Bitcoin whales are selling and small investors are buying

According to the latest statistics, wealthy bitcoin investors have recently shown little inclination to buy new units, while micro-investors have been steadily increasing their holdings.

To Report At Bitcoin, the price of Bitcoin is now more than 8% lower than its seven-day high of $ 42,500. However, as intra-chain data shows, this has not prevented micro-investors from optimism.

The Ecoinometrics platform, which provides in-chain data related to digital currencies, shows the accumulation and sales patterns of the Bitcoin community in the charts below.

“Equinometrics” said on Twitter:

Bitcoin whales (rich buyers) and fish (small traders) live in two different worlds. Small fish are still accumulating; But the whales are selling. Without the presence of whales, it is unlikely that Bitcoin will have enough power to maintain its uptrend.

In the image above, the first diagram shows the addresses that have a maximum of one bitcoin. Since the beginning of the third quarter of 2021, these investors have started accumulating bitcoins and have increased their total inventory by about 10%.

By the end of 2020, these investors had only stopped accumulating bitcoins once, at a time when bitcoin was at an all-time high of more than $ 69,000 in November 2021.

In contrast, the largest bitcoin whales, each with between 1,000 and 10,000 units, are less eager to accumulate this digital currency. For the past 30 days, the largest bitcoin whales have been selling their assets.

Has the price of bitcoin reached the bottom?

Top Bitcoin whales have been accumulating new units in the fourth quarter of 2020 and the second and third quarters of 2021. Their net worth is now about the same as it was 15 months ago.

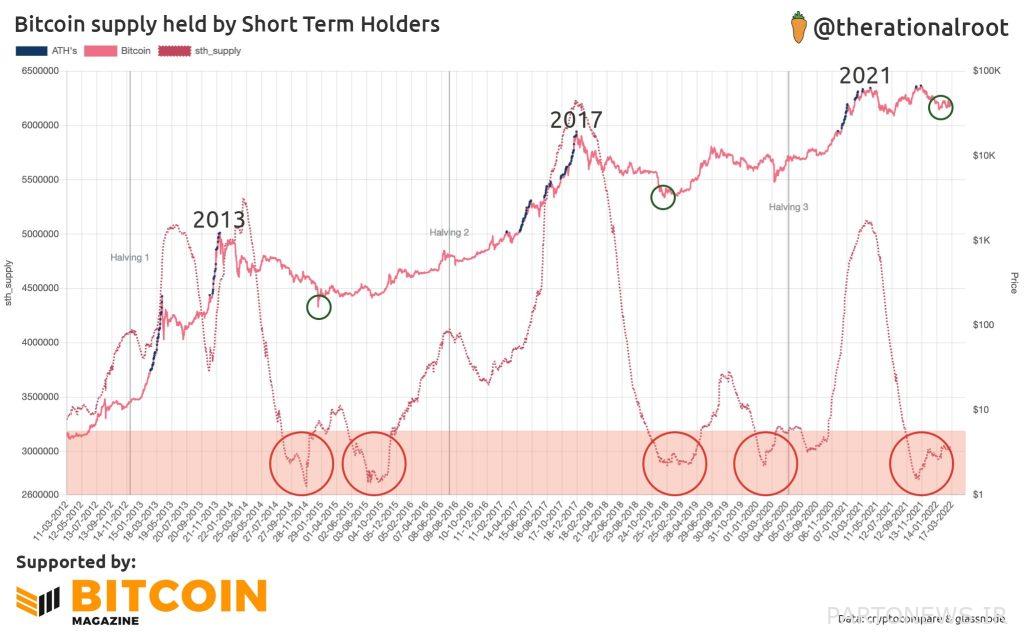

In addition, another intra-chain and reliable indicator indicates that bitcoin may be at its price floor. This indicator shows the “share of short-term investors in the total supply of bitcoins”, which is currently very low.

From this chart, it can be seen that short-term investors have stopped distributing and selling bitcoins. These are usually an upside signal for Bitcoin.