Bitcoin transaction fees hit a 10-year low; what is the reason?

According to the latest available statistics, Bitcoin network transaction fees have reached the lowest level since 2011. This is certainly in the interest of a large portion of Bitcoin network users, and can also be a sign that small, emerging investors are leaving the market.

To Report Coin Telegraph is now a great time to transfer bitcoins between an exchange account and a private wallet. According to the latest research from the Galaxy Digital Institute, bitcoin transaction fees have reached their lowest level in a decade.

As shown in the chart below, the average bitcoin transaction fee decreased to 0.000004541 ($ 2.06) during 2022, while the median fee is now around 0.00001292 bitcoin ( $ 0.59), which is the lowest level in the last 10 years.

The average is the total of the fees paid per transaction, and the middle boundary between the upper and lower halves of the fees is determined by their value.

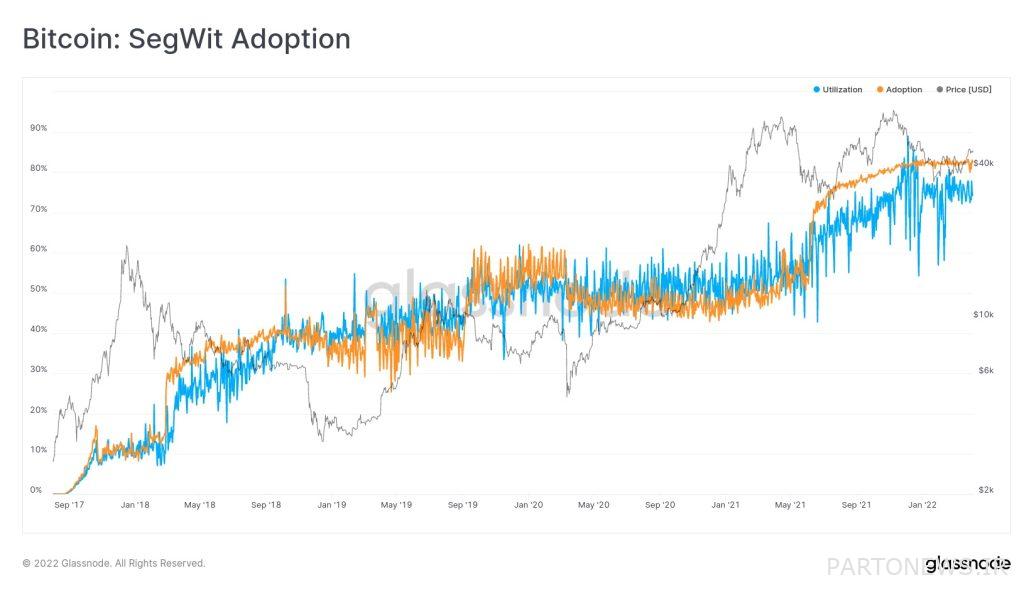

According to Alex Thorn, head of research at Galaxy Digital, a combination of growing acceptance of Segwit software, batching transactions, growing Lightning network, reducing miner sales and reducing the use of the “OP_Return” code for Burning bitcoins has reduced transaction fees over the past decade.

James Check, chief glass data analyst at Glassnode, said he agreed with Thorne, adding that “batching and segway are certainly part of the reason for the fee reduction” because it combines the number of transactions in a block. They increase and as a result, as the network throughput increases, the fee decreases.

He shared the chart below to show that acceptance of the Segway update has “increased significantly from its lowest level between May and July (May and July).”

Also read: Bitcoin fee and transaction verification issue; Everything you need to know

The check also said:

This is not the whole story. My first reason for the low wages is that in May we had a 50% drop in prices; What happened is that small investors left the market.

