Bitcoin was invented sooner or later

It has been more than a decade since Bitcoin and other digital currencies have emerged in the world, and concepts such as decentralization and decentralized finance have become popular. However, the issue of decentralization of money and finance is much older than this, and many people have thought about it throughout history. In this article, with help an article Written from Medium’s website, we explore the history of modern money and explain who has been thinking about decentralizing money and finance from the past until now. So stay with us until the end of this interesting article.

Modern money theory

In the last decade, the global financial system has been under serious surveillance by reducing interest rates to near zero and significantly manipulating asset prices with the serious support of the media. The improvement of economic conditions is not very optimistic, and according to today’s realities, it must be accepted that the global monetary system has structural defects. Today, this thinking is popularized as Modern Monetary Theory (MMT).

A government that prints its own money based on modern monetary theory has no restrictions on its finances and expenditures. This means that the argument of modern monetary theory is based on the principle that the government should spend as much as it wants, and the only obstacle in the way of the government is price inflation. Proponents of this theory think that by establishing a rigid policy and policy in the field of employment, the government can simultaneously create employment and avoid inflationary problems caused by the increase in employment and increase the employment rate to the highest level.

In modern monetary theory, an independent government that has its own currency does not rely on taxes to finance its expenditures. Money is a government product that circulates with government spending. It is clear that a government with fiat money will never go bankrupt; Because it does not make its budget dependent on taxes. So if a government does not go bankrupt and does not lose its ability to pay debts; Why should he be taxed? The answer is obvious: this government does not collect taxes.

The government does not need your taxes

Warren Mosler, an eminent American economist and politician, in the book “The Seven Deadly Innocent Frauds of Economic Policy” (The Seven Deadly Innocent Frauds) examines the tax and its true role in the financial prosperity of the government and considers the tax as a “deadly innocent fraud”. remembers:

Scam #1: The federal government must either tax more or borrow from the central bank to pay for itself. This means that government spending is limited to taxes or borrowing.

the truth:

Government expenditures in relation to government revenues limited It is not, and this means that the government will never be exposed to the risk of “inability to pay debts”. In simpler terms, the government can always print more currency to cover its spending and payments, regardless of the size of the budget deficit or the amount of taxes it collects from people and businesses.

You may ask, why does the government tax us? The answer to this question is simple: taxation creates an endless demand for money, and people find it necessary to sell goods and services and work in various jobs to earn more money. In other words, the existence of taxes is a good reason for governments to print more money and make it available to people who try to earn more income through various activities and actions so that they can pay their taxes with more money.

Decentralization of money

Nobel laureate Friedrich Hayek wrote in his book “The Decentralization of Money” that the government monopoly on money must be abolished to end the repeated cycles of inflation that have become so frequent in the last century. In this book, he talks in detail about “private money” and how money, unlike law or language or morality, does not need government legislation. He Four defects Inflation, instability, excessive government spending and economic nationalism indicate and state that these cases have common reasons and solutions. The common reason and solution for these four defects is to provide private currency to compete with the state currency and remove the state monopoly. Issuers of private money must limit the amount of money they print and maintain its value in order to maintain public trust in this money.

Although in the last century we have seen many crises and big crashes in the economy and the market, including the crises of 1920, 1937, 1987, 1991, 1997 and 2000, it seems that people have established a stronger connection with the important financial event of 2008 and this event compared to the past events. It has clarified the monetary conditions for them.

Hayek says:

I don’t think we can have money with the right features until we can get the money out of the hands of the government. Of course, this cannot be done with violence, and we must find a cunning and unhurried way and introduce something that no one can fight and stop.

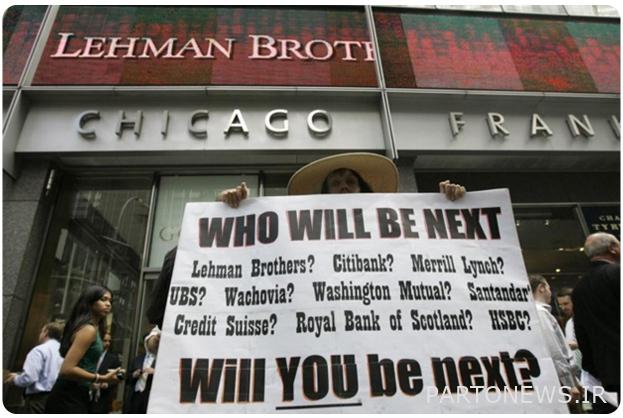

The financial and economic crisis of 2008

Western leaders’ interpretation of the free market was heavily influenced by thinkers like Milton Friedman, who said that if things go wrong and a crisis occurs, they can heroically enter the field and restore the economic system and put everything back on track; But some economic schools, such as what Hayek believed, considered this claim to be only arrogance that distorted the perspective of the market economy and caused the financial and economic crisis of 2008.

