Do Russian authorities really use digital currencies to circumvent sanctions?

Some time ago, Elizabeth Warren, one of the most famous Democratic senators in the United States, introduced a bill to the US Congress to prevent Russian digital currency transactions by fearing that the Russian authorities would escape economic sanctions by converting their wealth into digital currency. But is Warren’s concern really true?

To Report Cryptonews Warren warned at a Senate committee hearing:

So no one can say that Russia is able to circumvent sanctions by transferring all its assets to digital currencies; But for Putin’s drug lords, who want to hide $ 1 billion or $ 2 billion in wealth, digital currency seems like a great option.

The bill does not seek to impose a general ban on all Russian digital currency transactions; But it does allow the US government to bar US companies from processing digital currency transactions related to Russian-sanctioned accounts, and to impose secondary sanctions on foreign digital currency exchanges that trade with Russian-sanctioned individuals, companies or government agencies.

Now a question! Are these measures necessary?

Although evidence shows that the number and value of Russian digital currency transactions increased last month, the data still suggest that digital currency buyers are in fact ordinary Russians trying to maintain their savings after the ruble has fallen. .

Targeted sanctions ?!

Economic sanctions imposed on Russia by invading Ukraine will naturally damage the entire Russian economy. However, the sanctions are aimed at hurting Putin and the billionaire drug lords who support the Russian government. Where most of this damage is supposed to go.

The cornerstone of this strategy is to prevent these people from using or transferring their wealth by freezing assets invested by Russian officials abroad and freezing financial transactions.

Also read: How can sanctions encourage Russia to extract more bitcoins?

But for some time now, US officials have been worried about the continued operation of digital currency exchanges in Russia, such as Binance, Yobit and Local Bitcoins. Even before Russia’s recent invasion of Ukraine, the US Treasury Department had warned that digital currencies could weaken sanctions previously imposed on Russia over its annexation of Crimea in 2014.

Weakening value of the ruble

The chart below shows why ordinary Russians tend to buy digital currencies. Since the invasion of Ukraine on February 24, the ruble has fallen by 40 percent against the US dollar. Before the attack, the dollar was worth about 76 rubles, and after the attack, the same dollar was trading at 132 rubles. . Of course, at the time of writing, one dollar is worth about 100 rubles.

