Continuation of stabilization policy and decreasing liquidity growth rate

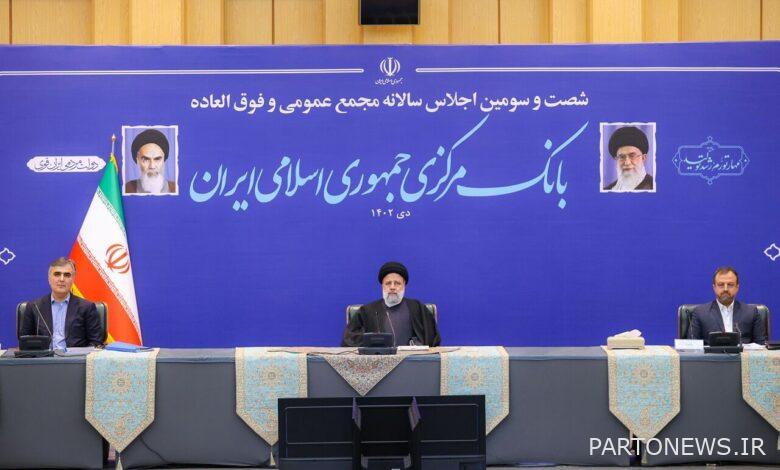

According to Iran Economist From the central bank, the 63rd annual meeting of the general and extraordinary assembly of the central bank with the presence of the president, the attorney general of the country, the minister of economy, the head of the program and budget organization, the minister of peace, the minister of oil, the minister of agricultural jihad and other members of the assembly along with the members The money and credit council and members of the executive board and managers of the Central Bank were held.

Mohammadreza Farzin, the Governor General of the Central Bank said in this meeting: In line with the new policies of the Central Bank with the axes of controlling and managing liquidity growth with the aim of curbing inflation, regulating and managing the foreign exchange market, strengthening supervision and reforming the banking system, strengthening the governance of the Rial and strengthening diplomacy. Currency and monetary management and management of inflationary expectations and increasing the confidence of people and economic activists in the future of Iran’s economy are emphasized.

Regarding the actions of the central bank to regulate and manage the foreign exchange market, he said: strengthening the supply side of foreign exchange with measures such as following the return of foreign exchange from exports to the country’s economic cycle, using the capacities of neighboring countries and trading partners, and diversifying the methods of returning foreign exchange from trade. It is a performance.

This responsible official added: on the demand side, with the approach of meeting the real needs of foreign exchange, compiling the annual foreign exchange expenditure plan, providing foreign currency for basic goods on the platform of the foreign exchange portal, setting up the Iranian currency and gold exchange center, changing the approach of monitoring the country’s foreign exchange expenditure and controlling consumption. The necessary currency for the foreign currency account of the applicants was put on the agenda and satisfactory results were obtained for the optimal management of the country’s foreign exchange market.

The Governor General of the Central Bank stated: We are currently in a good position in terms of foreign exchange reserves through foreign exchange diplomacy and moving towards the release of blocked resources in other countries, and we will try to strengthen these reserves with future plans. We will also take advantage of the capacities of the Asian Exchange Union, which is periodically chaired by Iran, to expand interactions.

Farzin said: Designing a currency stabilization fund, designing and setting up new systems for foreign exchange transactions, opening a central exchange for Iranian currency and gold, designing and issuing foreign exchange bonds with the aim of financing domestic production, and reforming the procedures for removing accrual exports are among the other actions of the central bank. In line with the implementation of the program of economic stabilization and stability in the currency market.

The burden of financing the country is on the banking network

Referring to the importance of the banking network in the country’s financing system, he said: nearly 89.9 percent of the country’s financing is the responsibility of the banking system. In the meantime, about 10% of the financing burden is provided by the capital market and only 10% by foreign investors, which shows the heavy pressure of the country’s financing burden on the banking network.

The Governor General of the Central Bank added: Based on this, the general approaches of the central bank’s credit policy include strengthening working capital, chain financing in line with non-inflationary financing, strengthening the financing of knowledge-based companies, improving micro financing in such a way that the economic system and production The country should not suffer interruptions and at the same time inflation control programs should be implemented well.

Realization of 110% payment of marriage and childbearing facilities

Regarding the payment of marriage and childbearing facilities, which is also emphasized by the presidency, he explained: While the payment of 111.8 thousand billion Tomans was approved until January 7, 1402, more than 129 marriage facilities were paid. It has been reported that the banking network achieved 115% performance in 1402.

Farzin added: Also, until January 7th, payment of 38.2 tons of child-bearing facilities was approved, and more than 35.5 tons of child-bearing loans have been paid to applicants, which shows that 93% of the above tasks have been fulfilled.

The head of the Central Bank said: In total, 110% of the assigned duties regarding marriage and childbearing loans have been paid.

He stated: Since the payment of marriage benefits to all applicants is one of the concerns of the honorable president, and also due to the high number of applicants and the importance of the issue for members of the society, we have written programs in the Central Bank for the payment of marriage and child benefits to the applicants, so that all applicants have access. Applicants should be provided with this facility. This program will be implemented in the coming weeks with the provision of necessary resources from the banking network.

Regarding the financing of knowledge-based companies, Farzin also said: In the first eight months of the year, 1,541 thousand billion rials were paid to knowledge-based companies, which shows a growth of 71.8% compared to the same period last year.

Regarding the central bank’s plan to reform the banking system and resolve the disputes, he said: reforming the relationship between the government and the banking network and the central bank, reforming the relationship between banks and the central bank, strengthening the capital adequacy ratio of banks, and strengthening the central bank’s intelligent and multi-layered supervision over the banking network’s activities in It is the agenda, and if a bank cannot take steps to correct and resolve the dispute, we will go to the decision operation.

Referring to the results of stabilization policy in reducing the liquidity growth rate as the main factor of inflation control, the Governor of the Central Bank stated: The liquidity growth rate has reached 42.8% in Mehr 1400 to 26.2% at the end of November of this year. By the end of the year, with the strict implementation of the inflation control program, we are expected to reach the 25% growth target.

He said: Regarding the growth rate of the monetary base, which was around 45% at the end of April this year, it reached 38.5% in November, and it is expected that it will continue to decrease.

Referring to the 4.7% growth of the country’s economy in the first 6 months of this year, Farzin added: 4.7% economic growth with oil and 3.6% growth without oil shows that the country is returning to the path of long-term economic growth, and we hope that with Continuing the policy of stabilizing and making the economy more predictable, we will witness the prosperity of the country’s economy as much as possible.