In order to understand how the government caused this crisis, we need to see what happened before this crisis. In January 2001, the United States Federal Reserve lowered interest rates; Because he was “worried” about the economic stagnation of the United States. The Central Bank of America lowers interest rates to facilitate borrowing and investment by businesses and consumers; That is, the same reason as the central banks for lowering the interest rate. The central bank’s decision to reduce interest rates created the basis for this financial crisis. Practically, any government intervention in the market, such as rescuing bankrupt companies and applying trading and trading restrictions or manipulating interest rates, will harm the economy in the long run.

The central bank continued to reduce the interest rate after 2001 and there was such a growth in real estate prices that it needed to be stopped. In early 2007, the US housing bubble burst and the global financial crisis began. Basically, the central bank should not have anything to do with the interest rate. Hayek also believes in eliminating the role of the government in market regulation, and this belief distinguishes him from other free market theorists. Hayek believed that the market would be able to regulate itself much better if the government stopped taking care of the market.

When the government adjusts the interest rate, it is considered a kind of price adjustment; As the Soviet Union had set a fixed price for food. The market must determine the interest rate itself. Now, the main question is how the market can “determine” the interest rate by itself or be successful in this setting without the influence and corruption of the big participants in the market?

Blockchain and digital currencies

Decentralized finance or DeFi, which emerged based on digital money and blockchain, is the answer to the age-old question of how the market can regulate itself away from manipulation and corruption. To explain this part, it is better to go back to 2008, when Bitcoin was invented. After the financial and economic crisis of 2008, an unknown person or group of people named “Satoshi Nakamoto” published a revolutionary white paper or detailed paper that talked about a peer-to-peer electronic payment system, and finally, Bitcoin was introduced as the product of this group. .

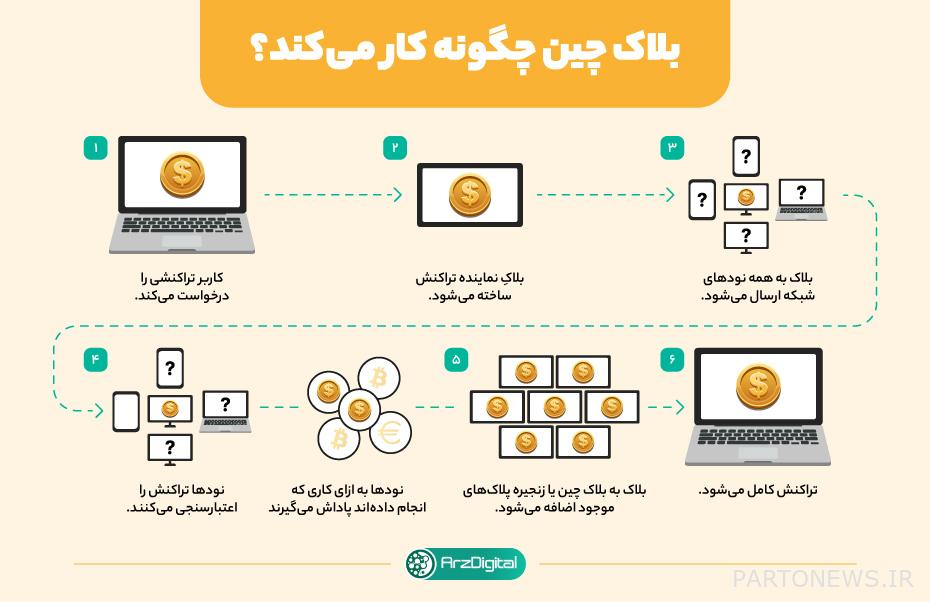

Blockchain technology, which Bitcoin was based on, was highly praised, and it was believed that blockchain has the same ability to create transformations as printing technology or the Internet, and it will create big problems for the banking industry. Simply put, blockchain is a distributed, decentralized, public digital ledger that is placed on a wide network. Using cryptography, blockchain can ensure the correctness and security of data, and at the same time, create trust between users without the need for an intermediary. This is not a new concept; Because previously Stuart Haber and Scott Stornetta, cryptography and computer science scientists, presented it in the form of a research project in 1991.

