Bitcoin withdrawals from exchange offices peaked in the last 3 months

In just one day, about 30,000 bitcoins left the main exchanges, and buyers decided not to market their bitcoins like miners. The quarterly record was set when bitcoin prices rose slightly and traders were optimistic about the digital currency.

To Report Coin Telegraph, statistics on the daily outflow of bitcoins from digital currency exchanges show that investors have withdrawn approximately 30,000 bitcoins from large exchanges.

CryptoQuant analytics service data show that on January 11, 29,371 bitcoins were taken out of exchange offices to record the highest record since September 11, 2021.

The four-month record was driven by yesterday’s rise in the price of bitcoin and the maintenance of levels above 42,000, which led traders to become more optimistic.

The price rose to $ 43,150 on Tuesday, before the Bitcoin market stabilized. However, yesterday’s rise was completely different from the forecast of many analysts who thought that the price of bitcoin would fall to about $ 30,000.

While this is still a matter of debate, it seems that buyers have no problem entering the market at prices above $ 40,000.

It is noteworthy that even the increase in the price of bitcoin at the end of September (September) and reaching its historical peak, did not cause buyers to be attracted to this market as much as yesterday.

“Samson Mow, CEO of Blockstream, said about the current situation:

Bitcoin trading volume is low. This indicates that bitcoin can easily rise or fall. Given that the price of bitcoin has fallen sharply before and now everyone is eager to buy it, I think the trend will be upward.

The Crypto Quantum site inspects the order book of 21 exchanges every day. Last week, various data showed that there was a strong mismatch between buying and selling orders, and sellers were finally tired of selling.

Buyers become bolder

When the price of bitcoin fell, instant market buyers were the main group that was not present in the market.

Existing surveys and reports show that miners want to increase their reserves quickly this year as well, and long-term holders have no plans to sell their bitcoins.

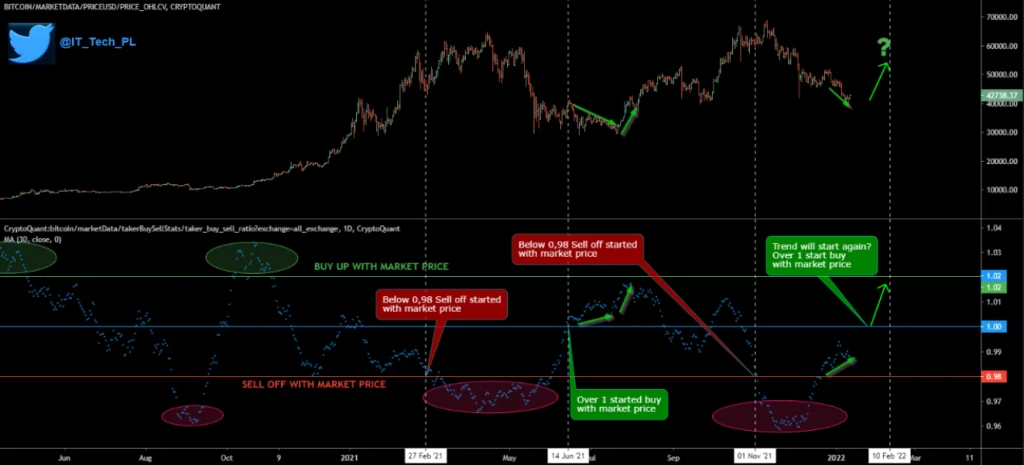

One cryptocurrency user, IT Tech, noted that the trend in “ratio of purchase volume to sales volume of marketable bitcoin orders” is upward, noting that similar conditions exist in derivative markets.

The diagram below shows the blue dotted line. If this ratio is less than 1, it indicates that the sentiment in the market is more downward. Although the ratio is now less than 1, the trend seems to be upward.

The user said in a post on the cryptocurrency site on Wednesday:

If the index crosses the number 1, the sentiment in the market will rise again and Bitcoin will have a chance to change its trend. I am personally preparing for the bullish market that will come sooner or later.