CryptoSlite report: Ethereum is neither decentralized nor anti-inflationary!

Ethereum is the foundation of the Decentralized Financial Ecosystem (DeFi), so it is typically categorized as a decentralized network. Many people think that Ethereum is a completely decentralized and democratic network with an anti-inflationary digital currency; But how true is this hypothesis?

The article you are reading below is a translation of the report of one of the authors of the “Crypto Slate” website and is not the opinion of “Erzdigital”.

To Report CryptoSlate About a month away from its integration update, the Ethereum network is more centralized than ever, and its native cryptocurrency is also fiercely resisting deflation. In fact, Ethereum is now neither decentralized nor anti-inflationary.

Ethereum is an inflationary asset

In September 2021 (September 1400), the London hardfork introduced the “EIP-1559” improvement plan; An update that was supposed to significantly change the way the Ethereum network works. This update allows the network to burn a portion of the gas fees (Gas or fees) paid by users to permanently reduce the Ethereum supply.

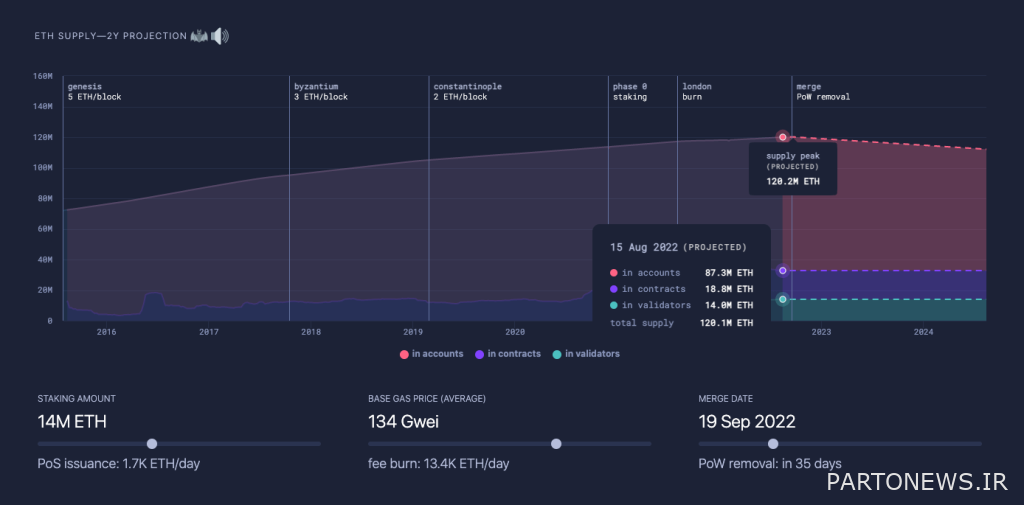

Developers expected the cryptocurrency’s continuously burning supply volume to exceed the daily rewards paid to miners, making Ethereum an anti-inflationary asset. However, as you can see in the chart below, Ethereum’s burn rate never exceeded its mining rate.

The decrease in activity on the Ethereum network is the biggest factor that has prevented the burn rate from surpassing the Ethereum mining rate. To turn Ethereum into an anti-inflationary digital currency, the amount of Ethereum burned from the source of gas fees must exceed the amount of Ethereum multiplied as block mining rewards.

Last year, an average of 13,000 Ethereum was distributed to miners as block rewards every day. Consequently, to burn this amount, the average base cost of gas on the Ethereum network must be around 130 gwei.

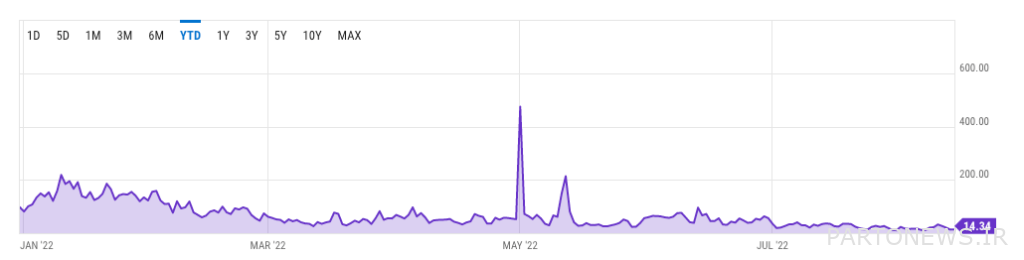

Since the beginning of the year, the average cost of Ethereum gas has rarely exceeded 130 gwei. According to YCharts data, the cost of gas has always remained below 60 gwei since April, except for two peaks recorded during May. Also, the average cost of gas has been less than 20 gwei since the beginning of July.

The increase in the price of Ethereum, which is still against the general market trend, can be one of the factors that reduce the activity of the network of this digital currency. Conversely, the rise in Ethereum price could be a direct result of increased (speculative) trading volume as the merger update approaches. According to the past reports of CryptoSlate, the increase in the amount of speculative transactions in derivatives markets is quite evident; Where the volume of open contracts in the Ethereum options market has surpassed the volume of open positions in Bitcoin for the first time.

Read more: Bitcoin vs. Ethereum; Which one has a better monetary policy?

