Bitcoin’s fall to $17,100 coincides with the liquidation of a billion dollar trading position

Yesterday, following the news of the crisis in the FTX exchange, the market value of digital currencies fell below 900 billion dollars. As a result of this event, which caused the price of Bitcoin to reach its lowest level in the last 2 years for a short period of time, nearly a billion dollars of trading positions were also liquidated.

To Report Cointelegraph, while Binance’s purchase of FTX seems to have calmed things down a bit, analysts are still not optimistic about the end of the current turmoil.

The data shows that the (liquidity) crisis of the FTX exchange has caused prices to fall in the digital currency market.

Fear returned to the market after the Wall Street open, despite the Bitcoin price returning to above $20,000 due to news of Binance’s purchase of FTX.

Also read: What is the benefit of buying FTX exchange for Binance?

The price in the market of the Bitcoin/USD currency pair, with a decrease of $2,000 in less than 2 hours, witnessed a sudden fall and registered a price floor of $17,120 on the Bitstamp exchange.

November 2020 was the last time Bitcoin was traded in this price range; This means that Bitcoin has fallen below its previous low of $17,600, which it recorded in June of this year.

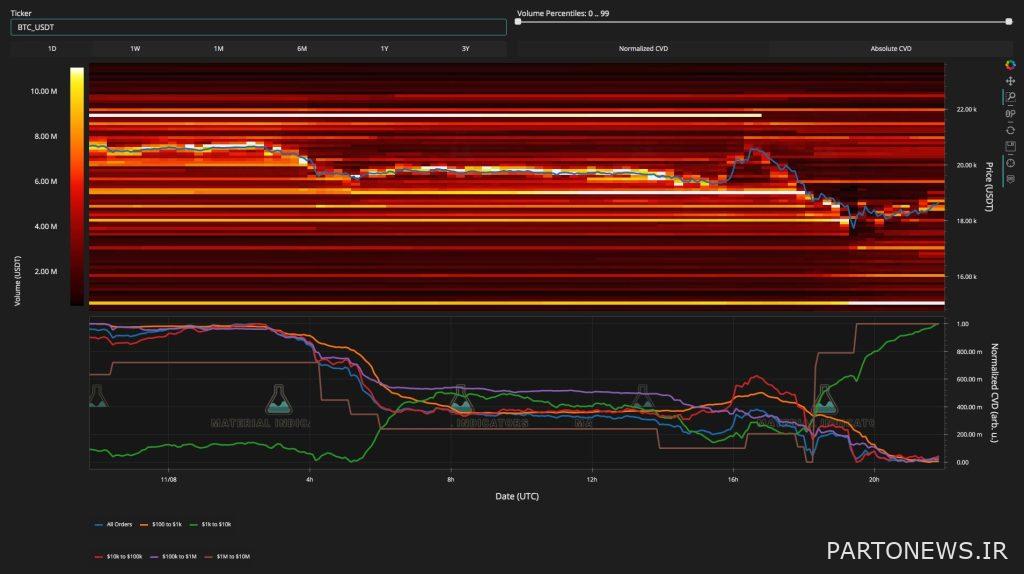

Binance order book data shows that a sudden bearish trend caused the price to miss the key support of $18,000.

By the close of the daily candle on November 8 (November 17), most of the Bitcoin trading volume was in the $18,400 range. At the time of writing this report, the price of Bitcoin is fluctuating in the $17,700 range with a 10% decrease in the last 24 hours.

At the same time, data from the on-chain monitoring platform CoinGlass shows the big mistake of long traders who got caught in the market at the wrong time.

On November 8, while $214 million of long Bitcoin trading positions were liquidated, the value of liquidated long trading positions of other digital currencies was $670 million.

If we also consider the value of short trading positions, the total value of liquidated assets will be more than 915 million dollars.

Important weeks ahead

Well-known digital currency experts are still cautious in analyzing the current situation to declare the end of the turbulent price trend.

TechDev, a typically bullish analyst, tweeted:

It is still too early to know how this problem will end; But the fact that we see another liquidity crisis caused by exchanges at this point in the structure [اقتصاد] We are big, it is really a remarkable event. Important weeks ahead.

While some analysts are looking for glimmers of hope originating outside the cryptocurrency space, others have admitted to being caught up in the volatility themselves.

The weakening of the US dollar during the mid-term elections was a promising sign for the growth of risky assets for the well-known analyst IncomeSharks.

Today, he wrote about the US dollar index:

It seems that [شاخص دلار] It is ready to drop below its support line.

IncomeSharks also stated:

[وضعیت] The stock market looks good. Black’s strong negative event (referring to FTX crash concerns) hampered the price movements of digital currencies; But when people’s bad feelings subside, we will see a small increase in the price of Bitcoin and Ethereum. Once again [تأکید میکنم] The issue is not related to the assets themselves.

Previously, November 10 (November 19) was supposed to be the volatile day of the week due to the publication of the October inflation rate of the United States.