Bitcoin on the verge of falling below a key support; Is there a recurrence of coronary heart disease?

Analysts believe that the price of Bitcoin is on the verge of breaking a key support, the passage of which could lead to a collapse similar to the Corona epidemic; The decline, of course, was followed by an unprecedented leap in the market.

To Report Coin Telegraph, the price of Bitcoin once again near the level of $ 38,000 yesterday due to distrust in the market.

Bitcoin is now hovering at $ 39,000 after repeated attempts by sellers to break the $ 38,000 support level.

The price of Bitcoin jumped slightly above $ 40,000 on Friday, but returned to its previous trend after a few minutes due to the current political developments.

These “deceptive leaps” to reach higher levels this month were a familiar event for market participants. During this period, Bitcoin has returned to its previous position each time after starting an uptrend, and in these cycles, it has liquidated the short and long positions in the market.

However, if we look at the bitcoin chart over short periods of time, we find that the price of this digital currency may fall further.

Analytical website Material Indicators said to its followers on Twitter yesterday:

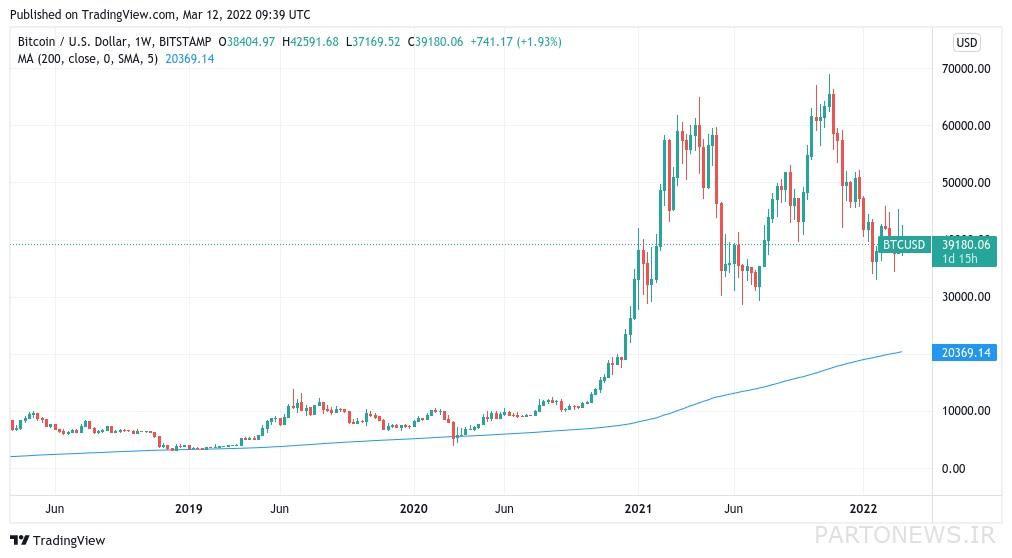

Bitcoin 3-day candlesticks are approaching the moving average (MA) of 200 candlesticks. This is the first time this has happened since the outbreak of the Corona virus and the fall of bitcoin. Make sure you have enough money to take advantage of the purchase opportunity if this happens in the 1-week market view. Jumping after a fall can change your life forever.

The 200-week moving average of bitcoin is currently just above $ 20,000 and continues to rise. This index has so far acted as a solid historical floor for Bitcoin and has never been broken.

For Bitcoin to reach this historic low, it must move away from 50% of its current price and 70% of its historic high. It is worth noting that Bitcoin has never experienced such a fall.

For example, after the outbreak of the Corona virus, the value of bitcoin fell by 60% in just a few days. Then the price entered an upward trend that was just as strong, pushing it to a new price peak that year.

The S&P 500 and Nasdaq fell 2.9 percent and 3.5 percent, respectively, last week, and the correlation between them and bitcoin continues.

Earlier, Pentoshi, a popular financial market trader, had made it clear that he thought something similar to the historic Wall Street crash of 1929 could happen this year.

Investors large and small continue to buy bitcoins

On the other hand, the purchase of whales and the growth of micro-investor wallet assets have given long-term traders hope.

On Friday alone, 30,000 bitcoins ($ 1 billion) were withdrawn from the CoinBase exchange, and stock exchanges declined as of July and September 2021 (July and September). It is worth noting that in 2021, shortly after the reduction of stock exchanges, the price of Bitcoin increased sharply.

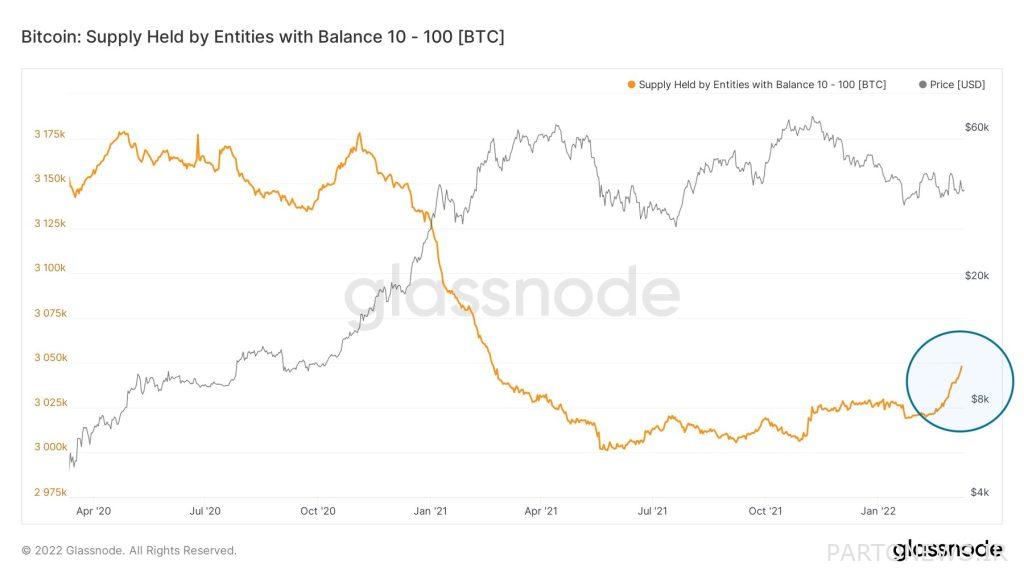

Lex Moskovski, CEO of Moskovski Capital, based on data from the analytical company Glassnode, examined the changes in the stock of Bitcoin wallets.

He said:

Wallets with between 10 and 100 bitcoins are accumulating heavily and their inventory continues to grow. These are the people who sold their bitcoins when the price of bitcoin rose from $ 10,000 to $ 50,000.

By publishing the chart below, he shows that the share of corporate investors in bitcoin supply has reached its highest level in the past year. It is assumed that each person owns one or more of these addresses.