Resistance to decentralization

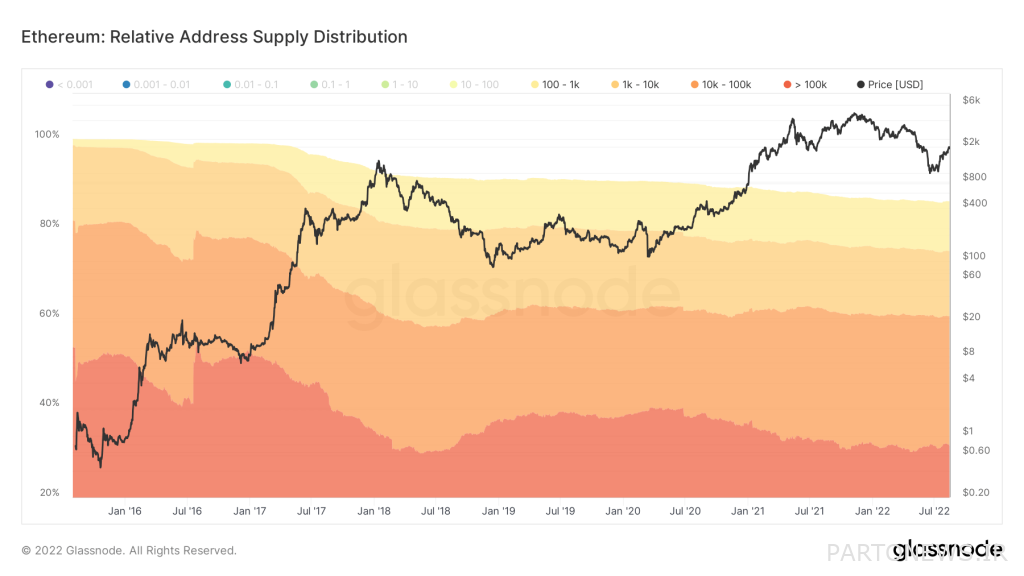

If we look at the issue from the decentralization aspect, Ethereum is facing more problems. According to Glassnod data, more than 85% of the Ethereum supply is held by individuals or groups that hold 100 Ethereum or more. Also, wallets that have more than 100,000 Ethereum have taken 30% of its supply.

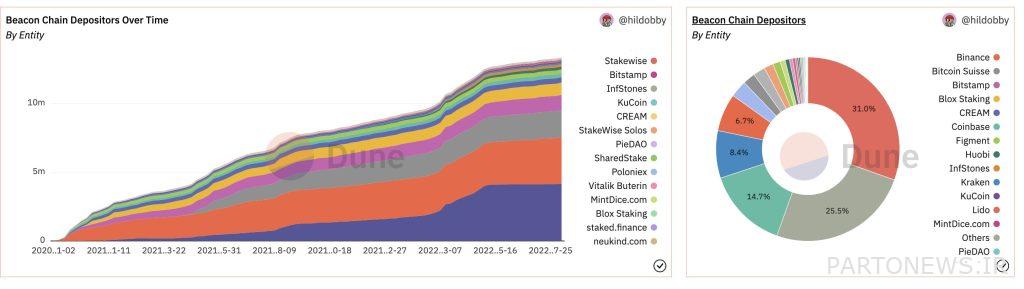

The future transition of the Ethereum network to a proof-of-stake mechanism raises more questions. The Proof of Stake network’s requirement for validators to deposit at least 32 Ethereum can effectively target small players. Currently, there are a set of validators in the Ethereum Beacon Chain network, whose review can show what the state of this network will be after the merger.

Read more: 5 Common Mistakes About Ethereum Merge Update

Large institutions make up the majority of China Beacon validators; From old cryptocurrency exchanges to new staking service providers that hold large amounts of Ethereum. A large portion of Ethereum network validators are legal entities registered in the United States and the European Union. As a result, they will be subject to the regulations of their jurisdiction.

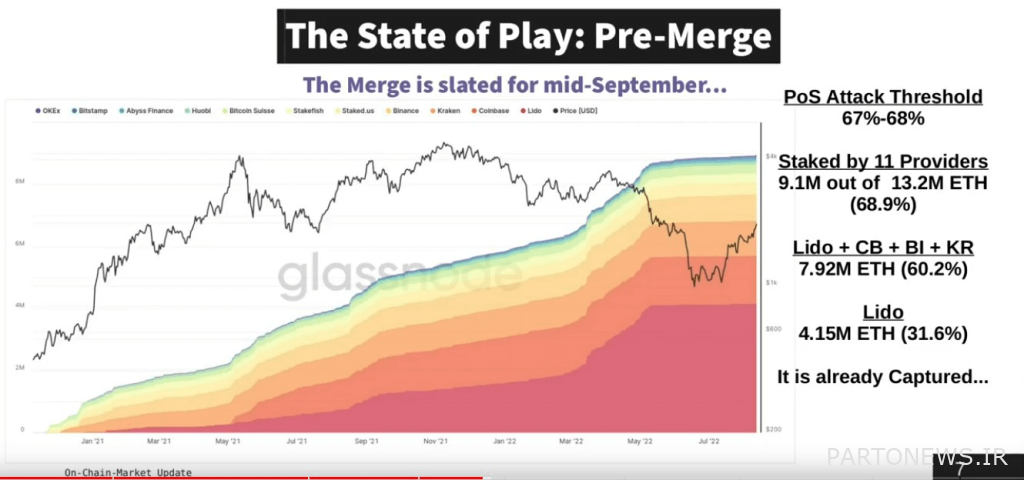

About 69% of the total amount deposited in Beacon China belongs to only 11 institutions. 4 institutions alone account for 60% of the total deposited amount, while 31% of the total Ethereum deposited belongs to the Lido platform.

In a hard bear market, this level of Ethereum centralization has not received enough attention. However, the turbulence of the digital currency market under the influence of macroeconomic factors will reveal all these problems.

Controversies surrounding the banning of mixer Tornado Cash (Tornado Cash) and other decentralized platforms active in the field of privacy have led many to believe that pressure from governments could cause their Ethereum validators to become enforcers of these sanctions in the future.