Bitcoin prices likely to fall in early April

As the latest statistics show, the sentiment of digital currency market traders is neither up nor down, and experts believe that this neutral situation can be a prelude to intensifying price fluctuations. Some analysts also believe that the beginning of April (April) could be accompanied by a temporary decrease in the price of bitcoin, as in the past two months.

To Report Bitcoin Desk, yesterday the price of Bitcoin again reached above $ 47,000 for a while. Avi, which had a price increase of more than 48% last week, experienced a 25% jump on Friday and has been able to maintain a large part of its gains to this day. The rise in price during this period has been largely due to the upgrade of the platform lending to the third version at the beginning of last month. Bitcoin and Atrium prices have remained virtually unchanged over the past 24 hours, with Solana growing by 2%.

Global stock market volatility was largely downward last week, and as the US unemployment rate plummeted, many stock market investors are preparing to tighten contractionary monetary policy in the United States. Low bank interest rates and monetary stimulus that the US Federal Reserve has injected into the market during this period have led to an increase in the price of goods and services in this country. Rising inflation and economic growth of a country with unusual and unstable speed, encourage central banks to use contractionary monetary policies; This is mainly due to the intensification of fluctuations in the financial markets.

Yesterday, as bitcoin jumped above $ 47,000 again, the volume of liquidated futures traded in futures markets. Liquidation occurs when an exchange completely closes the trader’s leveraged trading position to prevent the initial amount owed to a trader from being burned. In fact, trading platforms do not allow a trader’s account balance to reach less than his debt. This happens primarily in futures markets.

The ratio of the volume of buy orders to the sale of Bitcoin has also been negative in the last 24 hours, which shows that despite the increase in the price of Bitcoin in recent days, investors are still hesitant.

The beginning of April can be accompanied by a reduction in prices

Bitcoin trading volume in the exchanges seems to be relatively small, while in the first and last week of March (March) the amount of trading activities was increasing.

The chart below shows the jump in bitcoin trading volume on different days. Some analysts believe that bitcoin will fall in price this month, as it did in February (February) and March (March), and then a bullish correction will begin in the market.

Traders’ sentiments are neither bullish nor bullish

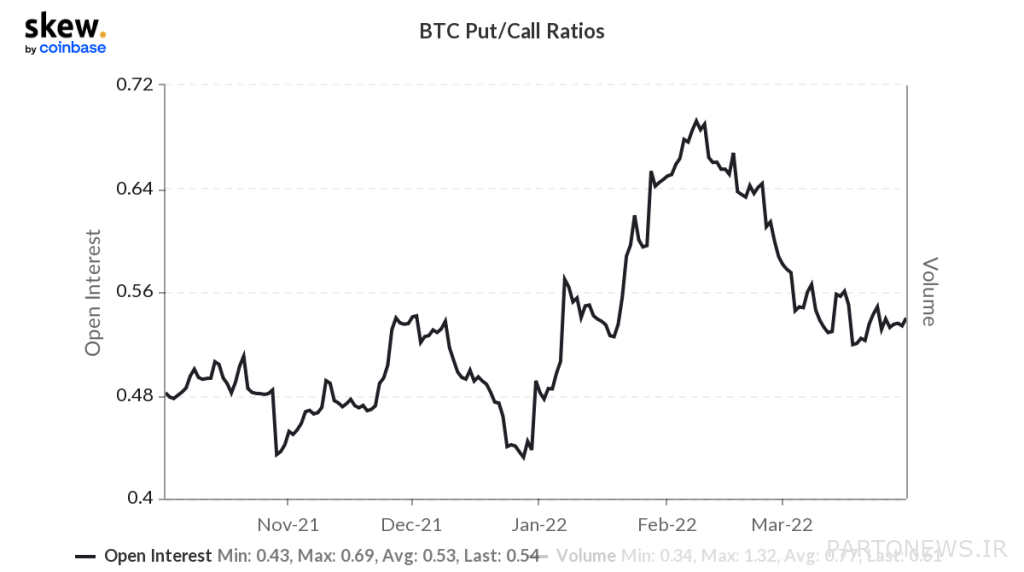

The chart below clearly shows the decrease in the ratio of Put to Bitcoin call options, which shows that the sentiment of traders in the Option markets is not declining much. This index has been almost constant over the past two weeks, which could be a prelude to increasing volatility; Especially if the price of Bitcoin comes out of the ceiling or floor of a channel that has been fluctuating for some time in the coming days.

According to data from derivatives markets, traders are 55% more likely to see bitcoin priced higher than $ 44,000 in May, and option volumes at agreed prices above $ 45,000 higher than contracts. It is a sales option.