Cryptocurrency Market Forecast 2023: What You Should Consider

The digital currency trading company QCP Capital (QCP Capital) has predicted the performance of the digital currency market in 2023 in its latest report. This company, by examining the key events of the past year, their impact in the new year, and has drawn a picture of the possible state of digital currencies in 2023.

To the report Bitcoinist.com, QCP Capital reports first on global asset returns in 2022. Market benchmark assets such as Bitcoin, the S&P 500 and the Nasdaq 100 have experienced their worst year ever.

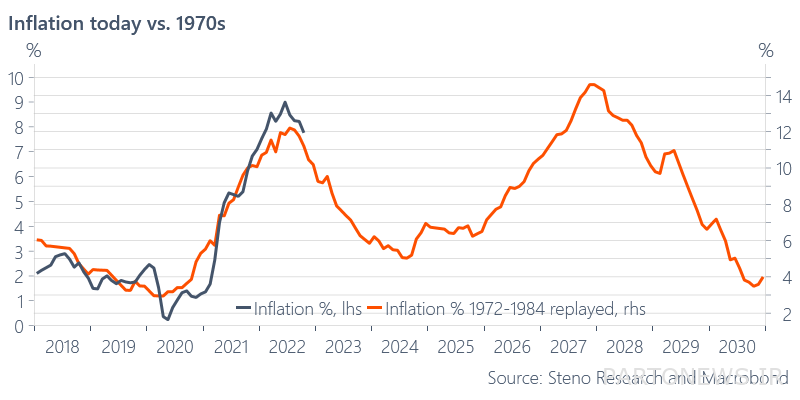

Except for natural gas, other assets saw their biggest losses since the 1970s. Bitcoin fell more than 70% from its highest price level and Ethereum also faced a 72% decrease in its value. The market’s negative performance in 2022 was the result of the most extreme rate hike cycle in recent history by the US Federal Reserve.

Continued pressure on the market

According to QCP Capital’s prediction of the digital currency market, the Federal Reserve will likely continue to pressure the markets. This financial institution is trying to reduce inflation from above 9% to a target rate of around 2%. As a result, the Fed continues to raise interest rates and shrink its balance sheet.

QCP Capital believes that once inflation has peaked, the market will witness sticky or sustained inflation. In other words, the Federal Reserve will have trouble trying to reduce inflation to its target rate.

In this situation, if the price of commodities such as oil rises above $100, the situation will worsen. According to this trading company, this is not the first time that the Federal Reserve has faced such a scenario.

In the 1970s, this financial institution reduced inflation by increasing interest rates. But when the price of oil began to rise, the inflation rate increased again. Russia’s military attack on Ukraine can also have the same consequences as in the 70s and act as a fuel to increase inflation.

As a result, as long as inflation remains sticky, the upside potential for Bitcoin and other risk assets may be limited. In addition, QCP Capital believes that the Federal Open Market Committee is unaware of the risks of rising inflation.

Therefore, the Federal Reserve will (eagerly) accept the fall in the value of risky assets such as digital currencies and ignore the losses of investors. On what could be one of the most important things to predict the future of the cryptocurrency market, the investment firm said:

This makes the Federal Reserve accept the recession instead of the risk of inflation returning; Even if the reason for the inflation jump again is due to supply side shocks. In terms of the likelihood of a recession, we are now above the peak of Covid in 2020 and quickly approaching the levels of the 2008 financial crisis and 2001 dotcom bubble.

When will market growth begin?

If the Federal Reserve rushes to ease the pressure of its tight monetary policy, there is potential for the market to grow. In the past months, some representatives of this financial institution mentioned the possibility of such an approach.

If this faction manages to change the approach of the Federal Reserve, the global market, including Bitcoin and other digital currencies, will see a big jump. The US dollar, reflected in the DXY index, will continue to act as a direct obstacle to the growth of the value of digital currencies.

From a technical perspective, the US Dollar Index has been in a downtrend over the past 6 weeks, but is likely to bounce back from current levels. This upward price movement may bring the dollar index to 120.1 and cause the value of global currencies, stock market and risky assets such as Bitcoin to fall. The failure of the index below the current level can also initiate a reverse scenario.