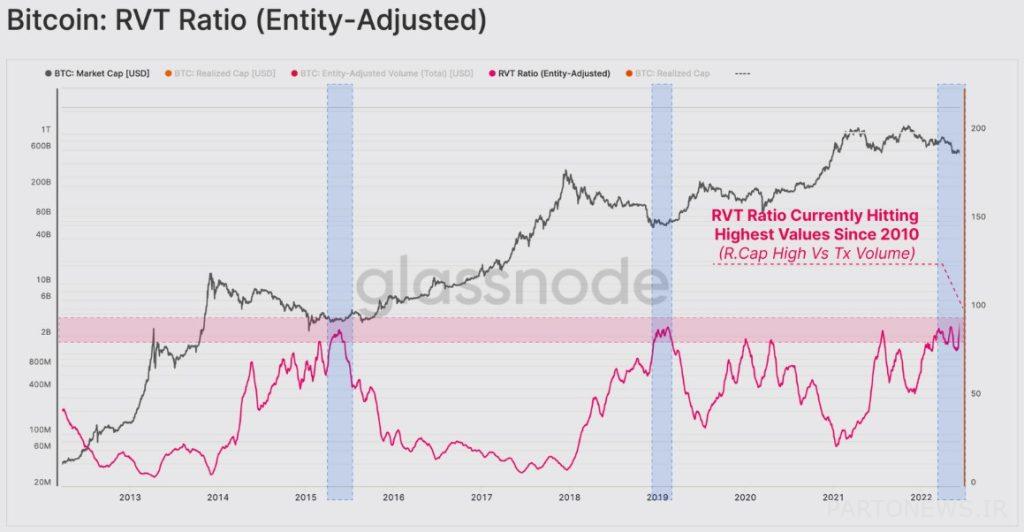

For example, the “RVT” ratio indicates that the realized market value of Bitcoin is 80 times the value of its daily transactions. In other words, the level of activity within the chains of this digital currency is low.

Golsnood said:

In previous downtrends, the decline in network usage has occurred simultaneously with the downturn.

The RVT ratio is currently at its peak since 2010 and probably indicates that the digital currency market has reached the maximum pressure it can withstand. As a result, digital currencies may recover soon; But the possibility of their further fall cannot be ignored.