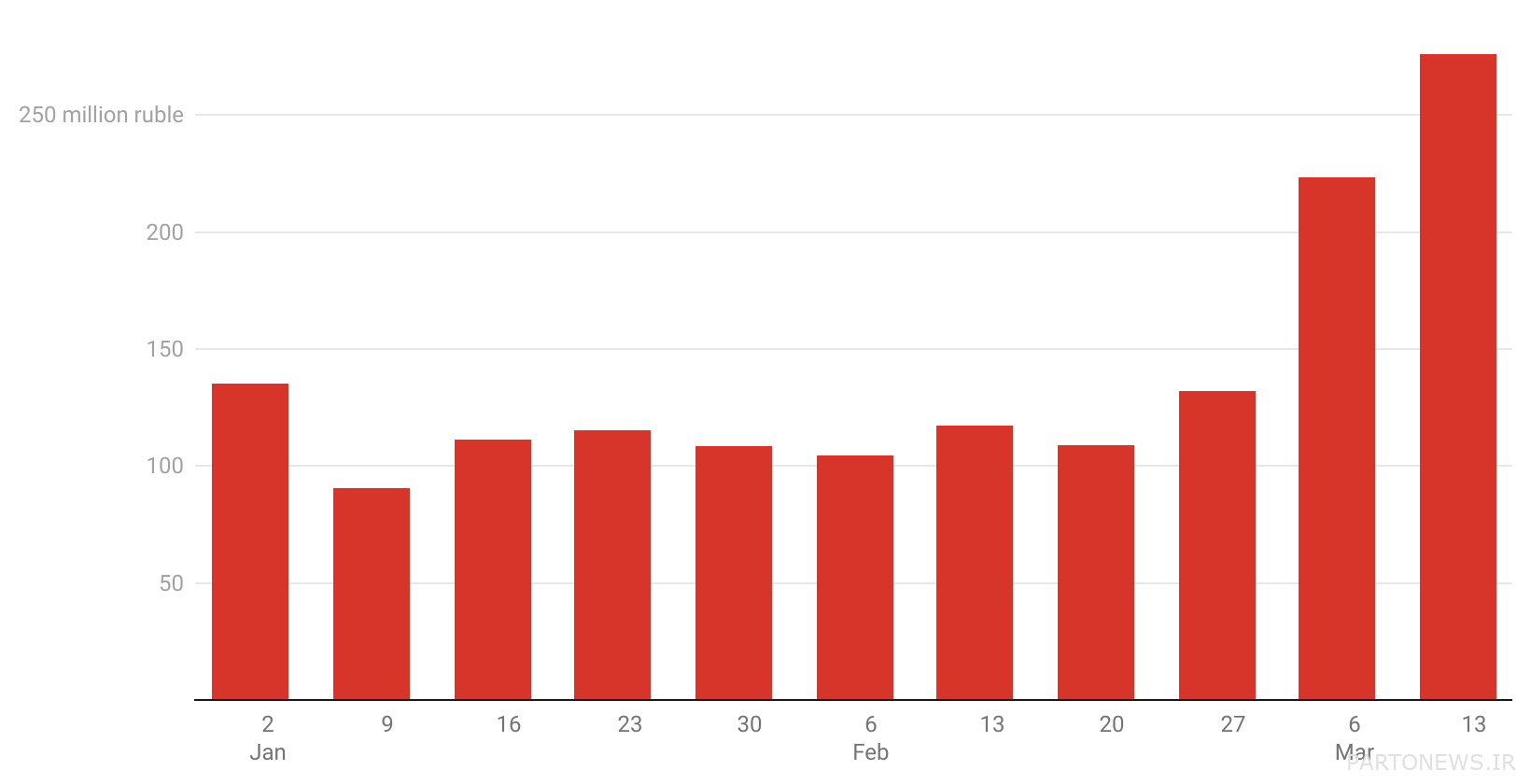

Increase the conversion of rubles to bitcoins

The following diagram shows the value of bitcoin transactions at Russian addresses. Although Bitcoin is not the only digital currency that can be purchased by Russians, it is by far the most traded and trusted digital currency available. Therefore, it can well play the role of an intermediary for the conversion of rubles. This data was obtained from Coin Dance.

Since the start of the war on February 24 until the release of this report, bitcoin purchases using the ruble have increased by 260 percent.

At first glance, this 260 percent increase seems very impressive; But when we consider the devaluation of the ruble, this figure will be less noticeable. The weekly value of rubles converted to bitcoin was about $ 28 million last week and about $ 14 million in mid-February; That is, the rate of increase this time decreases and increases to 100%.

On a global scale, this amount of bitcoin purchases using Russian rubles is negligible. According to Kaiko, between $ 20 billion and $ 40 billion are spent each week to buy bitcoins; Thus, bitcoin / ruble transactions account for less than 0.14% of total bitcoin transactions.

Small transactions

Another important point is the number of accounts and the average size of transactions. According to Glassnode, another digital currency data analysis service, the number of Russian bitcoin accounts has increased from 39.9 million to 40.7 million since the invasion of Ukraine (Russia’s population is about 144 million).

According to Bainance data, which is also the largest active exchange in Russia, the average daily size of each bitcoin / ruble transaction has increased to $ 580. For comparison, keep in mind that the average value of transactions in the United States at this time is $ 2,198.

The transfer of large amounts of rubles to digital currency exchanges operating in Russia is severely restricted due to their relatively low liquidity.

Liquidity refers to the ease with which an asset or security (here bitcoin) is converted “from” to “cash” without the price having a significant effect on the transaction. When the market has more buyers and sellers, trading becomes easier and the exchange rate is less affected. With fewer buyers and sellers, the transaction will be more difficult. The liquidity standard of Russian bitcoin exchanges is the value of the orders sent to buyers and sellers at any given time. That’s about $ 200,000, compared to $ 22 million in the United States for digital currency exchanges (about 110 times more).

This statistic shows that if one wants to trade a large amount of bitcoins against the ruble, one will face many problems.

Short-term investors

Given what we have said, there is evidence that small investors are more involved in increasing digital currency transactions in Russia than others.

Although Putin and his counterparts may have used hundreds or thousands of small accounts to carry out many small-scale transactions to transfer their wealth, it is likely that most of their wealth came through fictitious companies in areas such as Monaco, the British Virgin Islands, Ireland or Even the heroic region of the United States is invested.