Bitcoin return to above 16 thousand dollars; Should we worry about selling whales?

After hitting its lowest price in two years, Bitcoin rebounded to above $16,000 when Wall Street reopened on November 22. However, the formation of a new support in the $12,000 range has many investors concerned about selling whales.

To Report Cointelegraph, as can be seen from the chart below, the price of Bitcoin dropped below $16,000 on November 21 (November 30) and further fell to $15,480.

Meanwhile, rumors surrounding Digital Currency Group’s subsidiaries, including Greyscale, which is now at the center of rumors related to the consequences of FTX’s bankruptcy, have weighed on analysts’ opinions.

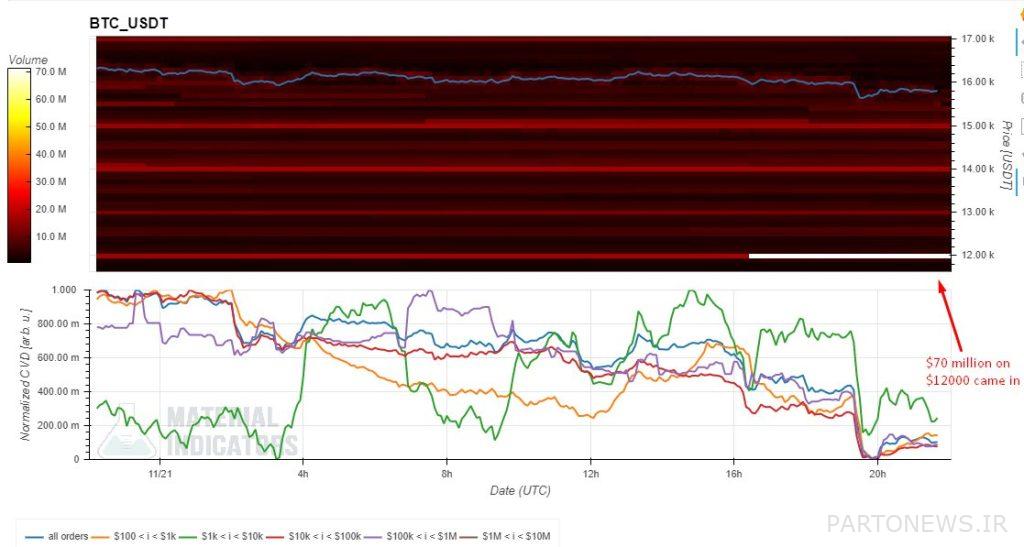

According to data from Material Indicators platform, the $12,000 buying wall could ultimately be the only thing protecting the market if investors sell more during the Thanksgiving holiday period (December 3-6).

Material Indicators said on its Twitter:

More than $300 million worth of bitcoins have been bought somewhere between $12,000 and current prices. This new $70 million shopping wall can be a protection for the upcoming holidays; A potential sale that could be triggered by speculation about Grayscale’s status or something else. Regardless, we’re always on the lookout for great new shopping walls.

Maartunn, an active analyst at CryptoQuant, has also published a heatmap of the Binance order book that shows the various levels of active buying and selling.

Meanwhile, bearish targets for Bitcoin price starting the week are mostly focused on $14,000 or below.

Investors are feeling the pressure

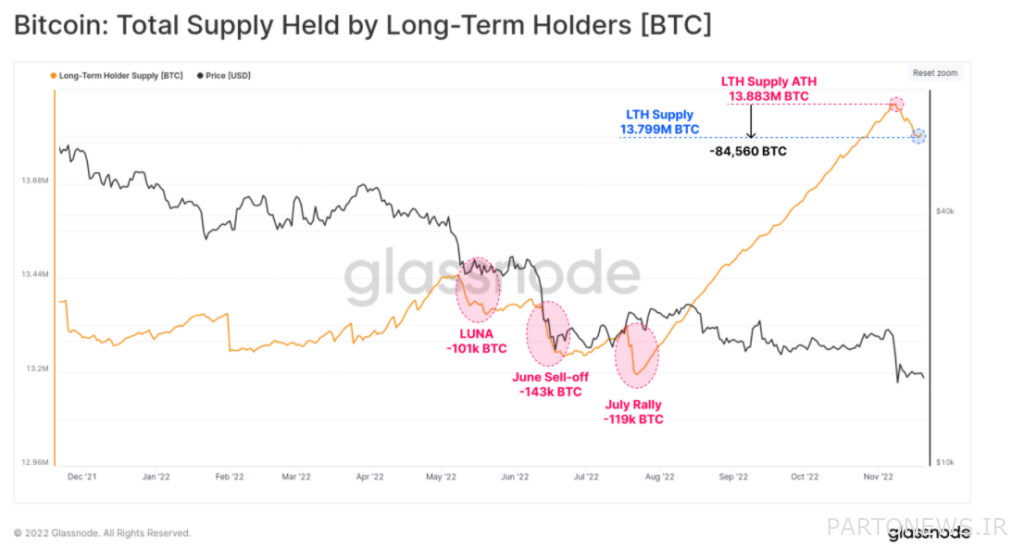

Analytical platform Glassnode has pointed out in the latest issue of its weekly newsletter that the rate of spending significant amounts of Bitcoin by long-term investors has increased.

Glassnod said:

The supply available to long-term investors after the collapse of FTX decreased by 84,560 Bitcoin units, which is still one of the most significant decreases in the last year, and this decrease in supply continues.

In addition, the biggest Bitcoin investors, the whales, were distributing their assets in the market during this time; This happened while previous data showed that certain addresses had already started buying at the price floor.

Glassnod added:

The whales are currently in net distribution (selling) mode, sending between 5,000 and 7,000 surplus bitcoins to exchanges. Meanwhile, Bitcoin withdrawals from exchanges in all groups have reached an all-time high. The impact of the FTX crash crisis continues and it remains to be seen how widespread the wavering of investor confidence has been.