Bitcoin on the verge of 25 thousand dollars; It is still not possible to say with certainty that the upward trend has started

While many technical analysts believe that the bear market is over after the 50% growth of the price of Bitcoin since the beginning of 2023, a review of the data shows that it is still not possible to say with confidence that the upward trend has started.

The downtrend may be over

According to Erzdigital, Woo_Minkyu, director of the Thailand CryptoQuant Association, says The average total amount of stablecoins entering spot exchanges has once again reached a new all-time high.

Overall, this means that as the price of Bitcoin falls to levels where there is demand for it, buyers are ready to step in, which is a favorable trend for the price of Bitcoin to rise.

Moreover, given that the price of Bitcoin has managed to stay above its realized price, the uptrend may have already started.

Has the demand in the market increased?

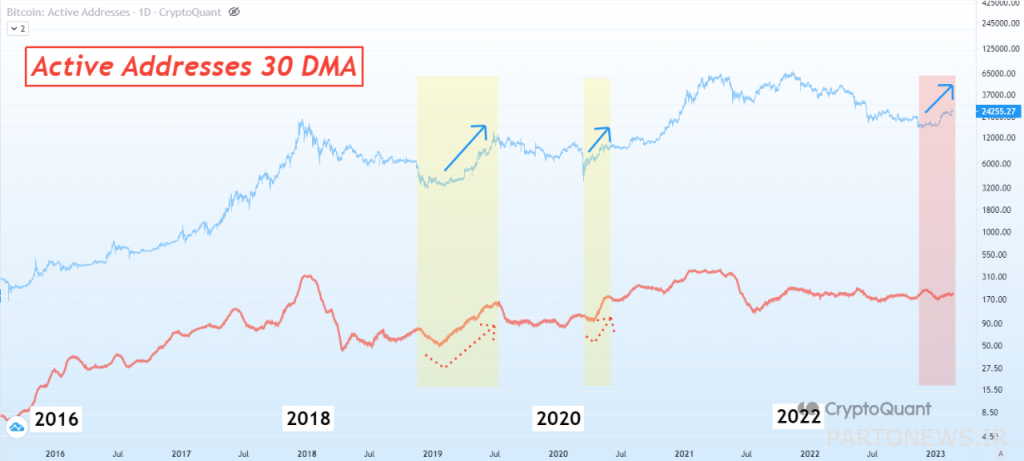

Yonsei_dent (Yonsei_dent) is one of such official analysts in CryptoQuant. says The Active Addresses Index, a metric that measures the number of unique sender and receiver addresses in the network that have had a successful transaction, provides a view of market demand.

This analyst argues that the price of an asset is determined by the law of supply and demand in the market, and the digital currency market is no exception. As a result, the growth of the price of an asset like Bitcoin requires an increase in interest and demand in the market.

As you can see in the chart above, the 30-day moving average of the number of active addresses on the Bitcoin network has increased both during the upturn of the market in 2019 and during the recovery from the shock caused by the Corona epidemic in 2020.

Vanessa Dent says:

I am concerned that the upward trend in the price of Bitcoin in 2023 has not been accompanied by any increase in the number of active addresses. Simply put, has market demand increased?

Poel’s multiplier index is at the highest level in the last 14 months

Gaah (gaah_im), another certified technical analyst in crypto-quant says The last time the Puell Multiple reached above one, the price of Bitcoin was around $48,000. Historically, this indicator can accurately determine the timing of a Bitcoin bear market; Because miners are the only players who have a fixed cost such as the cost of electricity. Therefore, miners’ behavior is always somewhat tied to price.

Poel multiplier is an indicator that is obtained by dividing the average daily earnings of miners in dollars (the daily value of issued bitcoins) by the 365-day moving average of their earnings.

Since the last price crash in November 2022 (Aban 1401), the average income of Bitcoin miners has doubled compared to last year. Therefore, in the short term values higher than 1 Poel’s multiplier are important to measure the likely behavior of miners in the future.

An increase in the average income of miners will cover more mining costs. As a result, these actors will not need to sell bitcoins to finance themselves. In other words, there will be less selling pressure from miners to the market.

It is too early to say that the upward trend has started

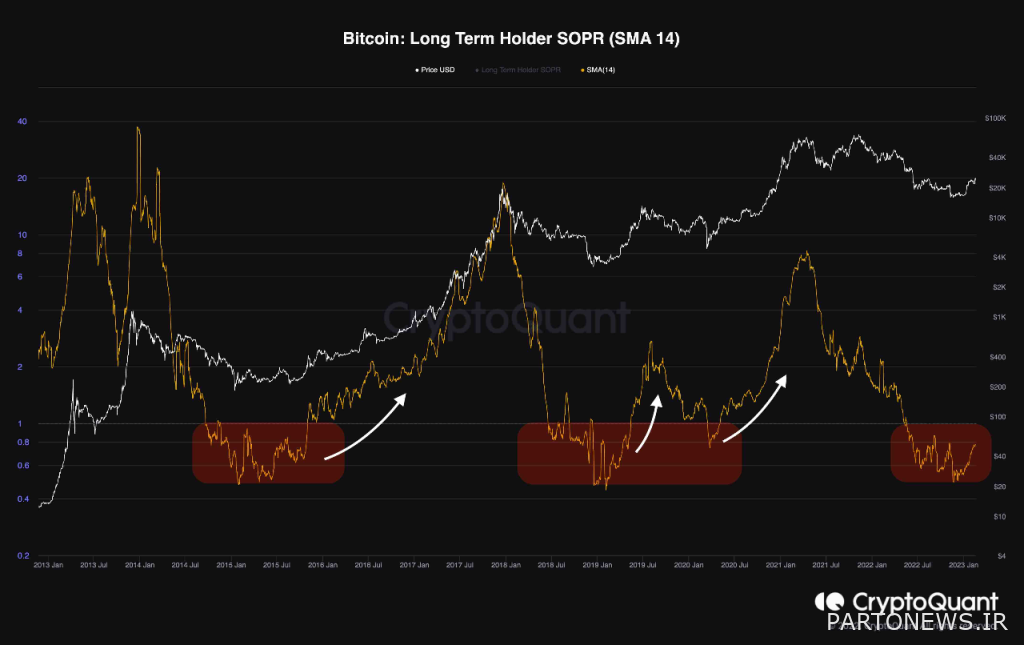

Greatest Trader (Greatest_Trader) is another official cryptoquant analyst says Bitcoin’s bear market in recent months has hurt many people, even long-term investors who usually spend their coins in profit.

Typically, long-term investors are the last group to sell their bitcoins at a loss after other market sectors enter the capitulation phase. The index, the ratio of profits to outputs spent in long-term investors (LTH-SOPR) measures the amount of profit or loss of transactions of this group.

The reduction of the value of this index below one since the end of May 2022 (May 1401) meant that long-term investors are spending their bitcoins at a loss. Historically, the start of a bull market usually coincides with the indicator crossing above the value of one.

As you can see in the chart above, the ratio of profit to output spent in long-term investors has started to improve and has increased slightly due to the recent upward trend in the price of Bitcoin.

However, Greatest Trader said:

It is still too early to consider the $15,500 level as the bottom of the bearish market and the beginning of the upward trend; Because the recent spike in the price of Bitcoin near $25,000 may just be a bull trap.