Bitcoin fluctuations near 23,000 dollars; Holders do not want to sell

Bitcoin’s continued price growth in recent weeks seems to have left some analysts skeptical, considering the surge a bull trap. Furthermore, a review of the data shows that long-term Bitcoin investors are reluctant to sell their holdings in the current situation.

Depreciation of the dollar at the same time as the growth of risky assets

To the report Cointelegraph, market data shows that the Bitcoin/USD pair continues to fluctuate in the $22,900 range.

Bitcoin was able to maintain its trading trend despite hitting a low of $22,315 over the weekend, allowing long traders to avoid a significant price decline.

The 1.2% growth of the S&P 500 and 2% of the Nasdaq over the past day shows that the situation of risky assets continues to grow. A trend that Alasdair Macleod, the director of Goldman’s research, sees as the result of the classic principles of supply and demand in the market.

Sharing the daily gold/dollar price chart, he wrote:

Attempts to correct the price of gold continue to fail.

McLeod continued:

While technical analysts note that a price correction will occur, they seem unaware that central banks are buying gold heavily.

As a result, the US dollar index, which had already entered a downward trend, saw an upward jump to the 102-point range before continuing its trend at the start of the market.

However, Bitcoin analysts remain skeptical as to whether the current price jump really represents a reversal after experiencing more than a year of bear market.

While some data suggests that this jump could be the start of an uptrend, other available data suggests that we are merely witnessing a temporary price increase in a bear market. Keith Alan, one of the founders of the Material Indicators platform, said:

Until I see confirmations, I’ll focus on the important data. This is how I will know if a possible breakout is a valid move or a possible false breakout.

Allen went on to say that we specifically need a macroeconomic stimulus to end the bear market trend.

According to the economic data we have seen so far, the upward trend in the unemployment rate has only just begun, which is now at historical lows.

He noted:

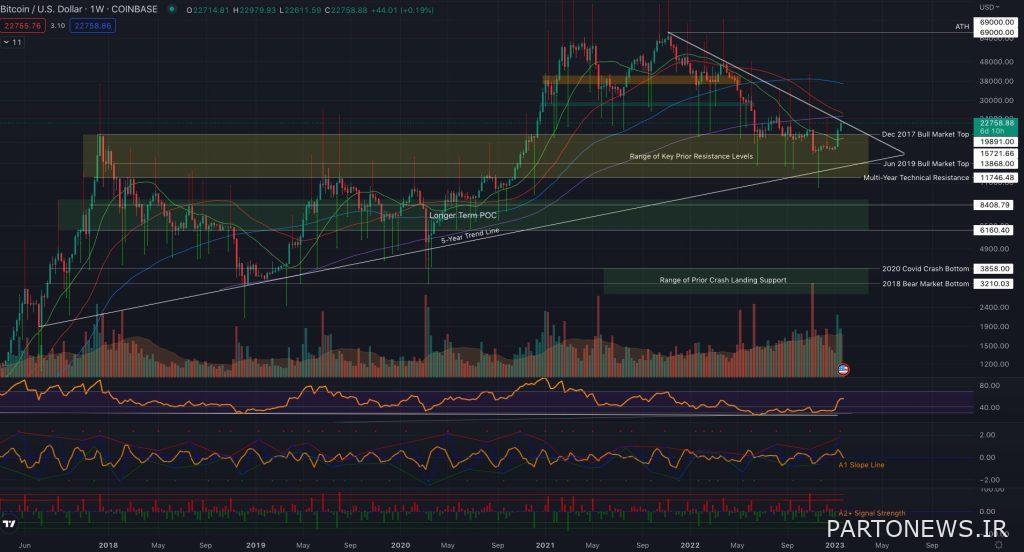

Maybe things will be different this time, but only when a full candle closes above the 200 week moving average can I consider it a confirmed breakout.

Referring to the 200-week moving average, he noted that Bitcoin is yet to recover after losing this trend line as a key support level.

Bitcoin holders are resisting the urge to sell

After the 40% growth of the price of Bitcoin since the beginning of 2023 until now, some of the analysts’ concerns were focused on the desire to sell and earn profits.

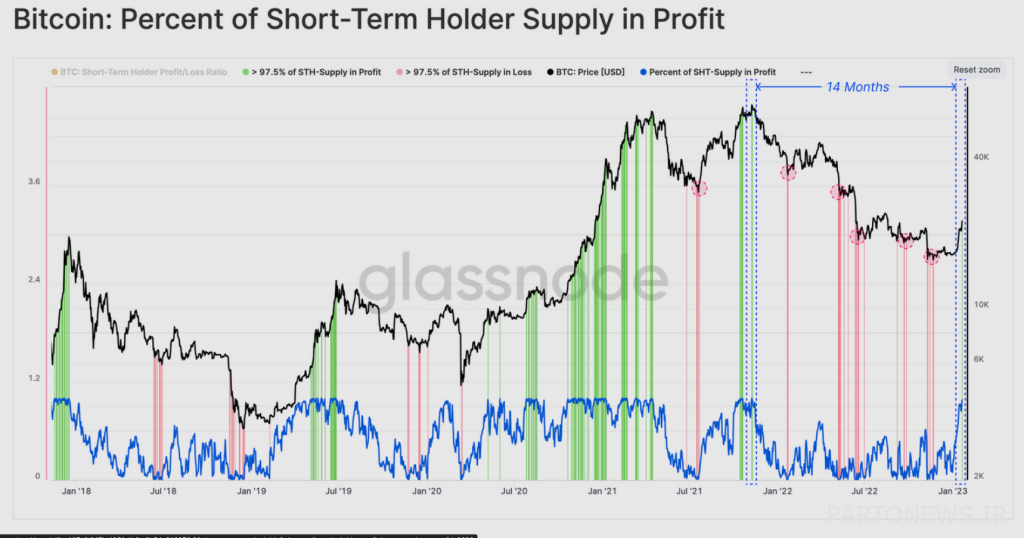

However, Chinese analyst Glassnode noted in the latest issue of its weekly newsletter that long-term investors are broadly reluctant to exit the market despite enduring more than a year of losses.

In part of the conclusion of this report, it is stated:

Analysis of the behavior of different groups shows that short-term holders and miners have used this opportunity to liquidate part of their assets. On the other hand, the growth in the supply of Bitcoin to long-term investors can be seen as a sign of the group’s strong will and confidence.

Glassnod notes at the end:

Given the influence of long-term investors on macro price trends, examining their spending behavior is a key indicator to watch in the coming weeks.

Long-term investors are addresses that hold their bitcoins for at least 155 days.