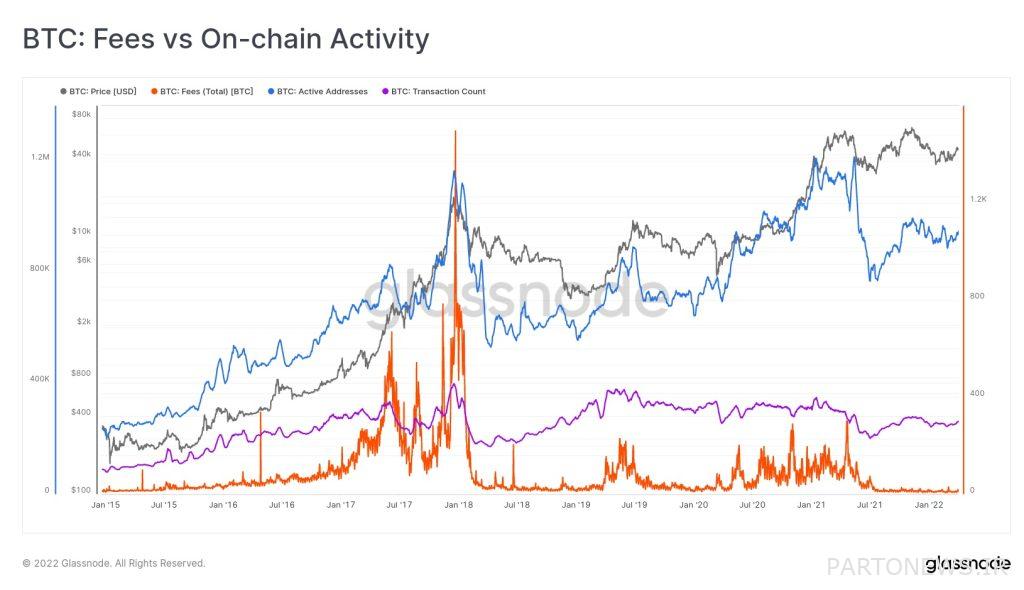

“The fee charts (orange line), the number of active addresses (blue line) and the number of transactions (purple line) have all decreased since the fall of the price (gray line) in May,” he said.

Check added:

In my opinion, this (reduction of wages) stems from the decline of the market, and even with the increase in prices, we saw the financial loss of many people and, as a result, their exit from the market.

Eric Yakes, author of The Seventh Asset: Bitcoin and the Monetary Revolution, told the Telegraph in a recent interview that “we are now witnessing a structural change in market trends and other historical correlations have become less important.”

Yax believes that raising $ 70 million from Lightning Labs to build a dedicated protocol for offering and transferring stable coins and other digital currencies across the Lightning network is a key development for Bitcoin.

Also read: The first tether transfer was made on the Lightning network; A historic start for Bitcoin

He added:

Reducing transaction fees is very important, as this is a major constraint on the scalability of the network and at the same time maintaining its decentralized structure.

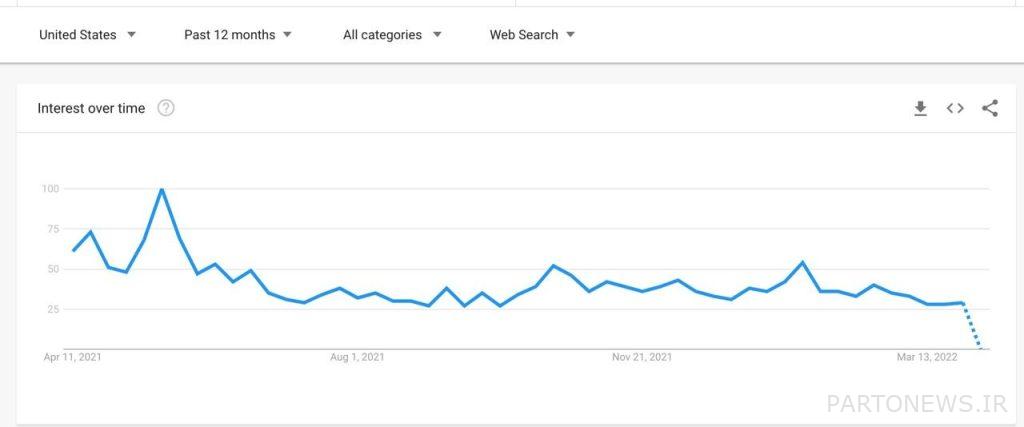

While reducing transaction fees and opening channels in the Lightning network is a boon for users, it can be a sign that micro-investors are losing interest in the field. “By looking at user search data on Google, we can see how popular Bitcoin is right now,” said James Check. “At the moment we can say that the rate of ‘new user searches for bitcoin is close to zero,'” he says.

At the end of his speech, Yax said:

Bitcoin needs Lightning to keep pace with its growth and become a thriving network for developing smart contracts.