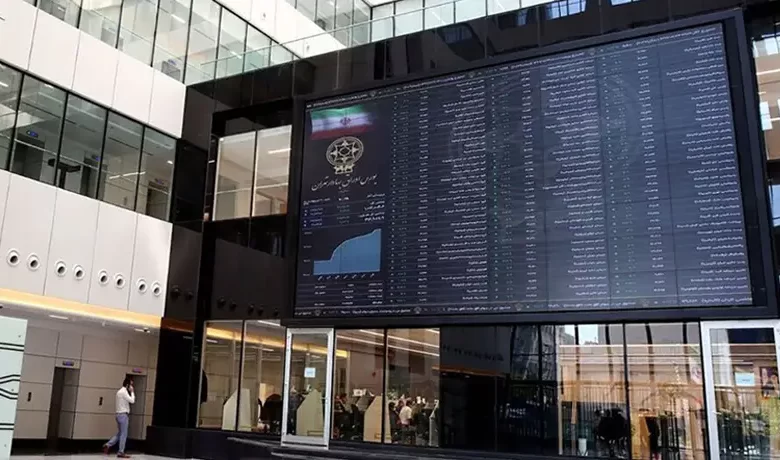

Comparison of dollar value of Tehran Stock Exchange with Middle East countries (infographic) – Tejaratnews

According to Tejarat News, analysts have been using an index called “dollar value” for some time to calculate the value of the stock market and to detect the formation of a bubble in this market; No matter how much such a calculation tells the whole truth about the stock market, it can be a benchmark for comparing the Iranian stock market with the stock markets of the world.

Which country has the most valuable stock market in the Middle East?

The downward trend of the market in recent years, along with the country’s currency fluctuations, has weakened the status of the Tehran Stock Exchange among the Middle East stock exchanges to some extent. A recent survey shows that the Tehran Stock Exchange has been ranked 7th among the Middle East stock exchanges in terms of dollar value.

According to the survey published by Eco Iran, the Saudi Stock Exchange has been able to place itself in the first position of the most valuable stock market in the Middle East in terms of dollar value, with a value of more than two thousand and 670 billion dollars, which of course owes this success to its oil giant. The company is “Aramco”.

In the meantime, the Abu Dhabi stock exchange (UAE) with a value of 741 billion dollars is in the second place, although it has gained a good position, but it is still far away from the Saudi stock exchange.

After the Abu Dhabi Stock Exchange, the Tel Aviv Stock Exchange is ranked third with a value of 216 billion dollars, which is far from the first and second stock exchanges in the Middle East. From this rank onwards, the dollar value of the country’s stock markets is declining and they draw a long distance from the two largest stock exchanges of Saudi Arabia and Abu Dhabi.

Stock exchanges with a value of less than 200 billion dollars

From the fourth place onwards, the dollar value of the stock markets has fallen below 200 billion dollars. Based on this, the four stock exchanges of Qatar, Istanbul, Kuwait and Tehran are worth 165 billion dollars, 152 billion dollars, 147 billion dollars and 145 billion dollars, respectively.

Tehran Stock Exchange is actually the last stock exchange in this table with a value of more than 100 billion dollars, which is in the seventh position of the Middle East stock exchanges in terms of dollar value.

It should be mentioned that the dollar value of Tehran Stock Exchange in 1998, just when the stock market started growing and the total index was in the range of 400,000 units, showed the figure of 115 billion dollars.

From this time until August of 1999, when the total index was at its peak, the strengthening of the inflow of real money and the relative stability of the dollar price brought the dollar value of the Tehran Stock Exchange to 356 billion dollars.

However, after the historic fall of the stock market this year and the total index of the stock market being in the range of less than 1.2 million units, the dollar value of the stock market was barely maintained at the level of 200 billion dollars. Currently, despite the total index crossing the historical ceiling, the dollar value of the Tehran Stock Exchange is 56.6% lower than the dollar value of the stock exchange in the middle of summer 2019.

Read more reports on the stock news page.