Bullish sign: Bitcoin short-term holders are increasing

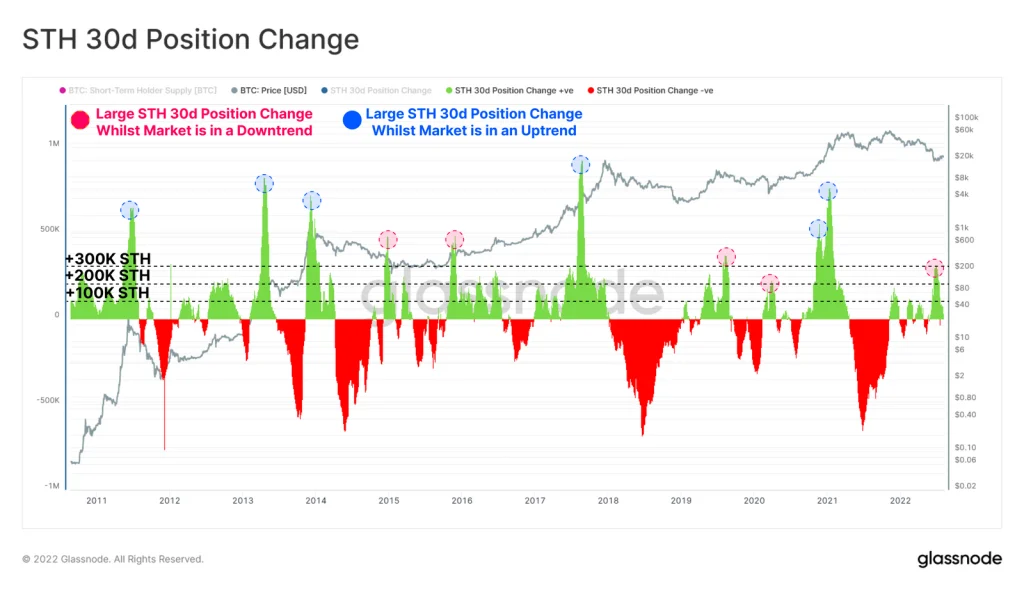

Bitcoin short-term holders have increased their holdings by 330,000 units since the market crash in May this year. According to analysts, this could indicate the end of mass selling by investors and the path to improvement of the digital currency market.

To Report Cointelegraph, the recent increase in the inventory of short-term holders of Bitcoin could signal the end of periods of mass selling among investors and the market is preparing for several months of continuous accumulation of new units.

Glassnod’s new report on the state of on-chain indices shows that short-term holders of Bitcoin have increased their holdings by 330,000 units since Luna’s price plummeted in May. A topic that can indicate the path to improvement of the digital currency market.

During the massive sell-off that started in May and continued until the end of June, short-term holders of Bitcoin started a new trend by buying Bitcoin at extremely low prices (near or below $20,000). ) and by doing so, they put themselves in a good position in terms of investment.

As stated in the Glassnod report, since May, 200,000 bitcoins have been withdrawn from the addresses of long-term holders and 100,000 bitcoins from digital currency exchanges, which seems to be the main reason for the increase in short-term holders. in this period of time.

Together, these events confirm that the mass sell-off by other investors is over and that those short-term holders who entered the market during periods of increased selling pressure are now getting out of Bitcoins at a much lower initial cost than other investors. They maintain themselves.

According to Glassnod’s definition, long-term holders are wallets that have held them for at least 155 days, and short-term holders are addresses that have held their bitcoins for less than 155 days.

Also read: What is On Chain Analysis?

According to Glassnod analysts, short-term holders usually buy near highs and sell when prices fall. Therefore, it can be said that the accumulation of Bitcoin among short-term holders usually happens in bullish markets; But the buyers who entered the market in May and June have created a “structural divergence” in opposition to this usual trend.

The Golsnod report states:

Such events represent the transfer of a portion of bitcoins to the accounts of new buyers who are initially considered as short-term holders; But it should be noted that these new holders bought at low prices and are in a good investment position to continue holding their bitcoins in the future.

The next change that market analysts should be watching is whether these short-term holders are determined to continue holding onto their bitcoins and help the price rise in the future, Glassnod analysts said.