Chairman of the Digital Economy Committee of the Parliament: The Central Bank is only a regulator of cryptocurrencies and payment instruments

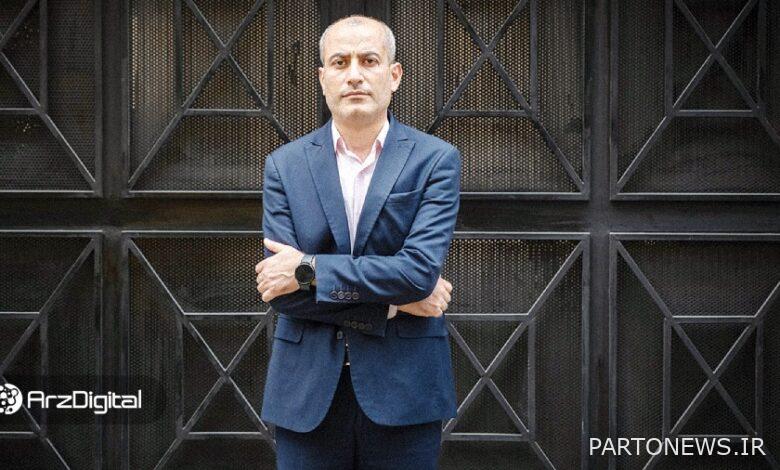

After the President promulgated the Central Bank Law on December 11, the Fintech Association raised its doubts about the definition of cryptocurrency and the role of the Central Bank in the field of regulation and supervision of these assets with Mojtaba Tawangar, the head of the Digital Economy Committee of the Parliament. Yesterday, in a letter addressed to Mohammadreza Pourabrahimi, Chairman of the Economic Commission of the Majlis, Tuwanger stated that the central bank is only a regulator of cryptocurrencies and payment instruments.

While emphasizing on not handing over the powers of regulation of other encrypted assets to the Central Bank, he said that the general approval of the plan to organize crypto-assets in the Economic Commission of the Majlis. In the text of Mojtaba Tawanger’s letter, it is stated:

Pursuant to the letter 10177 of the Fintech Association of Iran regarding the differences of opinion in the understanding of some provisions of the Central Bank of the Islamic Republic of Iran Law (approved on November 29, 1402), it is necessary to explain that at the beginning and in the resolution dated November 15, 1401, the Islamic Council of Parliament, the regulation of cryptocurrencies and cryptocurrencies to the bank Central Bank was assigned, but in the amendment that was approved after the ambiguity of the Guardian Council regarding the definition of the mentioned concepts, the decision of the Islamic Council was to assign only the regulation of cryptocurrencies (as one of the groups of cryptocurrencies) to the Central Bank, which It is the country’s monetary and banking regulator, and therefore carefully considering the diversity of the nature of cryptocurrencies, it removed all regulations related to cryptocurrencies from the decree.

He further wrote referring to the different nature of all types of cryptocurrencies:

On the other hand, in the definition of cryptocurrency, which was approved in the amendment and after four rounds of back and forth with the honorable Guardian Council, care was taken to pay attention to those cryptocurrencies, whose essential element is “money”, because cryptocurrencies or, more precisely, Crypto assets are different types of digital entities that have different natures, and according to the structure of the country’s legal system, the regulation of each group of them should be the responsibility of the related specialized institution, and the related law requires great care. For this reason, the general plan for the organization and development of crypto-assets, which was approved this week by the Economic Commission, with the aim of paying special attention to this concern, has determined the role of specialized and related regulatory bodies in various sectors related to crypto-assets.

The head of the digital economy committee finally noted:

First of all, it should be emphasized that the definition of cryptocurrency clearly defines the regulatory scope of the Central Bank, secondly, the progress of the initial and final approvals according to the opinions of the honorable Guardian Council is well indicative of the goals and opinions of the members of the Islamic Council and the non-awarding of regulation or regulation of cryptocurrencies to the bank. It is central, and thirdly, the plan under consideration by the commission, whose general aspects have been approved, is another proof that our view is to pay attention to the diversity of the nature of this type of assets, and granting regulatory and regulatory authority to one institution will not even be a correct thing in our legislative system.