Cryptocurrency billionaires have lost $116 billion in the past 9 months + new list

The continuation of the downward market and the beginning of the wave of large bankruptcies among the digital currency industry activists have caused the loss of 116 billion dollars of the wealth of the founders and well-known investors of this sector in the last 9 months alone.

To the report Cointelegraph, this statistic is obtained from the latest estimate of Forbes magazine, in which the decrease in the wealth of 17 figures active in the space of digital currencies has been measured. According to Forbes estimates, 15 of these 17 prominent figures have lost more than half of their wealth since March (March 1400), and as a result, the number of billions in the field of digital currencies has decreased by 10 people.

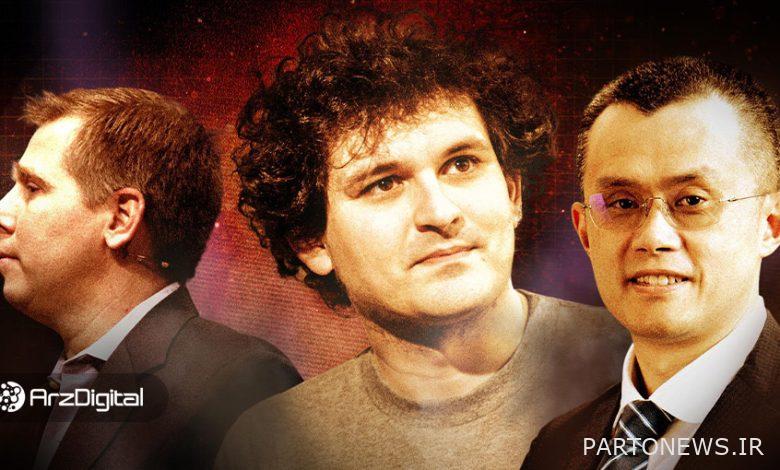

One of the biggest losers of the recent crash is Chang Peng Zhao, the CEO of the Binance exchange. His 70% stake in Binance, which was worth about $65 billion in March 2022, is now valued at only $4.5 billion.

Brian Armstrong, the CEO of American exchange Coinbase, who was worth $6 billion in March, now has only $1.5 billion in assets. The fortune of Chris Larsen, the co-founder of Ripple, has also decreased from $4.3 billion to $2.1 billion during this period, and the Winkelwas brothers (Cameron and Taylor), who previously had a fortune of $4 billion, now have only $1.1 billion in assets each.

Among those who have lost their position as an active billionaire in this field, the name of Seman Benkman Farid, the former CEO of the bankrupt FTX exchange, and Gary Wang, the co-founder of this trading platform, can be seen, respectively, in March 2022 equal to 24 billion and 5. They had $9 billion in wealth and now their assets are considered “zero”.

As Forbes wrote in its report, the value of the outstanding debts of Digital Currency Group (DCG) is now more than the company’s assets, and therefore the wealth of Barry Silbert, the founder and CEO of this institution, is considered zero in this estimate. has been Forbes added that Silbert’s personal investments were not included in the estimate and could not be measured due to a lack of information.

Read also: Incidence of bankruptcy; Will Grayskill suffer the same fate as FTX?

Nickel Viswanathan and Joseph Lay of Alchemy Software, Devin Finzer and Alex Atallah of OpenSea NFTs Market, Fred Ehrsam of Exchange Coinbase, Michael Silver of Microstrategy, and venture capitalist Tim Draper are also among the people who have been removed from the list of digital currency billionaires due to the loss of capital.

According to some activists in this field, it is unlikely that the bear market of digital currencies will end soon, and the damage caused by the collapse of the FTX exchange to investors’ confidence has created a major liquidity crisis throughout the industry. This group believes that the bear market we are currently in will continue until the end of 2023.