After the expansion of Bitcoin and the emergence of other new digital currencies, non-traditional tokens (NFT), smart contracts and DeFi, the use of blockchain became very popular. Decentralized finance, or DeFi, as we mentioned earlier, is built on a decentralized and secure blockchain, allowing the market to be fully self-regulated. For example, in this system, the interest rate is automatically adjusted based on supply and demand and determined using mathematical algorithms in DiFi applications.

We believe that the blockchain system is transparent and secure; Because everything, including the volume of transactions and unpaid loans and the total debt, is always visible, and none of these can be changed or manipulated. Accordingly, there is no need for government intervention in blockchain.

Conclusion

Supporters of the modern monetary theory are right about the fact that independent governments can print as much fiat money as they want, and they are right; But this does not invalidate the law of “scarcity”. This means that as money increases, its value decreases and this cycle continues even if it is the only currency that the government accepts as a unit of tax payment.

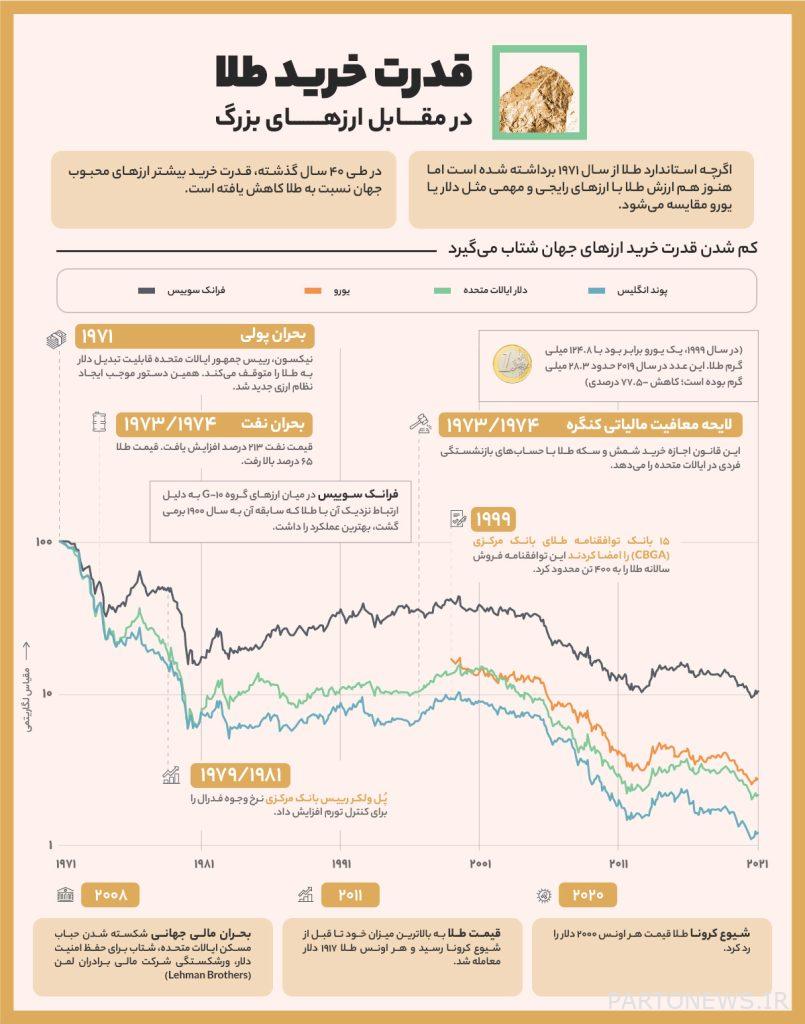

Of the 750 different currencies that we have had since the beginning of 1700, only 20% of them have remained and the value of all those that have remained has decreased compared to before. Take a look at this chart and pay attention to the fact that the value of gold has not increased; Rather, the value of other assets has decreased compared to gold. The same is true for Bitcoin.

Now the question is whether the financial system has the necessary efficiency under these conditions? What is your opinion on this matter?