Bitcoin’s Weak Start as the New Month Begins; How will the market situation be in the coming week?

Bitcoin started the new day, month and week with a price drop. Meanwhile, the general conditions of the market seem to be somewhat calmer than in the past weeks.

To Report Coindesk, Bitcoin has lost 51% of its value since the beginning of this year. The dominance rate of Bitcoin on the digital currency market, which was 40% at the beginning of January and 41.8% at the beginning of April, has increased to 42% since the beginning of August (August 10).

In traditional financial markets, the “S&P500” index experienced a 0.5% drop and the Dow Jones industrial index (Dow Jones) dropped 0.3%. The Nasdaq Composite stock index, which mainly covers the shares of companies active in the field of technology, has experienced a 0.4% decrease over the past day.

MicroStrategy, one of the largest institutional investors in Bitcoin, is scheduled to release its financial performance report for the second quarter of 2022 today. Analysts on average expect MicroStrategy to have recorded a loss of $7.27 per share in this period, while in the first half of 2022, the company had recorded a loss of $11.58 per share.

The 30-day correlation between the price of Bitcoin and the stock of Microstrategy is 85%, which means that the performance of this company’s stock is largely tied to Bitcoin. The numerical correlation coefficient is between negative 100% and positive 100%, and recording higher numbers in the positive range indicates a stronger correlation between two different assets.

The price of Ethereum fell by 4.5% yesterday, while this digital currency has increased in price by more than 10% in the last seven days. It should be noted that other altcoins in the market such as Polkadat and Cosmas (ATOM) have also lost 10.9% and 5.2% of their value during the last day and night, respectively.

The retreat of Bitcoin with the beginning of the new month

After last week’s price action, now is a good time to take a look at Open Interest and Strike Price in the Bitcoin options markets. The “Open Interest By Strike Price” index actually shows the volume of Call or Put option contracts at different agreed prices and can be used as a tool to measure traders’ views on The fair price of Bitcoin used.

The most important change of this index compared to the previous week is the increase in the volume of put contracts purchased at the price of $23,000. Having a put option contract means the “ability” to sell at a certain price (here $23,000) and the holder is not “obligated” to sell at that price. Therefore, put option contracts with an agreed price of $23,000 can generate profit for the holder if the price of Bitcoin falls below this level.

Having a purchase option contract also means the “ability” to buy at a certain price, and the holder is not “obligated” to buy and execute the contract at this price. As can be seen from the chart below, the volume of call option contracts at the agreed price of $25,000 is high; This means that investors who have been waiting for the growth of the Bitcoin price are willing to buy at this level.

Also read: What is an option contract? + Video

For a better understanding of the analysis of the above chart, you can use the on-chain data and the “index”Realized price» Bitcoin also got help. The price realized from the divisionRealized market value» is obtained by the current supply (the number of circulating units of Bitcoin) and the realized market value also calculates the value of all circulating units of the network based on their last purchase price (transfer).

The realized price of Bitcoin is now around $21,800. The index related to the spot price of the market has now reached above this level (at $22,800) after falling below the level of the realized price in June. The passing of the current market price from the realized price means that during this period, more part of the supply of Bitcoin circulation is in a profitable state. The more units are in profit in total, we can say that the realized price will show more support.

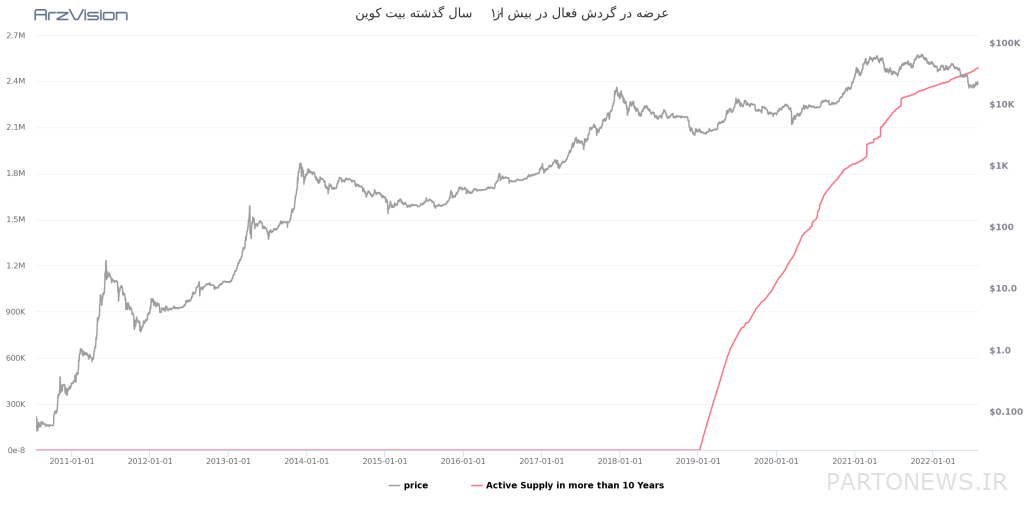

The number of bitcoins that haven’t been moved or traded in over 10 years continues to grow. Some of these bitcoins may have remained intact during this time because their owner no longer had access to their wallet or somehow lost their recovery words. However, there are many old Bitcoin holders who still have no intention of selling after 10 years.

For comparison, it should be said that currently, nearly 2.5 million bitcoins are kept in leading wallets (outside exchanges) that have not been moved for 10 years, and on the other hand, 2.4 million bitcoins are in the accounts of exchange users. Maintenance will be

From the point of view of macroeconomics, conditions will be relatively calm at the beginning of the new calendar week; However, the other day, the Society for Supply Chain Management (ISM) released a survey showing that the pace of manufacturing in the United States has slowed.